Question: Help answer multiple-choice question with explanation please Table 1: Present Value of $1.00 Period 1% 2% 3% 4% 5% 6% 7% 8% 9% 10% 11%

Help answer multiple-choice question with explanation please

Help answer multiple-choice question with explanation please

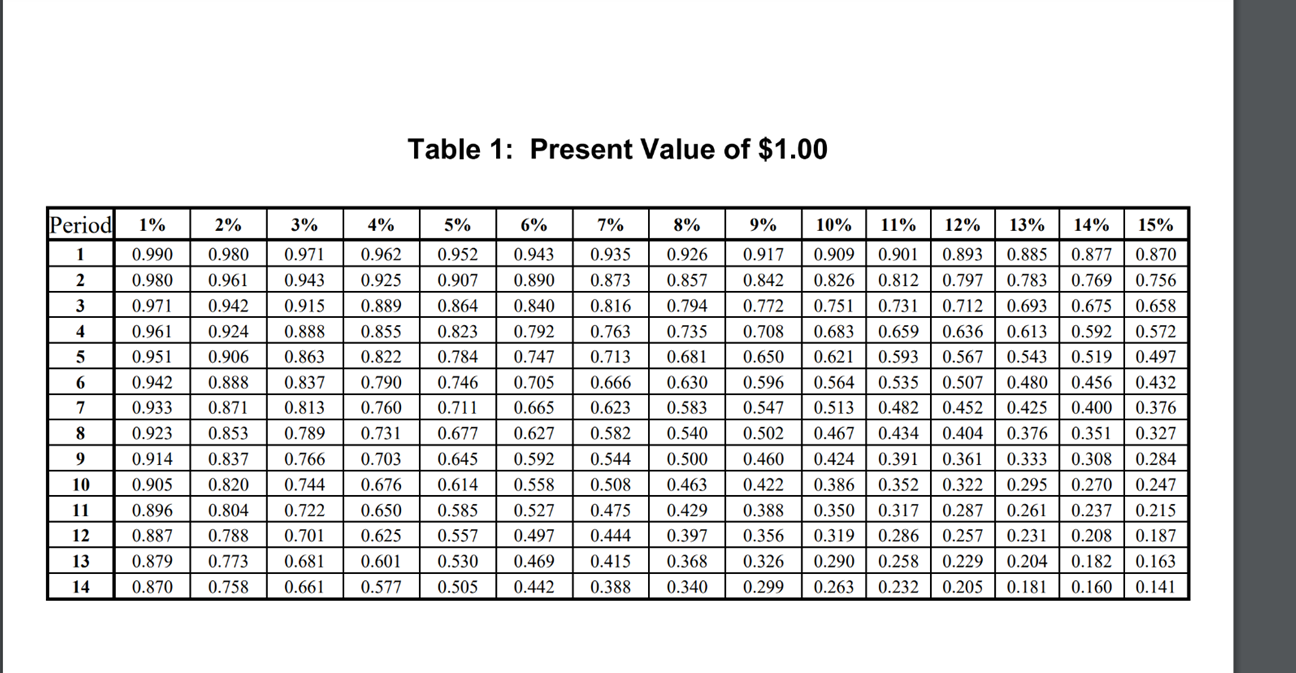

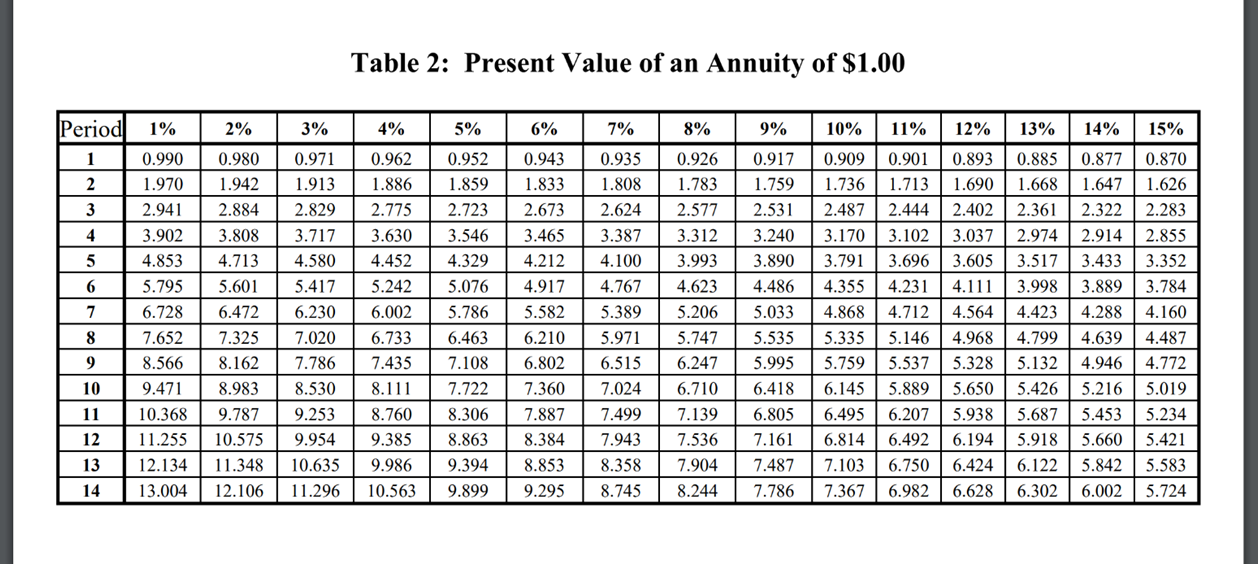

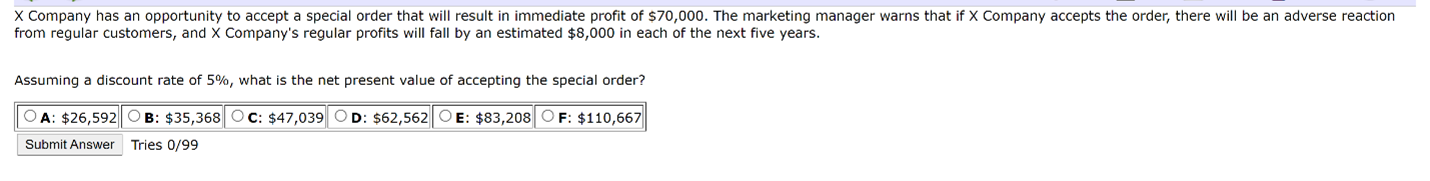

Table 1: Present Value of $1.00 Period 1% 2% 3% 4% 5% 6% 7% 8% 9% 10% 11% 12% 13% 14% 15% 1 0.990 0.971 0.943 0.909 0.901 0.893 IT 0.877 0.870 TI 2 3 0.926 0.857 0.794 0.735 0.681 0.797 0.712 0.636 4 5 T. A 0.826 0.751 0.683 0.621 0.564 0.513 TTTTT 0.943 0.915 0.888 0.863 0.837 0.813 0.789 0.766 0.567 0.507 0.962 0.925 0.889 0.855 0.822 0.790 0.760 0.731 0.703 0.676 ITT 6 0.980 0.961 0.942 0.924 0.906 0.888 0.871 0.853 0.837 0.820 0.804 0.788 0.773 0.758 0.980 0.971 0.961 0.951 0.942 0.933 0.923 0.914 0.905 0.896 0.887 0.879 0.870 7 0.952 0.907 0.864 0.823 0.784 0.746 0.711 0.677 0.645 0.614 0.585 0.557 0.530 0.505 0.935 0.873 0.816 0.763 0.713 0.666 0.623 0.582 0.544 0.508 0.475 0.444 0.415 0.388 0.890 0.840 0.792 0.747 0.705 0.665 0.627 0.592 0.558 0.527 0.497 0.469 0.442 0.885 0.783 0.693 0.613 0.543 0.480 0.425 0.376 0.333 0.295 8 0.917 0.842 0.772 0.708 0.650 0.596 0.547 0.502 0.460 0.422 0.388 0.356 0.326 0.299 0.467 0.812 0.731 0.659 0.593 0.535 0.482 0.434 0.391 0.352 0.317 0.286 0.258 0.232 0.630 0.583 0.540 0.500 0.463 0.429 0.397 0.368 0.340 0.769 0.675 0.592 0.519 0.456 0.400 0.351 0.308 0.270 0.237 0.208 0.182 0.160 9 0.756 0.658 0.572 0.497 0.432 0.376 0.327 0.284 0.247 0.215 0.187 0.163 0.141 0.452 0.404 0.361 0.322 0.287 0.257 CR 10 0.744 0.722 0.701 0.681 0.661 0.650 0.625 0.424 0.386 0.350 0.319 0.290 0.263 11 12 13 14 1 le 0.261 0.231 0.204 0.181 0.601 0.577 0.229 0.205 Table 2: Present Value of an Annuity of $1.00 Period 1% 2% 3% 4% 5% 6% 7% 8% 9% 10% 11% 12% 13% 14% 15% 1 0.990 1.970 2 3 4 5 6 7 0.980 1.942 2.884 3.808 4.713 5.601 6.472 7.325 8.162 8.983 9.787 10.575 11.348 12.106 2.941 3.902 4.853 5.795 6.728 7.652 8.566 9.471 10.368 11.255 12.134 13.004 0.971 1.913 2.829 3.717 4.580 5.417 6.230 7.020 7.786 8.530 9.253 9.954 10.635 11.296 0.962 1.886 2.775 3.630 4.452 5.242 6.002 6.733 7.435 8.111 8.760 9.385 9.986 0.952 1.859 2.723 3.546 4.329 5.076 5.786 6.463 7.108 7.722 8.306 8.863 9.394 9.899 0.943 1.833 2.673 3.465 4.212 4.917 5.582 6.210 6.802 7.360 7.887 8.384 8.853 9.295 0.935 1.808 2.624 3.387 4.100 4.767 5.389 5.971 6.515 7.024 7.499 7.943 8.358 0.926 1.783 2.577 3.312 3.993 4.623 5.206 5.747 6.247 6.710 7.139 7.536 7.904 8.244 0.917 1.759 2.531 3.240 3.890 4.486 5.033 5.535 5.995 6.418 6.805 7.161 7.487 7.786 0.909 1.736 2.487 3.170 3.791 4.355 4.868 5.335 5.759 6.145 6.495 0.901 0.893 1.713 1.690 2.444 2.402 3.102 3.037 3.696 3.605 4.231 4.111 4.712 4.564 5.146 4.968 5.537 5.328 5.889 5.650 6.207 5.938 6.492 6.194 6.750 6.424 6.982 6.628 0.885 1.668 2.361 2.974 3.517 3.998 4.423 4.799 5.132 5.426 5.687 5.918 6.122 6.302 0.877 0.870 1.647 1.626 2.322 2.283 2.914 2.855 3.433 3.352 3.889 3.784 4.288 4.160 4.639 4.487 4.946 4.772 5.216 5.019 5.453 5.234 5.660 5.421 5.842 5.583 6.002 5.724 8 9 10 11 12 13 "1"19 6.814 7.103 7.367 14 10.563 8.745 X Company has an opportunity to accept a special order that will result in immediate profit of $70,000. The marketing manager warns that if X Company accepts the order, there will be an adverse reaction from regular customers, and X Company's regular profits will fall an estimated $8,000 in each of the next five years. Assuming a discount rate of 5%, what is the net present value of accepting the special order? OA: $26,592 OB: $35,368 OC: $47,039 OD: $62,562 OE: $83,208 OF: $110,667 Submit Answer Tries 0/99

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts