Question: Help!!! 1. Prepare a multi-step income statement for the year ended December 31, 2015, including all required earnings per share disclosures. 2. Prepare a statement

Help!!!

1. Prepare a multi-step income statement for the year ended December 31, 2015, including all required earnings per share disclosures.

2. Prepare a statement of changes in equity for the year ended December 31, 2015.

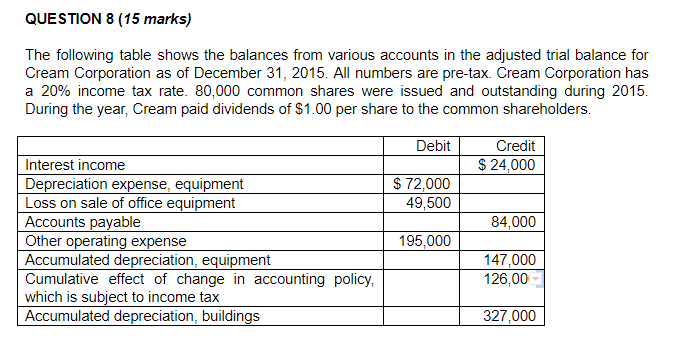

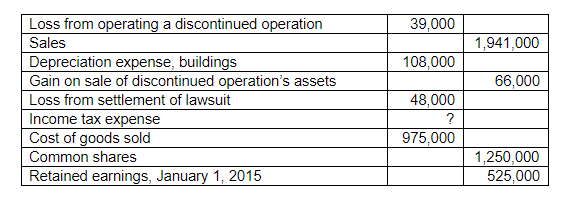

QUESTION 8 (15 marks) The following table shows the balances from various accounts in the adjusted trial balance for Cream Corporation as of December 31, 2015. All numbers are pre-tax. Cream Corporation has a 20% income tax rate. 80,000 common shares were issued and outstanding during 2015 During the year, Cream paid dividends of $1.00 per share to the common shareholders. Debit Credit $ 24,000 $ 72,000 49.500 84,000 Interest income Depreciation expense, equipment | Loss on sale of office equipment Accounts payable Other operating expense Accumulated depreciation, equipment Cumulative effect of change in accounting policy, which is subject to income tax Accumulated depreciation, buildings 195,000 147,000 126,00 327.000 39,000 1,941,000 108,000 66,000 Loss from operating a discontinued operation Sales Depreciation expense, buildings Gain on sale of discontinued operation's assets Loss from settlement of lawsuit Income tax expense Cost of goods sold Common shares Retained earnings, January 1, 2015 48,000 975,000 1,250,000 525,000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts