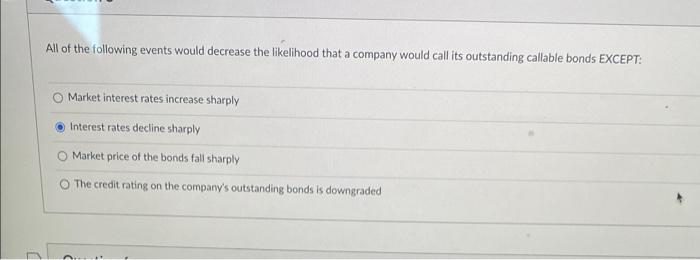

Question: help! 0 All of the following events would decrease the likelihood that a company would call its outstanding callable bonds EXCEPT: Market interest rates increase

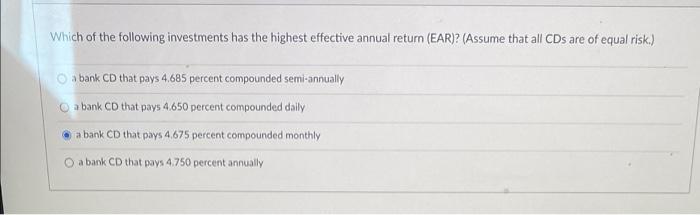

0 All of the following events would decrease the likelihood that a company would call its outstanding callable bonds EXCEPT: Market interest rates increase sharply Interest rates decline sharply Market price of the bonds fall sharply The credit rating on the company's outstanding bonds is downgraded Which of the following investments has the highest effective annual return (EAR)? (Assume that all CDs are of equal risk.) a bank CD that pays 4.685 percent compounded semi-annually a bank CD that pays 4.650 percent compounded daily a bank CD that pays 4.675 percent compounded monthly O a bank CD that pays 4.750 percent annually

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts