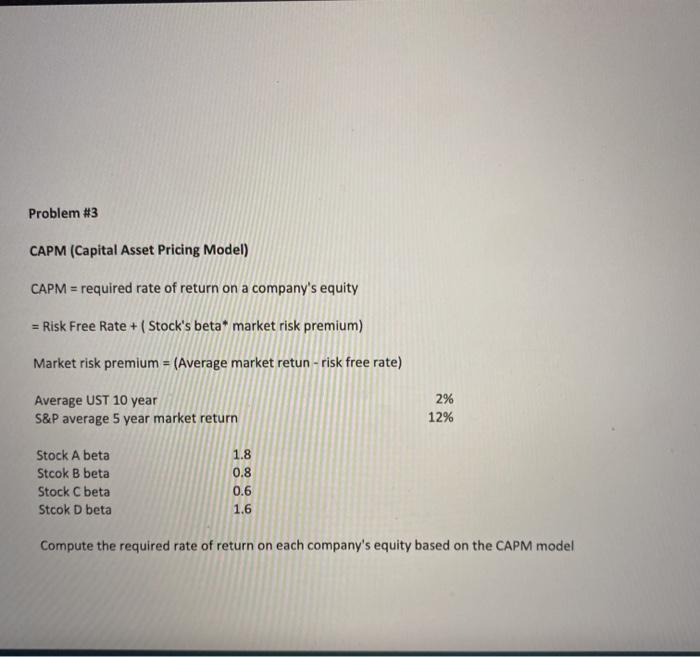

Question: helo please Problem #3 CAPM (Capital Asset Pricing Model) CAPM = required rate of return on a company's equity = Risk Free Rate + (Stock's

Problem #3 CAPM (Capital Asset Pricing Model) CAPM = required rate of return on a company's equity = Risk Free Rate + (Stock's beta* market risk premium) Market risk premium = (Average market retun - risk free rate) Average UST 10 year S&P average 5 year market return 2% 12% Stock A beta Stcok B beta Stock C beta Stcok D beta 1.8 0.8 0.6 1.6 Compute the required rate of return on each company's equity based on the CAPM model

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts