Question: help! 1 points QUESTION 7 For persons who eam an amount of income such that the Earned Income Tax Credit (EITC) benefit is neither increased

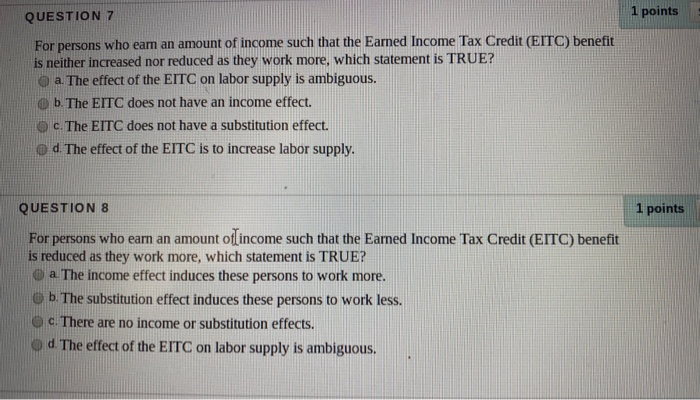

1 points QUESTION 7 For persons who eam an amount of income such that the Earned Income Tax Credit (EITC) benefit is neither increased nor reduced as they work more, which statement is TRUE? a. The effect of the EITC on labor supply is ambiguous. b. The EITC does not have an income effect. c. The EITC does not have a substitution effect. O d. The effect of the EITC is to increase labor supply. 1 points QUESTION 8 For persons who earn an amount of income such that the Earned Income Tax Credit (EITC) benefit is reduced as they work more, which statement is TRUE? O a The income effect induces these persons to work more. Ob The substitution effect induces these persons to work less. tc. There are no income or substitution effects. od. The effect of the EITC on labor supply is ambiguous

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts