Question: Help 41 42 44 45 41. Based on the information on the Bank Reconciliation sheet prepare the journal entry required to decreases cash. 42. Income

Help 41 42 44 45

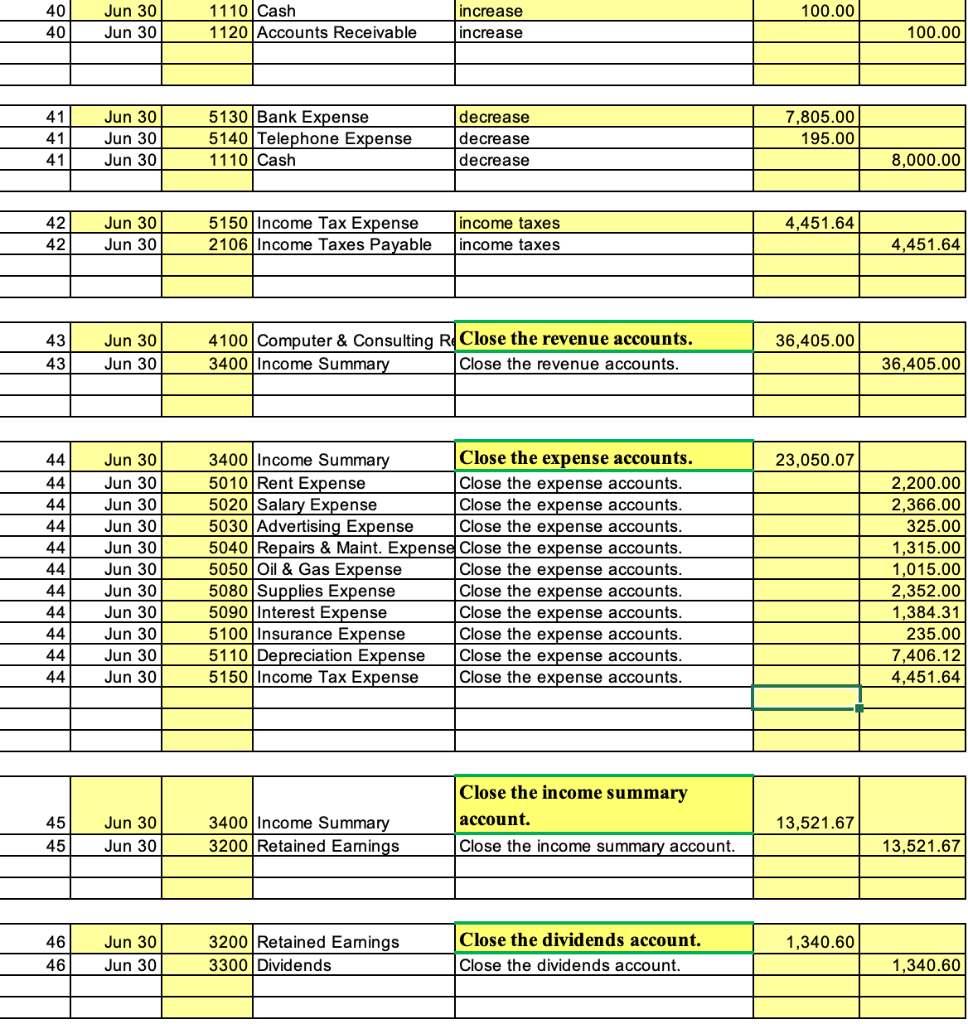

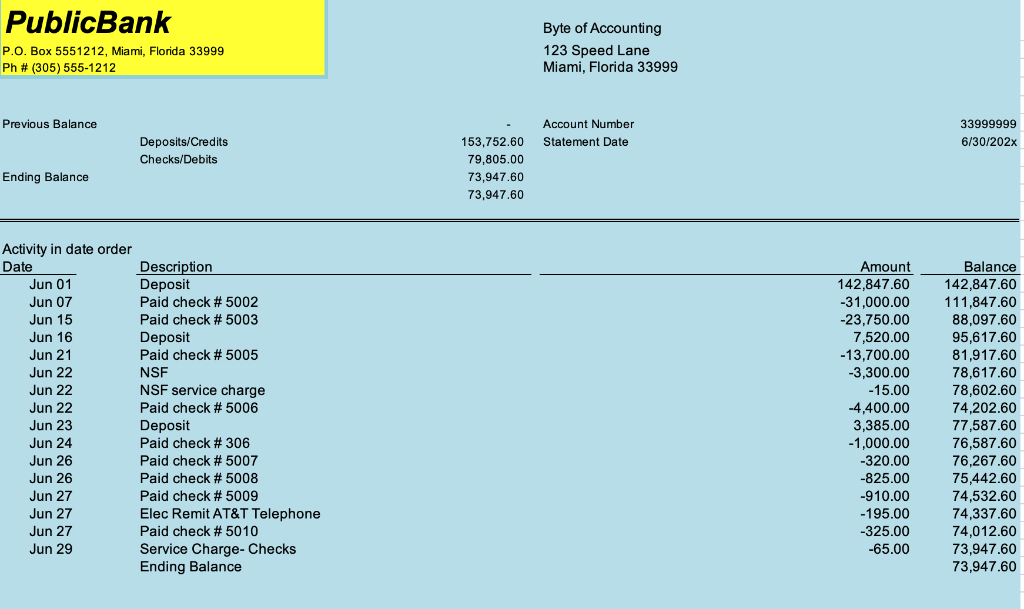

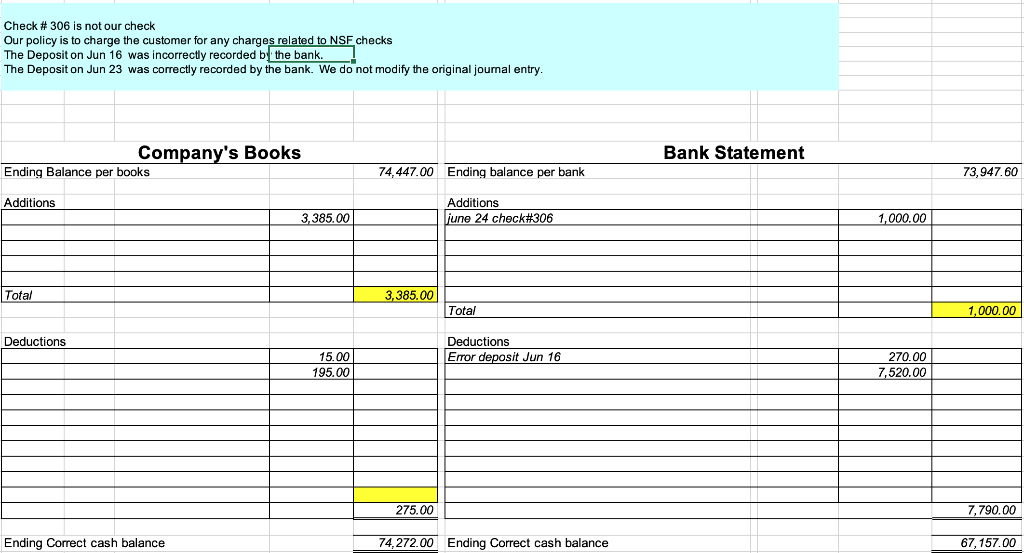

| 41. | Based on the information on the "Bank Reconciliation" sheet prepare the journal entry required to decreases cash. |

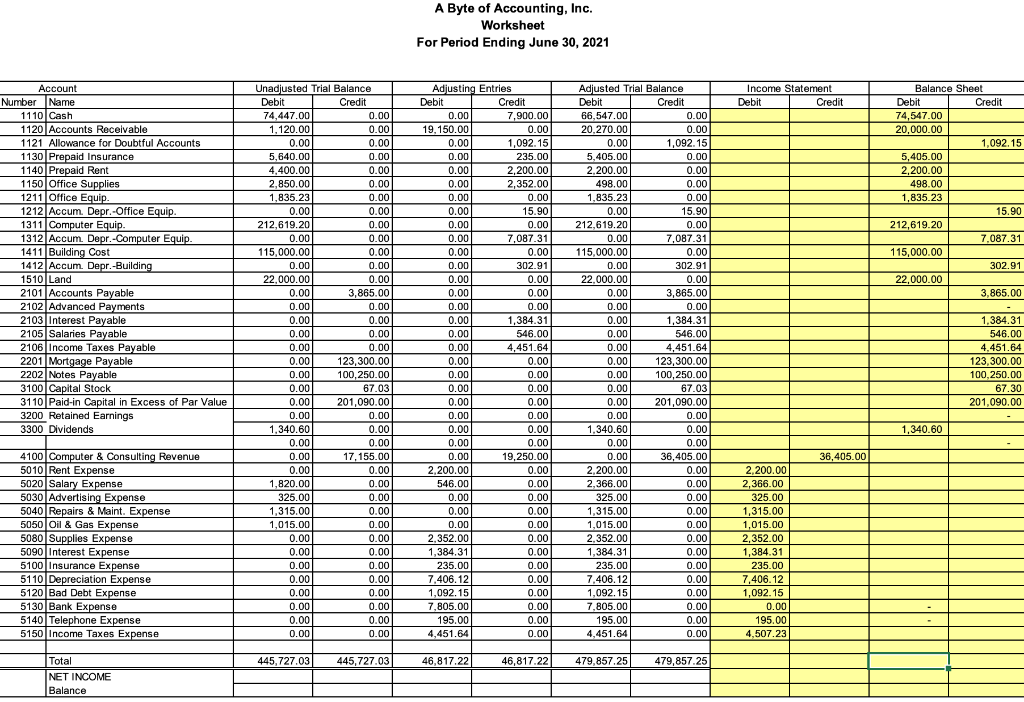

| 42. | Income taxes are to be computed at the rate of 25 percent of net income before taxes. |

| [IMPORTANT NOTE: Since the income taxes are a percent of the net income you will want to prepare the Income Statements through the Net Income Before Tax line. The worksheet contains all of the accounts and their balances which you can then transfer to the appropriate financial statement.] |

| 44. | Close the expense accounts. |

| 45. | Close the income summary account. |

100.00 40 40 Jun 30 Jun 30 1110 Cash 1120 Accounts Receivable increase increase 100.00 41 Jun 30 Jun 30 Jun 30 41 41 5130 Bank Expense 5140 Telephone Expense 1110 Cash decrease decrease decrease 7,805.00 195.00 8,000.00 4,451.64 42 42 Jun 30 Jun 30 5150 Income Tax Expense 2106 Income Taxes Payable income taxes income taxes 4,451.64 36,405.00 43 43 Jun 30 Jun 30 4100 Computer & Consulting R Close the revenue accounts. 3400 Income Summary Close the revenue accounts. 36,405.00 23,050.07 44 44 44 44 44 44 44 44 44 44 44 Jun 30 Jun 30 Jun 30 Jun 30 Jun 30 Jun 30 Jun 30 Jun 30 Jun 30 Jun 30 Jun 30 3400 Income Summary Close the expense accounts. 5010 Rent Expense Close the expense accounts. 5020 Salary Expense Close the expense accounts. 5030 Advertising Expense Close the expense accounts. 5040 Repairs & Maint. Expense Close the expense accounts. 5050 Oil & Gas Expense Close the expense accounts. 5080 Supplies Expense Close the expense accounts. 5090 Interest Expense Close the expense accounts. 5100 Insurance Expense Close the expense accounts. 5110 Depreciation Expense Close the expense accounts. 5150 Income Tax Expense Close the expense accounts. 2,200.00 2,366.00 325.00 1,315.00 1,015.00 2,352.00 1,384.31 235.00 7,406.12 4,451.64 45 45 13,521.67 Jun 30 Jun 30 Close the income summary account. Close the income summary account. 3400 Income Summary 3200 Retained Earnings 13,521.67 1,340.60 46 46 Jun 30 Jun 30 3200 Retained Earnings 3300 Dividends Close the dividends account. Close the dividends account. 1,340.60 Public Bank P.O. Box 5551212, Miami, Florida 33999 Ph # (305) 555-1212 Byte of Accounting 123 Speed Lane Miami, Florida 33999 Previous Balance Account Number Statement Date 33999999 6/30/202x Deposits/Credits Checks/Debits Ending Balance 153,752.60 79,805.00 73,947.60 73,947.60 Activity in date order Date Description Jun 01 Deposit Jun 07 Paid check # 5002 Jun 15 Paid check # 5003 Jun 16 Deposit Jun 21 Paid check # 5005 Jun 22 NSF Jun 22 NSF service charge Jun 22 Paid check # 5006 Jun 23 Deposit Jun 24 Paid check # 306 Jun 26 Paid check # 5007 Jun 26 Paid check #5008 Jun 27 Paid check # 5009 Jun 27 Elec Remit AT&T Telephone Jun 27 Paid check # 5010 Jun 29 Service Charge-Checks Ending Balance Amount 142,847.60 -31,000.00 -23,750.00 7,520.00 -13,700.00 -3,300.00 -15.00 -4,400.00 3,385.00 -1,000.00 -320.00 -825.00 -910.00 -195.00 -325.00 -65.00 Balance 142,847.60 111,847.60 88,097.60 95,617.60 81,917.60 78,617.60 78,602.60 74,202.60 77,587.60 76,587.60 76,267.60 75,442.60 74,532.60 74,337.60 74,012.60 73,947.60 73,947.60 Check # 306 is not our check Our policy is to charge the customer for any charges related to NSF checks The Deposit on Jun 16 was incorrectly recorded by the bank. The Deposit on Jun 23 was correctly recorded by the bank. We do not modify the original journal entry. Company's Books Ending Balance per books Bank Statement 74,447.00 Ending balance per bank 73,947.60 Additions 3,385.00 Additions ljune 24 check#306 1,000.00 Total 3,385.00 Total 1,000.00 Deductions Deductions Error deposit Jun 16 15.00 195.00 270.00 7,520.00 275.00 7,790.00 Ending Correct cash balance 74,272.00 Ending Correct cash balance 67,157.00 A Byte of Accounting, Inc. Worksheet For Period Ending June 30, 2021 Income Statement Debit Credit Account Number Name 1110 Cash 1120 Accounts Receivable 1121 Allowance for Doubtful Accounts 1130 Prepaid Insurance 1140 Prepaid Rent 1150 Office Supplies 1211 Office Equip. 1212 Accum. Depr.-Office Equip 1311 Computer Equip. 1312 Accum. Depr.-Computer Equip 1411 Building Cost 1412 Accum. Depr.-Building 1510 Land 2101 Accounts Payable 2102 Advanced Payments 2103 Interest Payable 2105 Salaries Payable 2106 Income Taxes Payable 2201 Mortgage Payable 2202 Notes Payable 3100 Capital Stock 3110 Paid-in Capital in Excess of Par Value 3200 Retained Earnings 3300 Dividends Balance Sheet Debit Credit 74,547.00 20,000.00 1.092.15 5,405.00 2,200.00 498.00 1,835.23 15.90 212,619.20 7.087.31 115,000.00 302.91 22,000.00 3,865.00 Unadjusted Trial Balance Debit Credit 74,447.00 0.00 1,120.00 0.00 0.00 0.00 5,640.00 0.00 4,400.00 0.00 2,850.00 0.00 1,835.23 0.00 0.00 0.00 212,619.20 0.00 0.00 0.00 115,000.00 0.00 0.00 0.00 22,000.00 0.00 0.00 3,865.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 123,300.00 0.00 100,250.00 0.00 67.03 0.00 201,090.00 0.00 0.00 1.340.60 0.00 0.00 0.00 0.00 17,155.00 0.00 0.00 1,820.00 0.00 325.00 0.00 1,315.00 0.00 1,015.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 Adjusting Entries Debit Credit 0.00 7,900.00 19,150.00 0.00 0.00 1,092.15 0.00 235.00 0.00 2,200.00 0.00 2,352.00 0.00 0.00 0.00 15.90 0.00 0.00 0.00 7.087.31 0.00 0.00 0.00 302.91 0.00 0.00 0.00 0.00 0.00 0.00 0.00 1,384.31 0.00 546.00 0.00 4,451.64 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 19,250.00 2,200.00 0.00 546.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 2,352.00 0.00 1,384.31 0.00 235.00 0.00 7,406.12 0.00 1,092.15 0.00 7,805.00 0.00 195.00 0.00 4,451.64 0.00 Adjusted Trial Balance Debit Credit 66,547.00 0.00 20,270.00 0.00 0.00 1,092.15 5,405.00 0.00 2,200.00 0.00 498.00 0.00 1,835.23 0.00 0.00 15.90 212,619.20 0.00 0.00 7.087.31 115,000.00 0.00 0.00 302.91 22.000.00 0.00 0.00 3,865.00 0.00 0.00 0.00 1,384.31 0.00 546.00 0.00 4,451.64 0.00 123,300.00 0.00 100,250.00 0.00 67.03 0.00 201,090.00 0.00 0.00 1.340.60 0.00 0.00 0.001 0.00 36,405.00 2,200.00 0.00 2,366.00 0.00 325.00 0.00 1,315.00 0.00 1,015.00 0.00 2.352.00 0.00 1,384.31 0.00 235.00 0.00 7,406.12 0.00 1,092.15 0.00 7,805.00 0.00 195.00 0.00 4,451.64 0.00 1,384.31 546.00 4,451.64 123,300.00 100,250.00 67.30 201,090.00 1,340.60 36,405.00 4100 Computer & Consulting Revenue 5010 Rent Expense 5020 Salary Expense 5030 Advertising Expense 5040 Repairs & Maint. Expense 5050 Oil & Gas Expense 5080 Supplies Expense 5090 Interest Expense 5100 Insurance Expense 5110 Depreciation Expense 5120 Bad Debt Expense 5130 Bank Expense 5140 Telephone Expense 5150 Income Taxes Expense 2,200.00 2.366.00 325.00 1,315.00 1,015.00 2,352.00 1,384.31 235.00 7,406.12 1,092.15 0.00 195.00 4,507.23 445,727.03 445,727.03 46,817.22 46,817.22 479,857.25 479,857.25 Total NET INCOME Balance 100.00 40 40 Jun 30 Jun 30 1110 Cash 1120 Accounts Receivable increase increase 100.00 41 Jun 30 Jun 30 Jun 30 41 41 5130 Bank Expense 5140 Telephone Expense 1110 Cash decrease decrease decrease 7,805.00 195.00 8,000.00 4,451.64 42 42 Jun 30 Jun 30 5150 Income Tax Expense 2106 Income Taxes Payable income taxes income taxes 4,451.64 36,405.00 43 43 Jun 30 Jun 30 4100 Computer & Consulting R Close the revenue accounts. 3400 Income Summary Close the revenue accounts. 36,405.00 23,050.07 44 44 44 44 44 44 44 44 44 44 44 Jun 30 Jun 30 Jun 30 Jun 30 Jun 30 Jun 30 Jun 30 Jun 30 Jun 30 Jun 30 Jun 30 3400 Income Summary Close the expense accounts. 5010 Rent Expense Close the expense accounts. 5020 Salary Expense Close the expense accounts. 5030 Advertising Expense Close the expense accounts. 5040 Repairs & Maint. Expense Close the expense accounts. 5050 Oil & Gas Expense Close the expense accounts. 5080 Supplies Expense Close the expense accounts. 5090 Interest Expense Close the expense accounts. 5100 Insurance Expense Close the expense accounts. 5110 Depreciation Expense Close the expense accounts. 5150 Income Tax Expense Close the expense accounts. 2,200.00 2,366.00 325.00 1,315.00 1,015.00 2,352.00 1,384.31 235.00 7,406.12 4,451.64 45 45 13,521.67 Jun 30 Jun 30 Close the income summary account. Close the income summary account. 3400 Income Summary 3200 Retained Earnings 13,521.67 1,340.60 46 46 Jun 30 Jun 30 3200 Retained Earnings 3300 Dividends Close the dividends account. Close the dividends account. 1,340.60 Public Bank P.O. Box 5551212, Miami, Florida 33999 Ph # (305) 555-1212 Byte of Accounting 123 Speed Lane Miami, Florida 33999 Previous Balance Account Number Statement Date 33999999 6/30/202x Deposits/Credits Checks/Debits Ending Balance 153,752.60 79,805.00 73,947.60 73,947.60 Activity in date order Date Description Jun 01 Deposit Jun 07 Paid check # 5002 Jun 15 Paid check # 5003 Jun 16 Deposit Jun 21 Paid check # 5005 Jun 22 NSF Jun 22 NSF service charge Jun 22 Paid check # 5006 Jun 23 Deposit Jun 24 Paid check # 306 Jun 26 Paid check # 5007 Jun 26 Paid check #5008 Jun 27 Paid check # 5009 Jun 27 Elec Remit AT&T Telephone Jun 27 Paid check # 5010 Jun 29 Service Charge-Checks Ending Balance Amount 142,847.60 -31,000.00 -23,750.00 7,520.00 -13,700.00 -3,300.00 -15.00 -4,400.00 3,385.00 -1,000.00 -320.00 -825.00 -910.00 -195.00 -325.00 -65.00 Balance 142,847.60 111,847.60 88,097.60 95,617.60 81,917.60 78,617.60 78,602.60 74,202.60 77,587.60 76,587.60 76,267.60 75,442.60 74,532.60 74,337.60 74,012.60 73,947.60 73,947.60 Check # 306 is not our check Our policy is to charge the customer for any charges related to NSF checks The Deposit on Jun 16 was incorrectly recorded by the bank. The Deposit on Jun 23 was correctly recorded by the bank. We do not modify the original journal entry. Company's Books Ending Balance per books Bank Statement 74,447.00 Ending balance per bank 73,947.60 Additions 3,385.00 Additions ljune 24 check#306 1,000.00 Total 3,385.00 Total 1,000.00 Deductions Deductions Error deposit Jun 16 15.00 195.00 270.00 7,520.00 275.00 7,790.00 Ending Correct cash balance 74,272.00 Ending Correct cash balance 67,157.00 A Byte of Accounting, Inc. Worksheet For Period Ending June 30, 2021 Income Statement Debit Credit Account Number Name 1110 Cash 1120 Accounts Receivable 1121 Allowance for Doubtful Accounts 1130 Prepaid Insurance 1140 Prepaid Rent 1150 Office Supplies 1211 Office Equip. 1212 Accum. Depr.-Office Equip 1311 Computer Equip. 1312 Accum. Depr.-Computer Equip 1411 Building Cost 1412 Accum. Depr.-Building 1510 Land 2101 Accounts Payable 2102 Advanced Payments 2103 Interest Payable 2105 Salaries Payable 2106 Income Taxes Payable 2201 Mortgage Payable 2202 Notes Payable 3100 Capital Stock 3110 Paid-in Capital in Excess of Par Value 3200 Retained Earnings 3300 Dividends Balance Sheet Debit Credit 74,547.00 20,000.00 1.092.15 5,405.00 2,200.00 498.00 1,835.23 15.90 212,619.20 7.087.31 115,000.00 302.91 22,000.00 3,865.00 Unadjusted Trial Balance Debit Credit 74,447.00 0.00 1,120.00 0.00 0.00 0.00 5,640.00 0.00 4,400.00 0.00 2,850.00 0.00 1,835.23 0.00 0.00 0.00 212,619.20 0.00 0.00 0.00 115,000.00 0.00 0.00 0.00 22,000.00 0.00 0.00 3,865.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 123,300.00 0.00 100,250.00 0.00 67.03 0.00 201,090.00 0.00 0.00 1.340.60 0.00 0.00 0.00 0.00 17,155.00 0.00 0.00 1,820.00 0.00 325.00 0.00 1,315.00 0.00 1,015.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 Adjusting Entries Debit Credit 0.00 7,900.00 19,150.00 0.00 0.00 1,092.15 0.00 235.00 0.00 2,200.00 0.00 2,352.00 0.00 0.00 0.00 15.90 0.00 0.00 0.00 7.087.31 0.00 0.00 0.00 302.91 0.00 0.00 0.00 0.00 0.00 0.00 0.00 1,384.31 0.00 546.00 0.00 4,451.64 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 19,250.00 2,200.00 0.00 546.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 2,352.00 0.00 1,384.31 0.00 235.00 0.00 7,406.12 0.00 1,092.15 0.00 7,805.00 0.00 195.00 0.00 4,451.64 0.00 Adjusted Trial Balance Debit Credit 66,547.00 0.00 20,270.00 0.00 0.00 1,092.15 5,405.00 0.00 2,200.00 0.00 498.00 0.00 1,835.23 0.00 0.00 15.90 212,619.20 0.00 0.00 7.087.31 115,000.00 0.00 0.00 302.91 22.000.00 0.00 0.00 3,865.00 0.00 0.00 0.00 1,384.31 0.00 546.00 0.00 4,451.64 0.00 123,300.00 0.00 100,250.00 0.00 67.03 0.00 201,090.00 0.00 0.00 1.340.60 0.00 0.00 0.001 0.00 36,405.00 2,200.00 0.00 2,366.00 0.00 325.00 0.00 1,315.00 0.00 1,015.00 0.00 2.352.00 0.00 1,384.31 0.00 235.00 0.00 7,406.12 0.00 1,092.15 0.00 7,805.00 0.00 195.00 0.00 4,451.64 0.00 1,384.31 546.00 4,451.64 123,300.00 100,250.00 67.30 201,090.00 1,340.60 36,405.00 4100 Computer & Consulting Revenue 5010 Rent Expense 5020 Salary Expense 5030 Advertising Expense 5040 Repairs & Maint. Expense 5050 Oil & Gas Expense 5080 Supplies Expense 5090 Interest Expense 5100 Insurance Expense 5110 Depreciation Expense 5120 Bad Debt Expense 5130 Bank Expense 5140 Telephone Expense 5150 Income Taxes Expense 2,200.00 2.366.00 325.00 1,315.00 1,015.00 2,352.00 1,384.31 235.00 7,406.12 1,092.15 0.00 195.00 4,507.23 445,727.03 445,727.03 46,817.22 46,817.22 479,857.25 479,857.25 Total NET INCOME Balance

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts