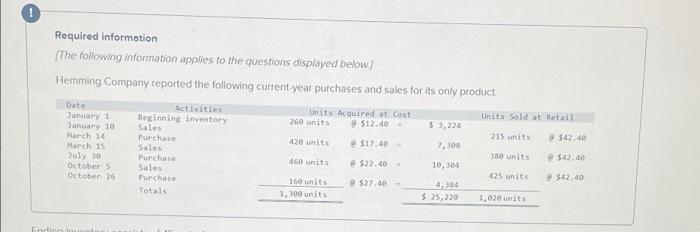

Question: help 2 help fast Required information (The following information applies to the questions displayed below.) Hemming Company reported the following current-year purchases and sales for

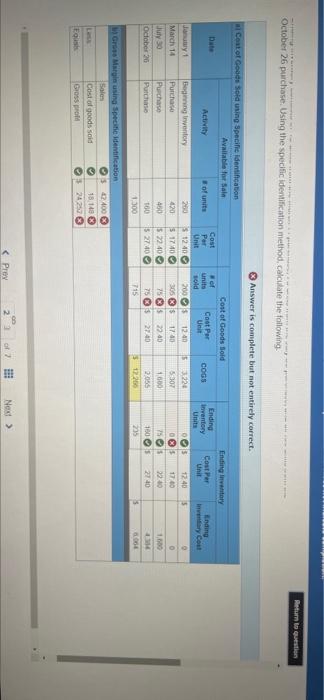

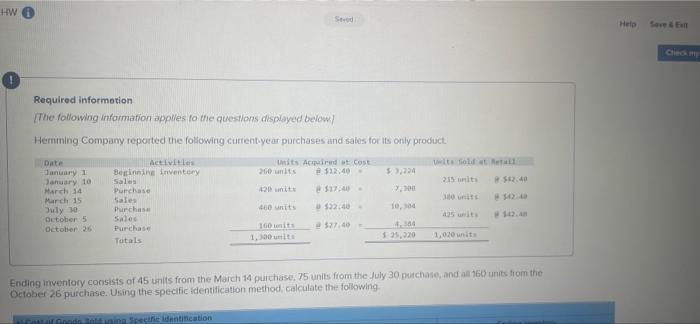

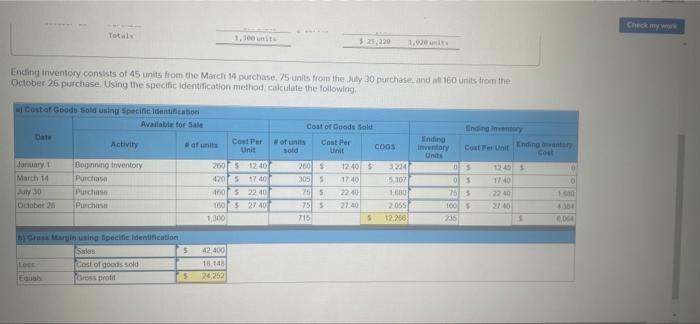

Required information (The following information applies to the questions displayed below.) Hemming Company reported the following current-year purchases and sales for its only product Data Activities Units Acquired at cost Units Sold at Retail January 1 Beginning inventory 260 units $12.40 $ 3,224 January 10 Sales March 24 Purchase 215 units 542.40 420 unit $17.60 7. Jos March 15 Sales 380 units $42.10 July 30 Purchase 460 units $22.40 10,304 October 5 425 units $42.40 October 26 Purchase 160 units @$27.40 Totals 1,300 units $ 25,220 1,020 units Sales Return to ton ---- October 26 purchase. Using the specific identification method, calculate the following Answer is complete but not entirely correct. mi Contot Goods Sold using Specific Identification Available for Sale Activity of units Cost Par Ending Inventory Cout Ult Ending Ending Inventory Cost Per Unita Unit OS 12.40 05 170 5 Jy March 14 July 30 October 20 Beginning Inventory Purchase Purchase Purchase 200 420 450 100 1300 Cost of Goods Gold Hef units Cost Per COGS Unit sold 2005 1240 53224 305 1740 5.307 75 635 7240 1600 75 635 2056 715 1220 $ 12:40 5 1740 57240 15 2740 22 1.000 2730 180 235 500 Gross Margusing Specite identification Sales $2400 Cost of goods sold 18.140 Foss Grosso 3 24 25 OOO 00 HW Seved Hello Sve fun Required information The following information applies to the questions displayed below) Hemming Company reported the following current year purchases and sales for its only product Date Activities Units Air Cost webold January 1 Beginning inventory its 12:40 January 10 Sales 215 units March 14 Purchase March is Sales Juris July 10 Purchase 400 units $22:40 October 5 Sales October 26 Purchase IGO $27.40 1,100 $35,320 Totals 1,020 unit , s 52:40 Ending Inventory consists of 45 units from the March 14 purchase, 75 units from the July 30 purchase, and all 160 units from the October 26 purchase. Using the specific identification method, calculate the following Lada Specificantication Total 1,100 units $ 25,220 1.000 Ending Inventory consists of 45 units from the March 14 purchase. 75 units from the July 30 purchase, and 160 units from the October 26 purchase. Using the specific identification method calculate the following w Cost of Goods Sold using Specine Identification Available for sale Date Activity of units Cost Per Unit Coat of Goods Solu of units Cost Per sold COGS 12405 1740 January 1 March 14 30 October 21 Beginning inventory Purchase Purchase Purchase 2005 12:40 2015 1740 1601 5 22 40 1005 2740 1300 2005 305 755 755 715 Ending inventory Coster Ending way Units os $ 755 2240 1005 2160 235 2004 3234 5107 1.000 2055 12.256 22:00 5 5 rerin using lipecite identification Sales Cost of goods sold Grosso 42.400 18.11 24,252 5

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts