Question: Hello, would you please help me with this question? I have done the hard part, question B needs me to remove the avoidable cost. It

Hello, would you please help me with this question? I have done the hard part, question B needs me to remove the avoidable cost.

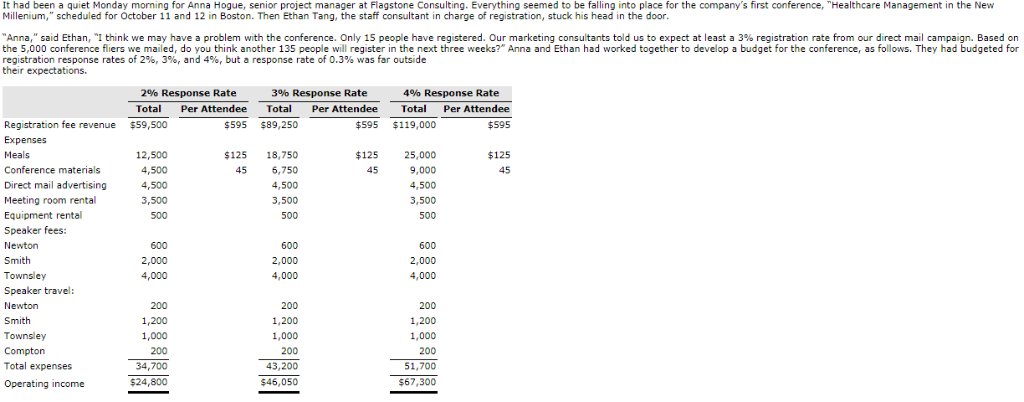

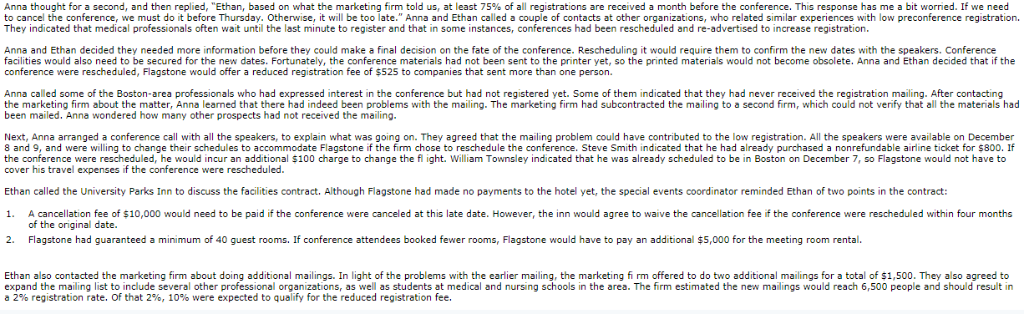

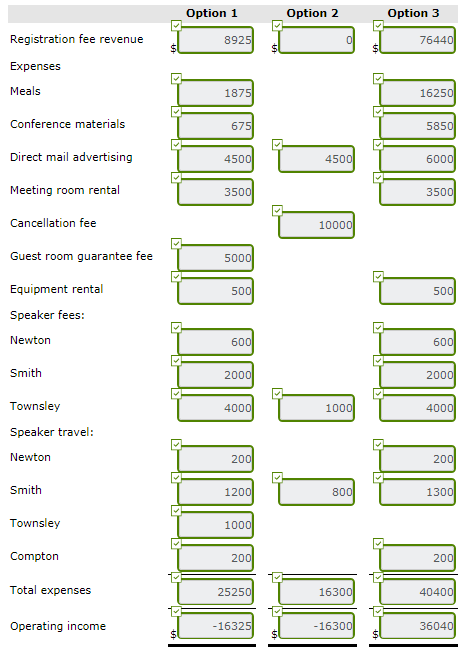

It had been a quiet Monday morning for Anna Hogue, senior project manager at Flagstone Consulting. Everything seemed to be falling into place for the company's first conference, "Healthcare Management in the New Millenium," scheduled for October 11 and 12 in Boston. Then Ethan Tang, the staff consultant in charge of registration, stuck his head in the door "Anna," said Ethan, "I think we may have a problem with the conference. Only 15 people have registered. Our marketing consultants told us to expect at least a 3% registration rate from our direct mail campaign. Based on the 5,000 conference fliers we mailed, do you think another 135 people will register in the next three weeks?" Anna and Ethan had worked together to develop a budget for the conference, as follows. They had budgeted for registration response rates of 296, 396, and 4%, but a response rate of 0.3% was far outside their expectations. 3% Response Rate Total 2% Response Rate Total Per Attendee 490 Response Rate Total Per Attendee Per Attendee Registration fee revenue $59,500 $595 $89,250 $595 $119,000 $595 12,500 4,500 4,500 3,500 $125 18,750 6,750 4,500 3,500 $125 25,000 9,000 4,500 3,500 $125 Conference materials Direct mail advertising Meeting room rental Equipment rental Speaker fees: Smith Townsley Speaker travel: 2,000 4,000 Smith Townsley Compton Total expenses Operating income 1,200 1,000 1,200 1,000 200 43,200 $46,050 1,200 1,000 200 51,700 $67,300 34,700 $24,800 Anna thought for a second, and then replied, "Ethan, based on what the marketing firm told us, at least 75% of all registrations are received a month before the conference. This response has me a bit worned. If we need to cancel the conference, we must do it before Thursday. Otherwise, it will be too late. Anna and Ethan called a couple of contacts at other organizations, who related similar experiences with low preconference registration. They indicated that medical professionals often wait until the last minute to register and that in some instances, conferences had been rescheduled and re-advertised to increase registration. Anna and Ethan decided they needed more information before they could make a final decision on the fate of the conference. Rescheduling it would require them to confirm the new dates with the speakers. Conference facilities would also need to be secured for the new dates. Fortunately, the conference materials had not been sent to the printer yet, so the printed materials would not become obsolete. Anna and Ethan decided that if the conference were rescheduled, Flagstone would offer a reduced registration fee of $525 to companies that sent more than one person. Anna caled some of the Boston-area professionals who had expressed interest in the conference but had not registered yet. Some of them indicated that they had never received the registration mailing. After contacting the marketing firm about the matter, Anna learned that there had indeed been problems with the mailing. The marketing firm had subcontracted the mailing to a second firm, which could not verify that all the materials had been mailed. Anna wondered how many other prospects had not received the mailing. Next, Anna arranged a conference call with all the speakers, to explain what was going on. They agreed that the mailing problem could have contributed to the low registration. All the speakers were available on December 8 and 9, and were willing to change their schedules to accommodate Flagstone if the firm chose to reschedule the conference. Steve Smith indicated that he had already purchased a nonrefundable ane ticket for $800. If the conference were rescheduled, he would incur an additional $100 charge to change the fl ight. William Townsley indicated that he was already scheduled to be in Boston on December 7, so Flagstone would not have to cover his travel f the conference were rescheduled. Ethan called the University Parks Inn to discuss the facilities contract. Although Flagstone had made no payments to the hotel yet, the special events coordinator reminded Ethan of two points in the contract: 1. A cancellation fee of $10,000 would need to be paid if the conference were canceled at this late date. However, the inn would agree to waive the cancellation fee if the conference were rescheduled within four months 2. Flagstone had guaranteed a minimum of 40 guest rooms. If conference attendees booked fewer rooms, Flagstone would have to pay an additional $5,000 for the meeting room rental. of the original date. Ethan also contacted the marketing firm about doing additional mailings. In light of the problems with the earlier mailing, the marketing fi rm offered to do two additional mailings for a total of $1,500. They also agreed to expand the mailing list to include several other professional organizations, as well as students at medical and nursing schools in the area. The firm estimated the new mailings would reach 6,500 people and should result in a 2% registration rate. Of that 2%, 10% were expected to qualify for the reduced registration fee. Option1 Option2 Option3 Registration fee revenue Expenses Meals 8925 76 187 1625 Conference materials 67 585 Direct mail advertising 450 450 600 Meeting room rental 350 3500 Cancellation fee 1000 Guest room guarantee fee Equipment rental Speaker fees: Newtorn 500 50 50 600 600 Smith Townsley Speaker travel: Newtorn 200 2000 4000 100 4000 20 20 Smith 120 130 800 Townsley Compton Total expenses Operating income 100 20 200 2525 1630 40400 -16325 1630 360 Adjust the statements in part (b) by eliminating the unavoidable costs from the calculation to show only the relevant income/loss from each option. (Enter negative amounts using either a negative sign preceding the number e.g. -45.) Relevant income (loss) Option 1 25250 Option 2 10000 Option 3 423430

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts