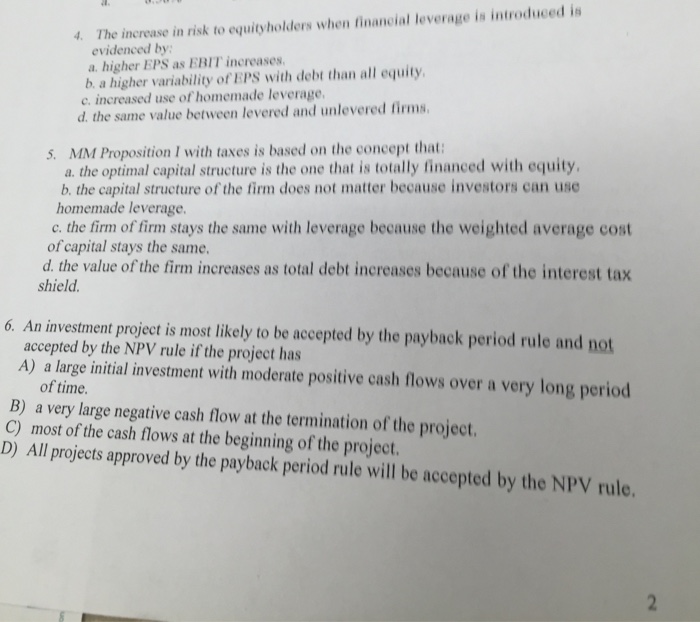

Question: Help 4 to 6 The increase in risk equityholders when financial leverage is introduced in evidenced by: higher EPS as EBIT increases. a higher variability

The increase in risk equityholders when financial leverage is introduced in evidenced by: higher EPS as EBIT increases. a higher variability of EPS with debt than all equity. increased use of homemade leverage. the same value between levered and unlevered firms. MM Proposition I with taxes is based on the concept that: the optimal capital structure is the one that is totally financed with equity the capital structure of the firm does not matter because investors can use homemade leverage. the firm of firm stays the same with leverage because the weighted average cost of capital stays the same. the value of the firm increases as total debt increases because of the interest tax shield. An investment project is most likely to be accepted by the payback period rule and not accepted by the NPV rule if the project has a large initial investment with moderate positive cash flows over a very long period of time. a very large negative cash flow at the beginning of the proje

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts