Question: help A non-current asset register showed a net book value of $67,460. A non-current asset costing $15,000 had been sold for $4,000, making a loss

help

help

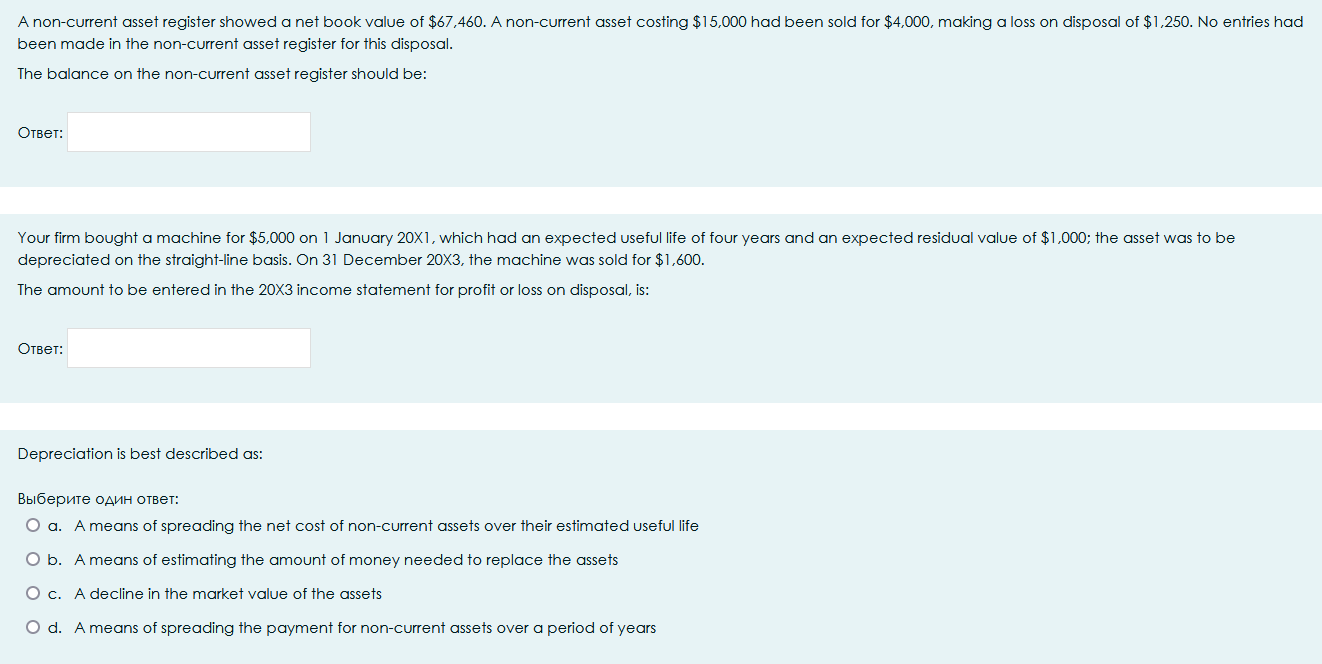

A non-current asset register showed a net book value of $67,460. A non-current asset costing $15,000 had been sold for $4,000, making a loss on disposal of $1,250. No entries ha been made in the non-current asset register for this disposal. The balance on the non-current asset register should be: O: Your firm bought a machine for $5,000 on 1 January 20X, which had an expected useful life of four years and an expected residual value of $1,000; the asset was to be depreciated on the straight-line basis. On 31 December 203, the machine was sold for $1,600. The amount to be entered in the 203 income statement for profit or loss on disposal, is: O: Depreciation is best described as: : a. A means of spreading the net cost of non-current assets over their estimated useful life b. A means of estimating the amount of money needed to replace the assets c. A decline in the market value of the assets d. A means of spreading the payment for non-current assets over a period of years

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts