Question: Hello tutors. Kindly answer the two questions below. Include step by step explanations for full reward. An institution has a liability to pay $15,000 per

Hello tutors. Kindly answer the two questions below. Include step by step explanations for full reward.

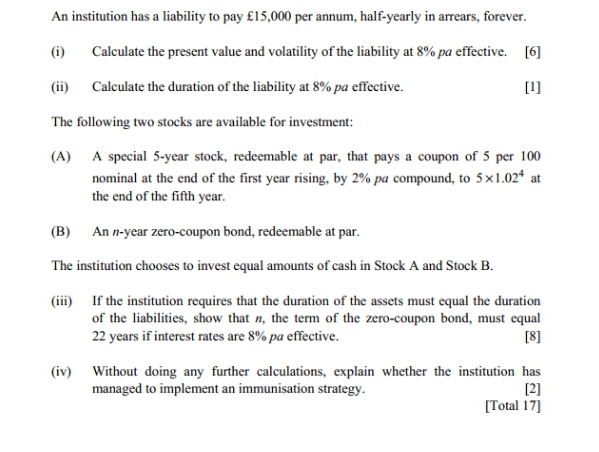

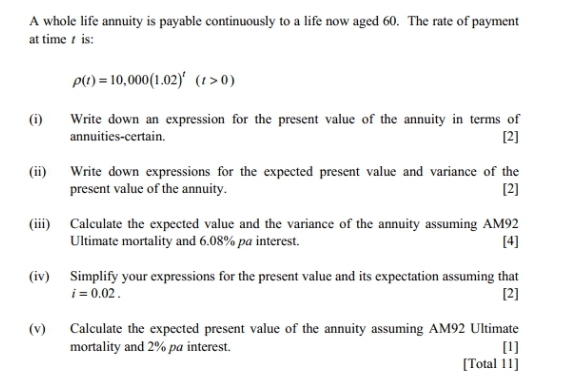

An institution has a liability to pay $15,000 per annum, half-yearly in arrears, forever. (i) Calculate the present value and volatility of the liability at 8% pa effective. [6] (ii) Calculate the duration of the liability at 8% pa effective. [1] The following two stocks are available for investment: (A) A special 5-year stock, redeemable at par, that pays a coupon of 5 per 100 nominal at the end of the first year rising, by 2% pa compound, to 5 x1.02# at the end of the fifth year. (B) An n-year zero-coupon bond, redeemable at par. The institution chooses to invest equal amounts of cash in Stock A and Stock B. (iii) If the institution requires that the duration of the assets must equal the duration of the liabilities, show that n, the term of the zero-coupon bond, must equal 22 years if interest rates are 8% pa effective. [8] (iv) Without doing any further calculations, explain whether the institution has managed to implement an immunisation strategy. [2] [Total 17]An institution has a liability to pay $15,000 per annum, half-yearly in arrears, forever. (i) Calculate the present value and volatility of the liability at 8% pa effective. [6] (ii) Calculate the duration of the liability at 8% pa effective. [1] The following two stocks are available for investment: (A) A special 5-year stock, redeemable at par, that pays a coupon of 5 per 100 nominal at the end of the first year rising, by 2% pa compound, to 5 x1.02# at the end of the fifth year. (B) An n-year zero-coupon bond, redeemable at par. The institution chooses to invest equal amounts of cash in Stock A and Stock B. (iii) If the institution requires that the duration of the assets must equal the duration of the liabilities, show that n, the term of the zero-coupon bond, must equal 22 years if interest rates are 8% pa effective. [8] (iv) Without doing any further calculations, explain whether the institution has managed to implement an immunisation strategy. [2] [Total 17]A whole life annuity is payable continuously to a life now aged 60. The rate of payment at time / is: p() = 10,000(1.02)' (1 >0) (i) Write down an expression for the present value of the annuity in terms of annuities-certain. [2] (1i) Write down expressions for the expected present value and variance of the present value of the annuity. [2] (iii) Calculate the expected value and the variance of the annuity assuming AM92 Ultimate mortality and 6.08% pa interest. [4] (iv) Simplify your expressions for the present value and its expectation assuming that i = 0.02. [2] (v) Calculate the expected present value of the annuity assuming AM92 Ultimate mortality and 2% pa interest. [1] [Total 11]A whole life annuity is payable continuously to a life now aged 60. The rate of payment at time / is: p() = 10,000(1.02)' (1 >0) (i) Write down an expression for the present value of the annuity in terms of annuities-certain. [2] (1i) Write down expressions for the expected present value and variance of the present value of the annuity. [2] (iii) Calculate the expected value and the variance of the annuity assuming AM92 Ultimate mortality and 6.08% pa interest. [4] (iv) Simplify your expressions for the present value and its expectation assuming that i = 0.02. [2] (v) Calculate the expected present value of the annuity assuming AM92 Ultimate mortality and 2% pa interest. [1] [Total 11]