Question: help! accounting problem- please help Texas Roadhouse opened a new restaurant in October. During its first three months of operation, the restaurant sold gift cards

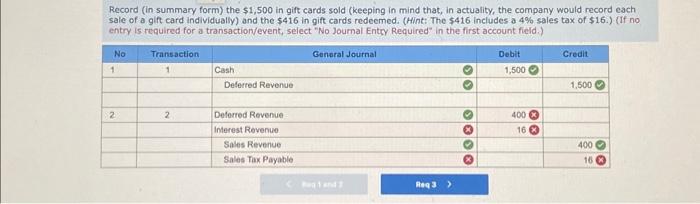

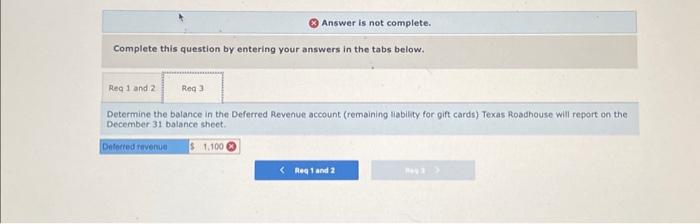

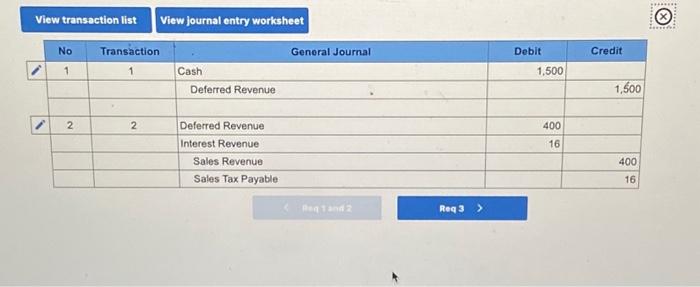

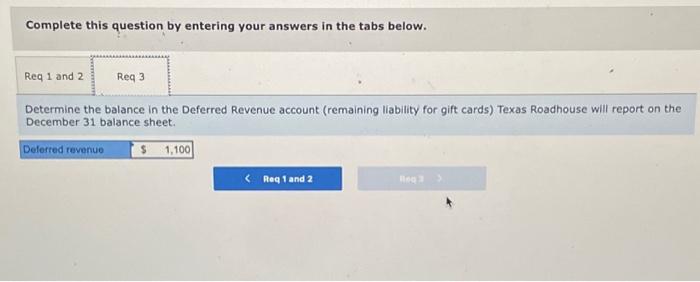

Texas Roadhouse opened a new restaurant in October. During its first three months of operation, the restaurant sold gift cards in various amounts totaling $1,500. The cards are redeemable for meals within one year of the purchase date. Gift cards totaling $416 were presented for redemption during the first three months of operation prior to year-end on December 31. The sales tax rate on restaurant sales is 4%, assessed at the time meals (not gift cards) are purchased. Texas Roadhouse will remit sales taxes in January. Required: 1. \& 2. Record (in summary form) the $1,500 in gift cards sold (keeping in mind that, in actuality, the company would record each sale of a gift card individually) and the $416 in gift cards fedeemed. (Hint. The $416 includes a 4%sales tax of $16.) 3. Determing the balance in the Deferred Revenue account (remaining liablity for gift cards) Texas Roadhouse will report on the December 31 balance sheet. Record (in summary form) the $1,500 in gift cards sold (keeping in mind that, in actuality, the company would record each sale of a gift card individually) and the $416 in gift cards redeemed. (Hint: The $416 includes a 4% sales tax of $16.) (If no entry is required for a transaction/event, select "No Journal Entry Required" in the first account field.) Complete this question by entering your answers in the tabs below. Determine the balance in the Deferred Revenue account (remaining liability for gift cards) Texas Roadhouse will report on the December 31 balance shect. Texas Roadhouse opened a new restaurant in October. During its first three months of operation, the restaurant sold gift cards in various amounts totaling $1,500. The cards are redeemable for meals within one year of the purchase date, Gift cards totaling $416 were presented for redemption during the first three months of operation prior to year-end on December 31. The sales tax rate on restaurant sales is 4%, assessed at the time meals (not gift cards) are purchased. Texas Roadhouse will remit sales taxes in January. Required: 1. \& 2. Record (in summary form) the $1,500 in gift cards sold (keeping in mind that, in actuality, the company would record each sale of a gift card individually) and the $416 in gift cards redeemed. (Hint. The $416 includes a 4% sales tax of $16.) 3. Determine the balance in the Deferred Revenue account (remaining liability for gift cards) Texas Roadhouse will report on the December 31 balance sheet. View transaction list View journal entry worksheet Complete this question by entering your answers in the tabs below. Determine the balance in the Deferred Revenue account (remaining liability for gift cards) Texas Roadhouse will report on the December 31 balance sheet

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts