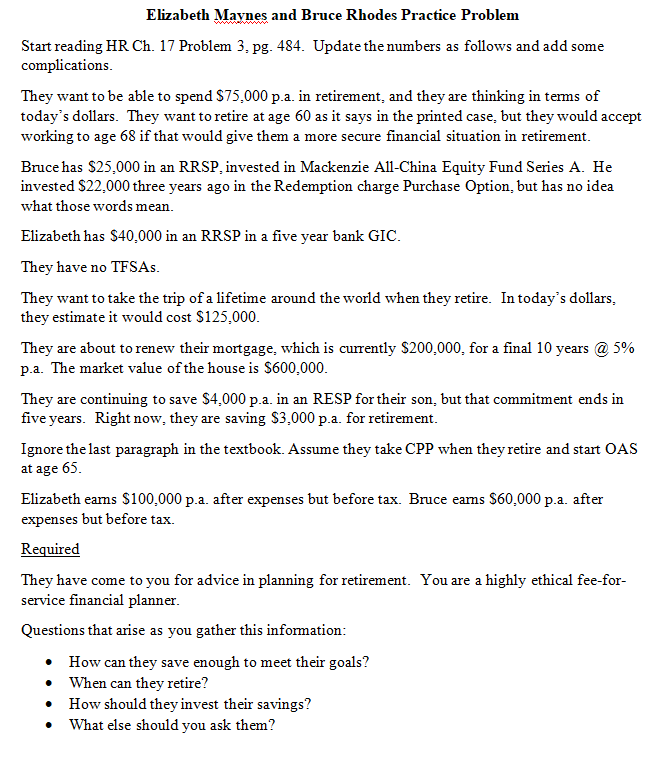

Question: Hello Tutors! Below I have attached a practice problem. However, for this problem there were some alterations that we had to do which I have

Hello Tutors! Below I have attached a practice problem. However, for this problem there were some alterations that we had to do which I have also attached below. I am having real trouble with this mini case. I was wondering if anyone could assist me in solving this problem and explaining the solution? It would really help my understanding and would really appreciate it. This was all the information that was given to us. Thank you.

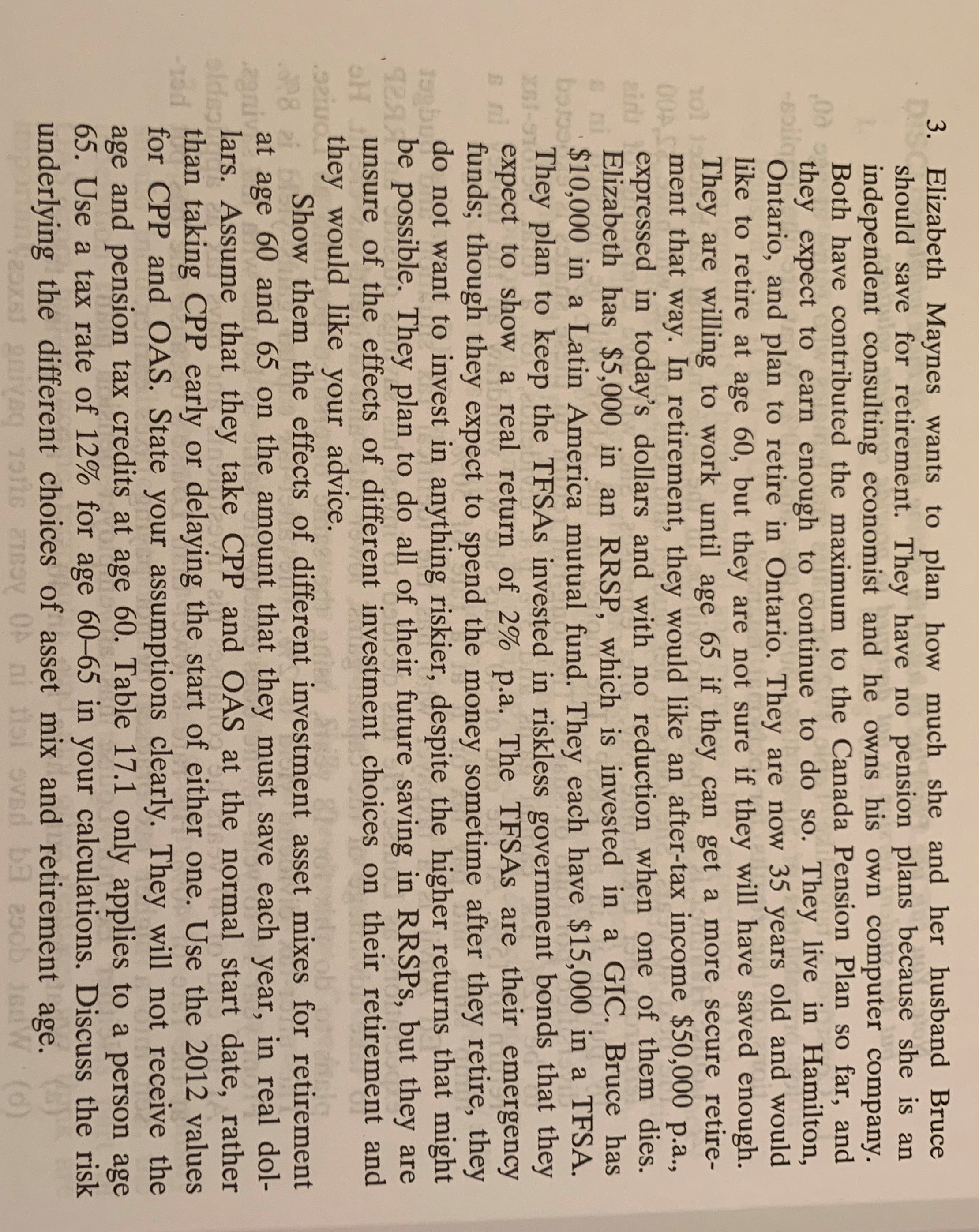

3. Elizabeth Maynes wants to plan how much she and her husband Bruce should save for retirement. They have no pension plans because she is an independent consulting economist and he owns his own computer company. Both have contributed the maximum to the Canada Pension Plan so far, and they expect to earn enough to continue to do so. They live in Hamilton, Ontario, and plan to retire in Ontario. They are now 35 years old and would like to retire at age 60, but they are not sure if they will have saved enough. 101 They are willing to work until age 65 if they can get a more secure retire- ment that way. In retirement, they would like an after-tax income $50,000 p.a., expressed in today's dollars and with no reduction when one of them dies. Elizabeth has $5,000 in an RRSP, which is invested in a GIC. Bruce has bojos $10,000 in a Latin America mutual fund. They each have $15,000 in a TFSA. x61-91 They plan to keep the TFSAs invested in riskless government bonds that they expect to show a real return of 2% p.a. The TFSAs are their emergency funds; though they expect to spend the money sometime after they retire, they do not want to invest in anything riskier, despite the higher returns that might gas be possible. They plan to do all of their future saving in RRSPs, but they are unsure of the effects of different investment choices on their retirement and .ezio they would like your advice. Show them the effects of different investment asset mixes for retirement at age 60 and 65 on the amount that they must save each year, in real dol- lars. Assume that they take CPP and OAS at the normal start date, rather than taking CPP early or delaying the start of either one. Use the 2012 values for CPP and OAS. State your assumptions clearly. They will not receive the age and pension tax credits at age 60. Table 17.1 only applies to a person age 65. Use a tax rate of 12% for age 60-65 in your calculations. Discuss the risk underlying the different choices of asset mix and retirement age. 2axel griveg jolts aBOY OF Di mol 9ved ba JedW ' (d )\f