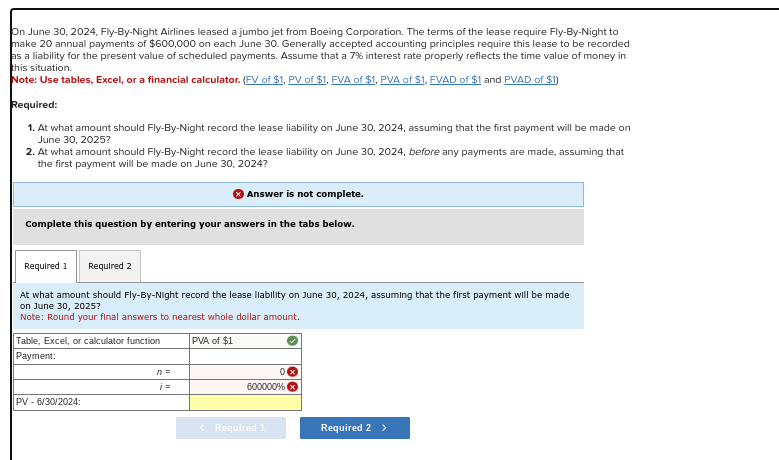

Question: Hello tutor, On June 3 0 , 2 0 2 4 , Fly - By - Night Airlines leased a jumbo jet from Boeing Corporation.

Hello tutor, On June FlyByNight Airlines leased a jumbo jet from Boeing Corporation. The terms of the lease require FlyByNight to

make annual payments of $ on each June Generally accepted accounting principles require this lease to be recorded

as a liability for the present value of scheduled payments. Assume that a interest rate properly reflects the time value of money in

this situation.

Note: Use tables, Excel, or a financial calculator. FV of $ PV of $ FVA of $ PVA of $ FVAD of $ and PVAD of $

Required:

At what amount should FlyByNight record the lease liability on June assuming that the first payment will be made on

June

At what amount should FlyByNight record the lease liability on June before any payments are made, assuming that

the first payment will be made on June

Answer is not complete.

Complete this question by entering your answers in the tabs below.

Required

Required

At what amount should FlyByNight record the lease llability on June before any payments are made, assuming

that the first payment will be made on June

Note: Round your final answers to nearest whole dollar amount.

Im struggling with this area, are you able to show solution and please box the table pv and payment from required question and

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock