Question: hello tutors please help answer all questions Question 1 (a) Kyamulibwa Fruit Processors Limited (KFPL) is a private company incorporated in Uganda and commenced business

hello tutors

please help answer all questions

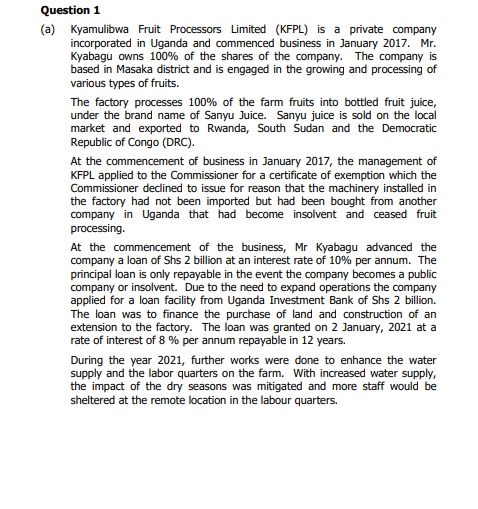

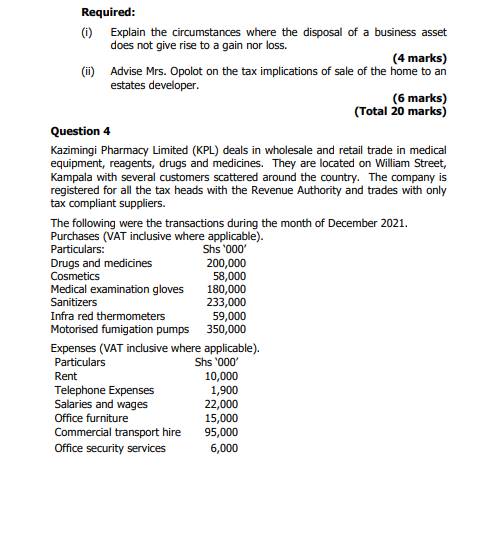

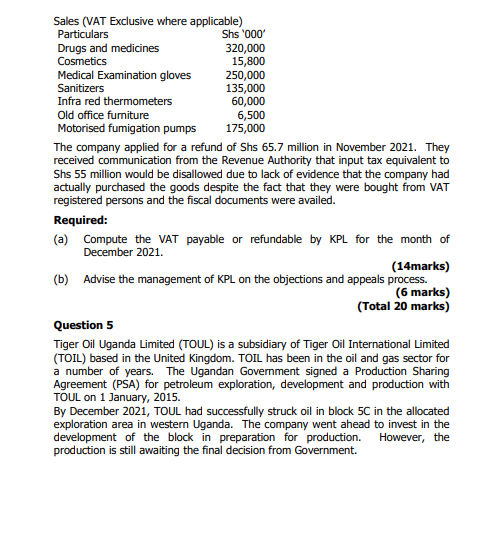

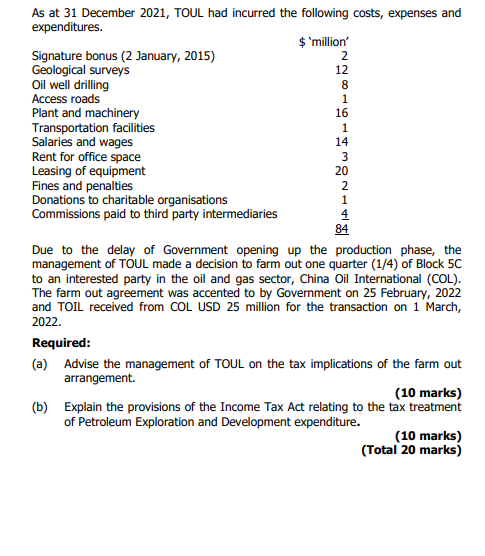

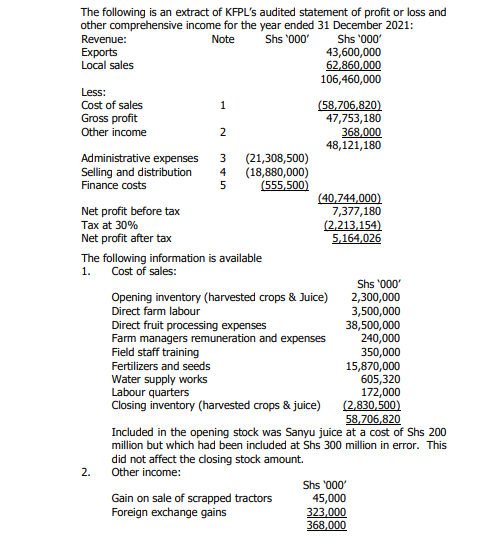

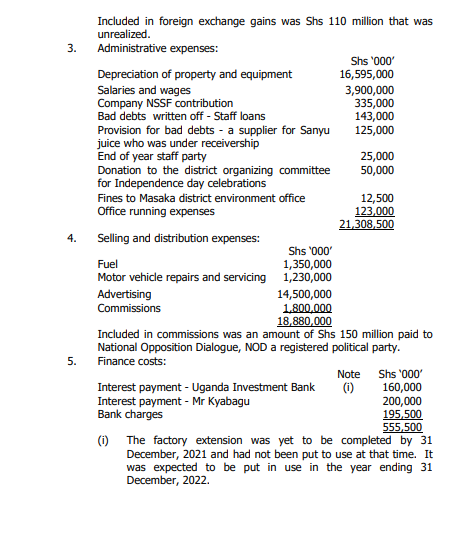

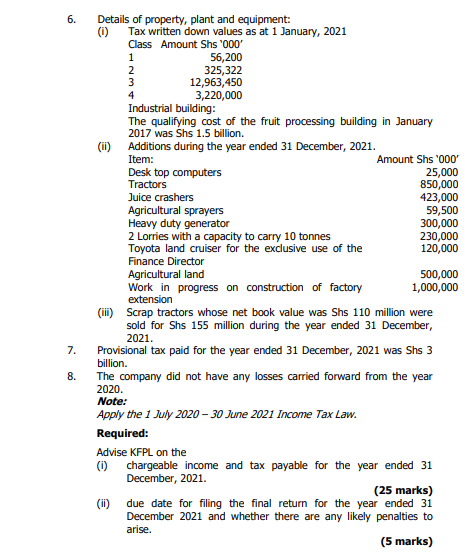

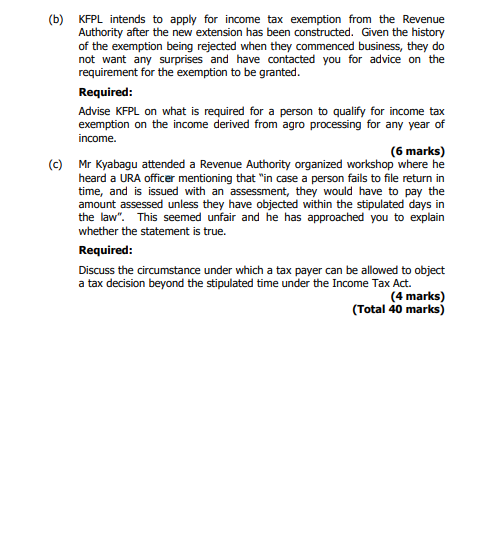

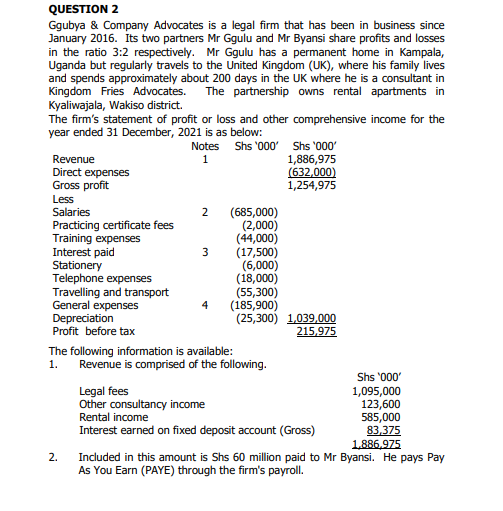

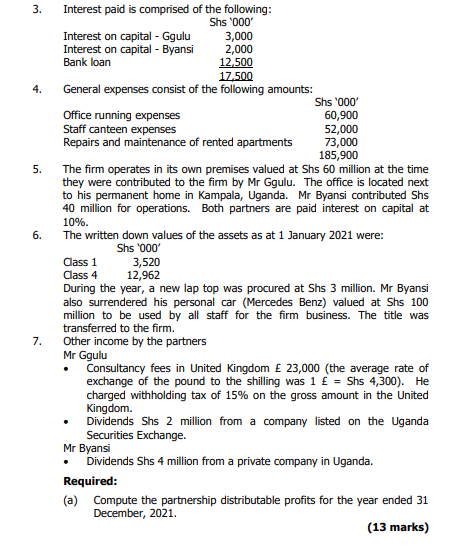

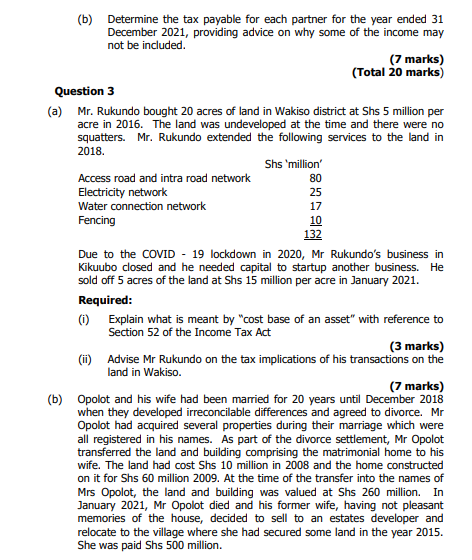

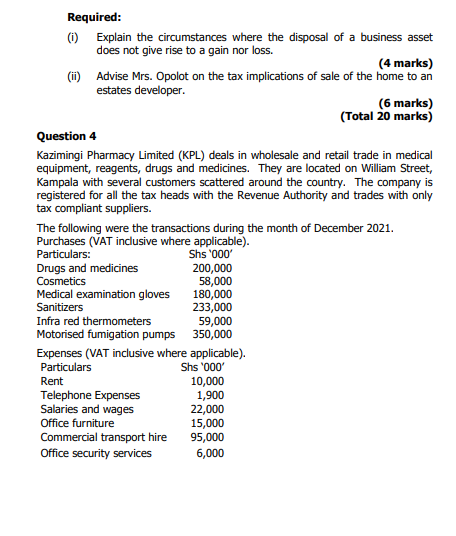

Question 1 (a) Kyamulibwa Fruit Processors Limited (KFPL) is a private company incorporated in Uganda and commenced business in January 2017. Mr. Kyabagu owns 100% of the shares of the company. The company is based in Masaka district and is engaged in the growing and processing of various types of fruits. The factory processes 100% of the farm fruits into bottled fruit juice, under the brand name of Sanyu Juice. Sanyu juice is sold on the local market and exported to Rwanda, South Sudan and the Democratic Republic of Congo (DRC). At the commencement of business in January 2017, the management of KFPL applied to the Commissioner for a certificate of exemption which the Commissioner declined to issue for reason that the machinery installed in the factory had not been imported but had been bought from another company in Uganda that had become insolvent and ceased fruit processing. At the commencement of the business, Mr Kyabagu advanced the company a loan of Shs 2 billion at an interest rate of 10% per annum. The principal loan is only repayable in the event the company becomes a public company or insolvent. Due to the need to expand operations the company applied for a loan facility from Uganda Investment Bank of Shs 2 billion. The loan was to finance the purchase of land and construction of an extension to the factory. The loan was granted on 2 January, 2021 at a rate of interest of 8 % per annum repayable in 12 years. During the year 2021, further works were done to enhance the water supply and the labor quarters on the farm. With increased water supply, the impact of the dry seasons was mitigated and more staff would be sheltered at the remote location in the labour quarters.Required: (i) Explain the circumstances where the disposal of a business asset does not give rise to a gain nor loss. (4 marks) (ii) Advise Mrs. Opolot on the tax implications of sale of the home to an estates developer. (6 marks) (Total 20 marks) Question 4 Kazimingi Pharmacy Limited (KPL) deals in wholesale and retail trade in medical equipment, reagents, drugs and medicines. They are located on William Street, Kampala with several customers scattered around the country. The company is registered for all the tax heads with the Revenue Authority and trades with only tax compliant suppliers. The following were the transactions during the month of December 2021. Purchases (VAT inclusive where applicable). Particulars: Shs '000' Drugs and medicines 200,000 Cosmetics 58,000 Medical examination gloves 180,000 Sanitizers 233,000 Infra red thermometers 59,000 Motorised fumigation pumps 350,000 Expenses (VAT inclusive where applicable). Particulars Shs '000' Rent 10,000 Telephone Expenses 1,900 Salaries and wages 22,000 Office furniture 15,000 Commercial transport hire 95,000 Office security services 6,000Sales (VAT Exclusive where applicable) Particulars Shs '000' Drugs and medicines 320,000 Cosmetics 15,800 Medical Examination gloves 250,000 Sanitizers 135,000 Infra red thermometers 60,000 Old office furniture 6,500 Motorised fumigation pumps 175,000 The company applied for a refund of Shs 65.7 million in November 2021. They received communication from the Revenue Authority that input tax equivalent to Shs 55 million would be disallowed due to lack of evidence that the company had actually purchased the goods despite the fact that they were bought from VAT registered persons and the fiscal documents were availed. Required: (a) Compute the VAT payable or refundable by KPL for the month of December 2021. (14marks) (b) Advise the management of KPL on the objections and appeals process. (6 marks) (Total 20 marks) Question 5 Tiger Oil Uganda Limited (TOUL) is a subsidiary of Tiger Oil International Limited (TOIL) based in the United Kingdom. TOIL has been in the oil and gas sector for a number of years. The Ugandan Government signed a Production Sharing Agreement (PSA) for petroleum exploration, development and production with TOUL on 1 January, 2015. By December 2021, TOUL had successfully struck oil in block 5C in the allocated exploration area in western Uganda. The company went ahead to invest in the development of the block in preparation for production. However, the production is still awaiting the final decision from Government.As at 31 December 2021, TOUL had incurred the following costs, expenses and expenditures. $ "million' Signature bonus (2 January, 2015) 2 Geological surveys 12 Oil well drilling 8 Access roads Plant and machinery 16 Transportation facilities Salaries and wages Rent for office space Leasing of equipment Fines and penalties Donations to charitable organisations Commissions paid to third party intermediaries Due to the delay of Government opening up the production phase, the management of TOUL made a decision to farm out one quarter (1/4) of Block 5C to an interested party in the oil and gas sector, China Oil International (COL). The farm out agreement was accented to by Government on 25 February, 2022 and TOIL received from COL USD 25 million for the transaction on 1 March, 2022. Required: (a) Advise the management of TOUL on the tax implications of the farm out arrangement. (10 marks) (b) Explain the provisions of the Income Tax Act relating to the tax treatment of Petroleum Exploration and Development expenditure. (10 marks) (Total 20 marks)The following is an extract of KFPL's audited statement of profit or loss and other comprehensive income for the year ended 31 December 2021: Revenue: Note Shs '000' Shs '000' Exports 43,600,000 Local sales 62,860,000 106,460,000 Less: Cost of sales (58,706,820) Gross profit 47,753,180 Other income 2 368,000 48,121,180 Administrative expenses (21,308,500) Selling and distribution (18,880,000) Finance costs (555,500) (40,744,000) Net profit before tax 7,377,180 Tax at 30% (2,213.154) Net profit after tax 5,164,026 The following information is available 1. Cost of sales: Shs '000' Opening inventory (harvested crops & Juice) 2,300,000 Direct farm labour 3,500,000 Direct fruit processing expenses 38,500,000 Farm managers remuneration and expenses 240,000 Field staff training 350,000 Fertilizers and seeds 15,870,000 Water supply works 605,320 Labour quarters 172,000 Closing inventory (harvested crops & juice) (2,830,500) 58,706,820 Included in the opening stock was Sanyu juice at a cost of Shs 200 million but which had been included at Shs 300 million in error. This did not affect the closing stock amount. 2. Other income: Shs '000' Gain on sale of scrapped tractors 45,000 Foreign exchange gains 323,000 368,000Included in foreign exchange gains was Shs 110 million that was unrealized. 3. Administrative expenses: Shs '000' Depreciation of property and equipment 16,595,000 Salaries and wages 3,900,000 Company NSSF contribution 335,000 Bad debts written off - Staff loans 143,000 Provision for bad debts - a supplier for Sanyu 125,000 juice who was under receivership End of year staff party 25,000 Donation to the district organizing committee 50,000 for Independence day celebrations Fines to Masaka district environment office 12,500 Office running expenses 123,000 21,308,500 4. Selling and distribution expenses: Shs '000' Fuel 1,350,000 Motor vehicle repairs and servicing 1,230,000 Advertising 14,500,000 Commissions 1.800.000 18,880,000 Included in commissions was an amount of Shs 150 million paid to National Opposition Dialogue, NOD a registered political party. 5. Finance costs: Note Shs '000' Interest payment - Uganda Investment Bank (i) 160,000 Interest payment - Mr Kyabagu 200,000 Bank charges 195.500 555 500 (i) The factory extension was yet to be completed by 31 December, 2021 and had not been put to use at that time. It was expected to be put in use in the year ending 31 December, 2022.6. Details of property, plant and equipment: (1) Tax written down values as at 1 January, 2021 Class Amount Shs '000' 56,200 325,322 AWNG 12,963,450 3,220,000 Industrial building: The qualifying cost of the fruit processing building in January 2017 was Shs 1.5 billion. (ii) Additions during the year ended 31 December, 2021. Item: Amount Shs '000' Desk top computers 25,000 Tractors 850,000 Juice crashers 423,000 Agricultural sprayers 59,500 Heavy duty generator 300,000 2 Lorries with a capacity to carry 10 tonnes 230,000 Toyota land cruiser for the exclusive use of the 120,000 Finance Director Agricultural land 500,000 Work in progress on construction of factory 1,000,000 extension (iii) Scrap tractors whose net book value was Shs 110 million were sold for Shs 155 million during the year ended 31 December, 2021. 7. Provisional tax paid for the year ended 31 December, 2021 was Shs 3 billion. 8. The company did not have any losses carried forward from the year 2020. Note: Apply the 1 July 2020 - 30 June 2021 Income Tax Law. Required: Advise KFPL on the (i) chargeable income and tax payable for the year ended 31 December, 2021. (25 marks) (ii) due date for filing the final return for the year ended 31 December 2021 and whether there are any likely penalties to arise. (5 marks)(b) KFPL intends to apply for income tax exemption from the Revenue Authority after the new extension has been constructed. Given the history of the exemption being rejected when they commenced business, they do not want any surprises and have contacted you for advice on the requirement for the exemption to be granted. Required: Advise KFPL on what is required for a person to qualify for income tax exemption on the income derived from agro processing for any year of income. (6 marks) (c) Mr Kyabagu attended a Revenue Authority organized workshop where he heard a URA officer mentioning that "in case a person fails to file return in time, and is issued with an assessment, they would have to pay the amount assessed unless they have objected within the stipulated days in the law". This seemed unfair and he has approached you to explain whether the statement is true. Required: Discuss the circumstance under which a tax payer can be allowed to object a tax decision beyond the stipulated time under the Income Tax Act. (4 marks) (Total 40 marks)QUESTION 2 Ggubya & Company Advocates is a legal firm that has been in business since January 2016. Its two partners Mr Ggulu and Mr Byansi share profits and losses in the ratio 3:2 respectively. Mr Ggulu has a permanent home in Kampala, Uganda but regularly travels to the United Kingdom (UK), where his family lives and spends approximately about 200 days in the UK where he is a consultant in Kingdom Fries Advocates. The partnership owns rental apartments in Kyaliwajala, Wakiso district. The firm's statement of profit or loss and other comprehensive income for the year ended 31 December, 2021 is as below: Notes Shs '000' Shs '000' Revenue 1 1,886,975 Direct expenses (632,000) Gross profit 1,254,975 Less Salaries 2 (685,000) Practicing certificate fees (2,000) Training expenses (44,000) Interest paid 3 (17,500) Stationery (6,000) Telephone expenses (18,000) Travelling and transport (55,300) General expenses 4 (185,900) Depreciation (25,300) 1,039,000 Profit before tax 215,975 The following information is available: 1. Revenue is comprised of the following. Shs *000' Legal fees 1,095,000 Other consultancy income 123,600 Rental income 585,000 Interest earned on fixed deposit account (Gross) 83,375 1.886.975 2. Included in this amount is Shs 60 million paid to Mr Byansi. He pays Pay As You Earn (PAYE) through the firm's payroll.3. Interest paid is comprised of the following: Shs '000' Interest on capital - Ggulu 3,000 Interest on capital - Byansi 2,000 Bank loan 12,500 17,500 4. General expenses consist of the following amounts: Shs '000' Office running expenses 60,900 Staff canteen expenses 52,000 Repairs and maintenance of rented apartments 73,000 185,900 5. The firm operates in its own premises valued at Shs 60 million at the time they were contributed to the firm by Mr Ggulu. The office is located next to his permanent home in Kampala, Uganda. Mr Byansi contributed Shs 40 million for operations. Both partners are paid interest on capital at 10%. 6. The written down values of the assets as at 1 January 2021 were: Shs '000' Class 1 3,520 Class 4 12,962 During the year, a new lap top was procured at Shs 3 million. Mr Byansi also surrendered his personal car (Mercedes Benz) valued at Shs 100 million to be used by all staff for the firm business. The title was transferred to the firm. 7. Other income by the partners Mr Ggulu Consultancy fees in United Kingdom E 23,000 (the average rate of exchange of the pound to the shilling was 1 { = Shs 4,300). He charged withholding tax of 15% on the gross amount in the United Kingdom. . Dividends Shs 2 million from a company listed on the Uganda Securities Exchange. Mr Byansi Dividends Shs 4 million from a private company in Uganda. Required: (a) Compute the partnership distributable profits for the year ended 31 December, 2021. (13 marks)(b) Determine the tax payable for each partner for the year ended 31 December 2021, providing advice on why some of the income may not be included. (7 marks) (Total 20 marks) Question 3 (a) Mr. Rukundo bought 20 acres of land in Wakiso district at Shs 5 million per acre in 2016. The land was undeveloped at the time and there were no squatters. Mr. Rukundo extended the following services to the land in 2018. Shs 'million' Access road and intra road network 80 Electricity network 25 Water connection network 17 Fencing 10 132 Due to the COVID - 19 lockdown in 2020, Mr Rukundo's business in Kikuubo closed and he needed capital to startup another business. sold off 5 acres of the land at Shs 15 million per acre in January 2021. Required: (i) Explain what is meant by "cost base of an asset" with reference to Section 52 of the Income Tax Act (3 marks) (ii) Advise Mr Rukundo on the tax implications of his transactions on the land in Wakiso. (7 marks) (b) Opolot and his wife had been married for 20 years until December 2018 when they developed irreconcilable differences and agreed to divorce. Mr Opolot had acquired several properties during their marriage which were all registered in his names. As part of the divorce settlement, Mr Opolot transferred the land and building comprising the matrimonial home to his wife. The land had cost Shs 10 million in 2008 and the home constructed on it for Shs 60 million 2009. At the time of the transfer into the names of Mrs Opolot, the land and building was valued at Shs 260 million. In January 2021, Mr Opolot died and his former wife, having not pleasant memories of the house, decided to sell to an estates developer and relocate to the village where she had secured some land in the year 2015. She was paid Shs 500 million.Required: (i) Explain the circumstances where the disposal of a business asset does not give rise to a gain nor loss. (4 marks) (ii) Advise Mrs. Opolot on the tax implications of sale of the home to an estates developer. (6 marks) (Total 20 marks) Question 4 Kazimingi Pharmacy Limited (KPL) deals in wholesale and retail trade in medical equipment, reagents, drugs and medicines. They are located on William Street, Kampala with several customers scattered around the country. The company is registered for all the tax heads with the Revenue Authority and trades with only tax compliant suppliers. The following were the transactions during the month of December 2021. Purchases (VAT inclusive where applicable). Particulars: Shs '000 Drugs and medicines 200,000 Cosmetics 58,000 Medical examination gloves 180,000 Sanitizers 233,000 Infra red thermometers 59,000 Motorised fumigation pumps 350,000 Expenses (VAT inclusive where applicable). Particulars Shs '000' Rent 10,000 Telephone Expenses 1,900 Salaries and wages 22,000 Office furniture 15,000 Commercial transport hire 95,000 Office security services 6,000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts