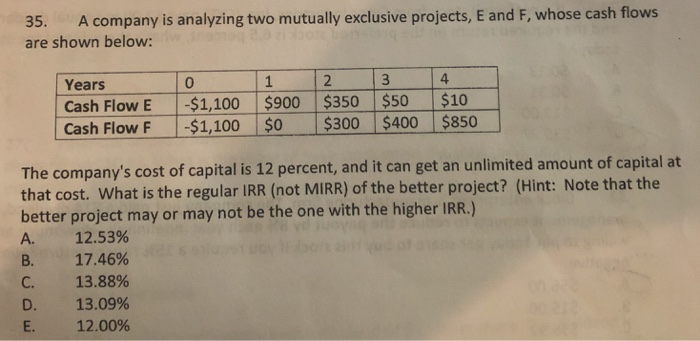

Question: HELP 35. A company is analyzing two mutually exclusive projects, E and F, whose cash flows are shown below: 4 Years Cash Flow E -$1,100

35. A company is analyzing two mutually exclusive projects, E and F, whose cash flows are shown below: 4 Years Cash Flow E -$1,100 $900 $350 $50 $10 Cash Flow F 1,100 $0 $300 $400 $850 0 The company's cost of capital is 12 percent, and it can get an unlimited amount of capital at that cost. What is the regular IRR (not MIRR) of the better project? (Hint: Note that the better project may or may not be the one with the higher IRR.) A. 12.53% B. 17.46% C. D. 13.09% 13.88% 12.00%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts