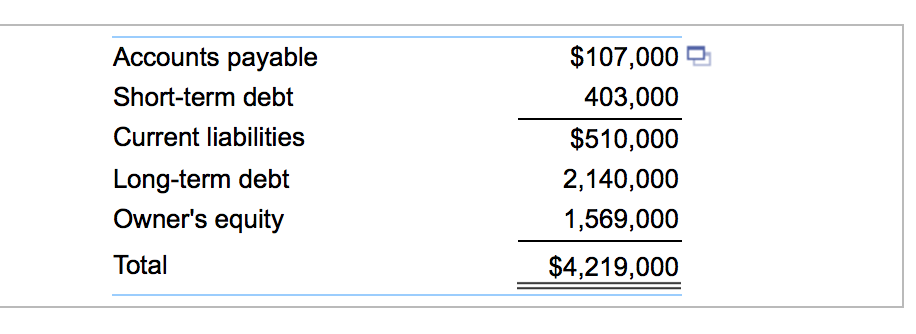

Question: help Accounts payable $107,000 n- Short- term debt 403,000 Current liabilities $510,000 Long-term debt 2, 140,000 Owner's equity 1, 569,000 Total $4, 219,000 (Adjusting a

help

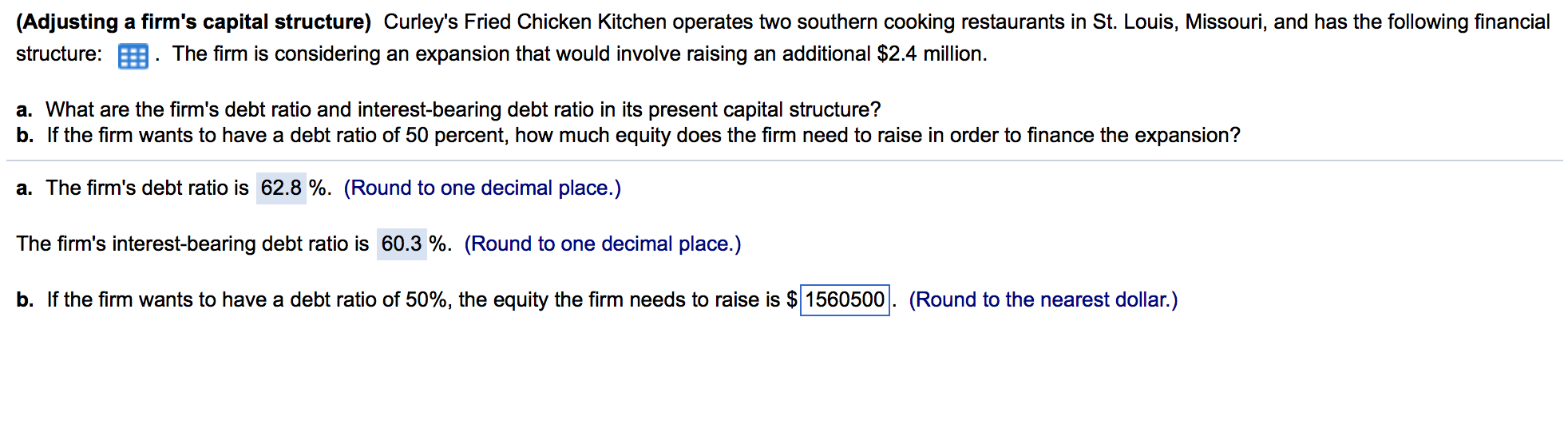

Accounts payable $107,000 n- Short- term debt 403,000 Current liabilities $510,000 Long-term debt 2, 140,000 Owner's equity 1, 569,000 Total $4, 219,000 (Adjusting a firm's capital structure) Curley's Fried Chicken Kitchen operates two southern cooking restaurants in St. Louis, Missouri, and has the following financial structure: gg. The firm is considering an expansion that would involve raising an additional $2.4 million. What are the firm's debt ratio and interest-bearing debt ratio in its present capital structure? If the firm wants to have a debt ratio of 50 percent, how much equity does the firm need to raise in order to finance the expansion? The firm's debt ratio is 62.8 %. (Round to one decimal place.) The firm's interest-bearing debt ratio is 60.3 %. (Round to one decimal place.) If the firm wants to have a debt ratio of 50%, the equity the firm needs to raise is $ 1560500. (Round to the nearest dollar.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts