Question: HELP!!!!!!! 2. Prepare the journal entry to record the allocation of the year 1 income under alternative (d) above. Question # 1 Fallon and Springer

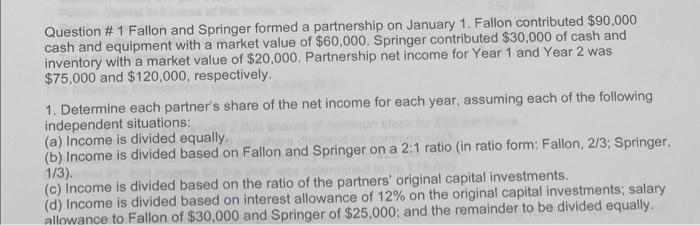

Question \# 1 Fallon and Springer formed a partnership on January 1. Fallon contributed $90,000 cash and equipment with a market value of $60,000. Springer contributed $30,000 of cash and inventory with a market value of $20,000. Partnership net income for Year 1 and Year 2 was $75,000 and $120,000, respectively. 1. Determine each partner's share of the net income for each year, assuming each of the following independent situations: (a) Income is divided equally. (b) Income is divided based on Fallon and Springer on a 2:1 ratio (in ratio form: Fallon, 2/3; Springer. 1/3). (c) Income is divided based on the ratio of the partners' original capital investments. (d) Income is divided based on interest allowance of 12% on the original capital investments: salary allowance to Fallon of $30,000 and Springer of $25,000; and the remainder to be divided equally

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts