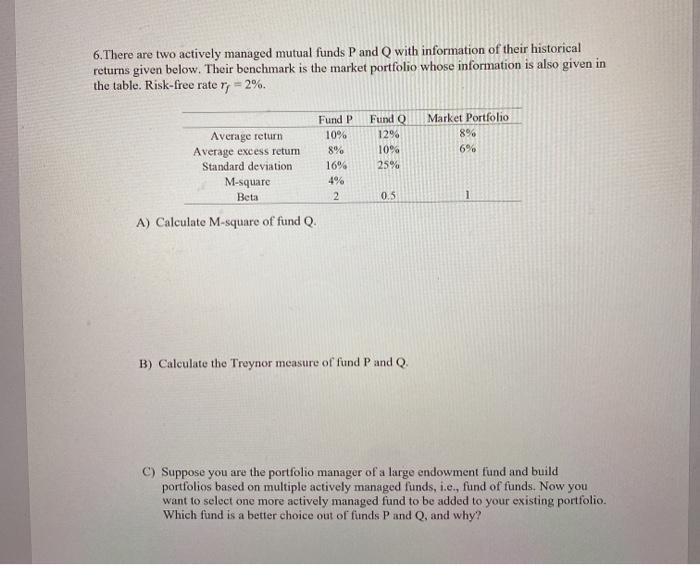

Question: HELP 6. There are two actively managed mutual funds P and Q with information of their historical returns given below. Their benchmark is the market

6. There are two actively managed mutual funds P and Q with information of their historical returns given below. Their benchmark is the market portfolio whose information is also given in the table. Risk-free rate ry = 2%. Market Portfolio 8% 6% Average return Average excess retum Standard deviation M-square Beta Fund P 10% 8% 16% 4% 2 Fund 0 129 10% 25% 0.5 1 A) Calculate M-square of fund Q. B) Calculate the Treynor measure of fund P and Q. C) Suppose you are the portfolio manager of a large endowment fund and build portfolios based on multiple actively managed funds, i.e., fund of funds. Now you want to select one more actively managed fund to be added to your existing portfolio. Which fund a better choice out of funds P and Q, and why

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts