Question: HELLPP! Gary, the manager at Flint's Danishes, was eacited to determine the company's profit this year it was a break-out year for the company, especially

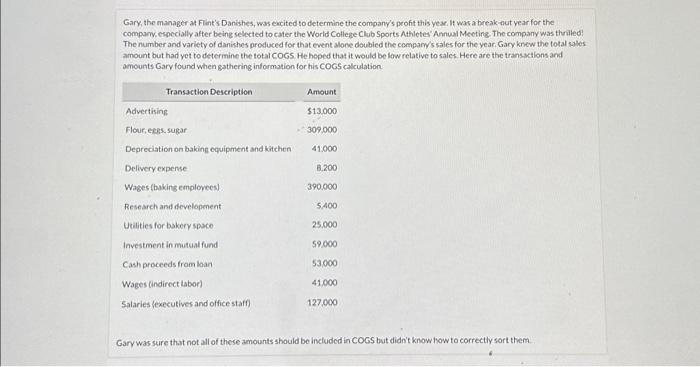

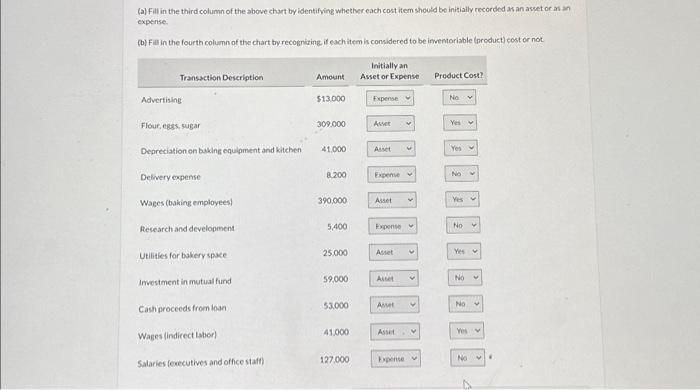

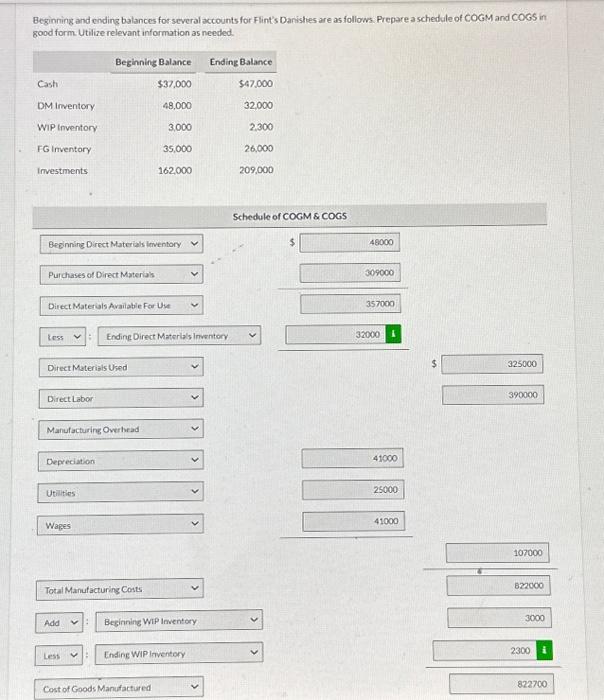

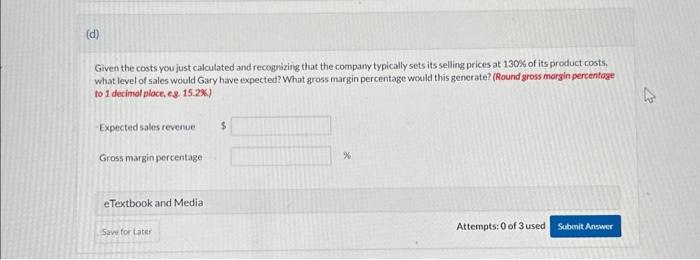

Gary, the manager at Flint's Danishes, was eacited to determine the company's profit this year it was a break-out year for the company, especially after being selected to cater the World College Club Sports Athletes Annual Meeting. The company was thraled! The number and variety of danishes produced for that event slone doubied the compary's sales for the year, Garyknew the total sales amount but had yet to determine the total COGS. He heped that it would be low relative to sales. Here are the transaktions and amounts Gary found when gathering informotion for his COGS calculation. Gary was sure that not all of these amounts should be included in COGS but didn't know how to correctly sort them. (a) Full in the third columin of the above chart by identifying whether cach cost item should bo initially recorded as an asset or as an expense. (b) Fill in the fourth column of the chart by recogniting, if each item is considered to be ieventeriable (preduct) cost or not Beginning and ending balances for severa accounts for Flint's Danishes are as follows. Prepare a schedule of COGM and COGS in good form Utilize relevant information as needed. Given the costs you just calculated and recognizing that the company typically sets its selling prices at 130% of its product costs. what level of sales would Gary have expected? What gross margin percentage would this generate? (Round gross margin percentage to 1 decimal ploce, es. 15.2\%) Expected sales revenue Grossmargin percentage Attempts: 0 of 3 used

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts