Question: Help answer multiple-choice question with explanation please Table 1: Present Value of $1.00 Period 1% 2% 3% 4% 5% 6% 7% 8% 9% 10% 11%

Help answer multiple-choice question with explanation please

Help answer multiple-choice question with explanation please

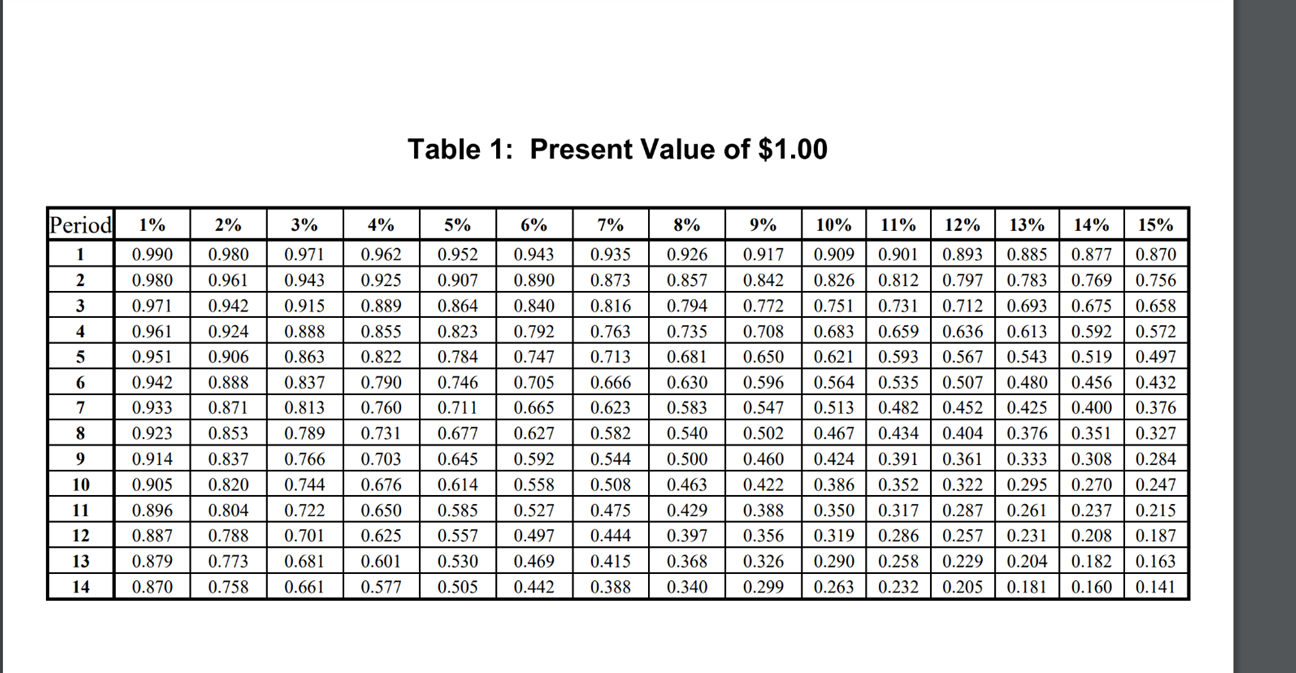

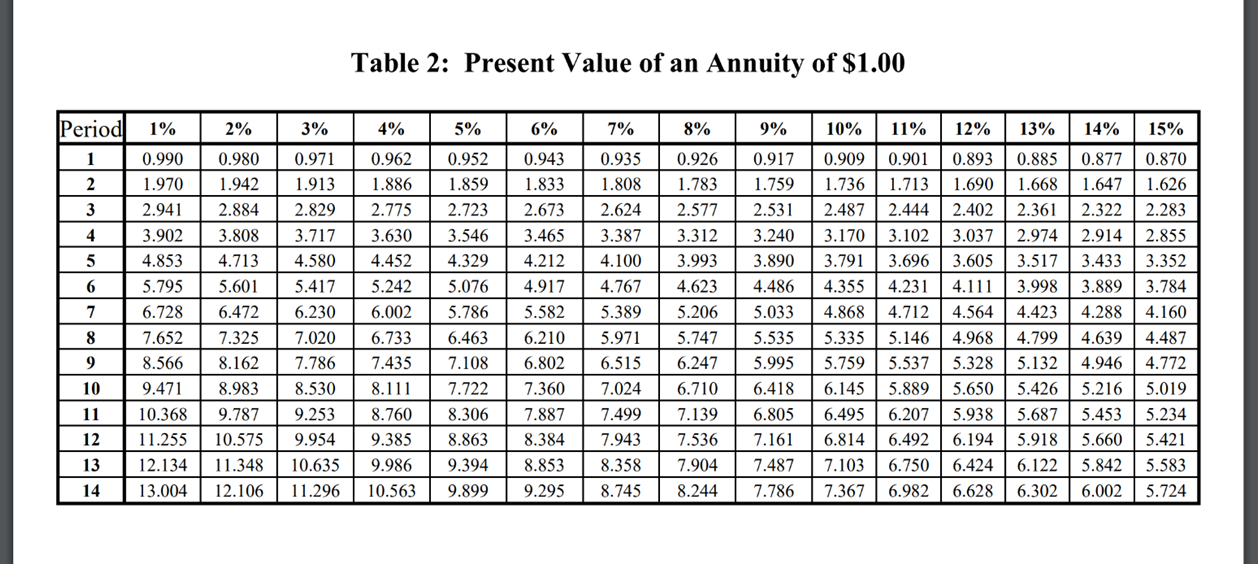

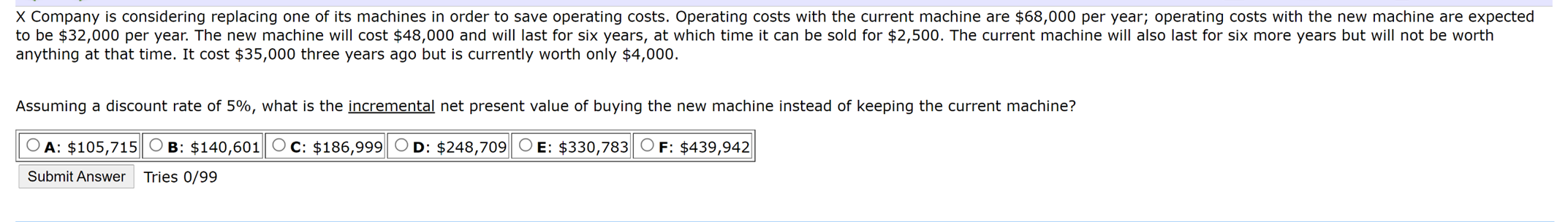

Table 1: Present Value of $1.00 Period 1% 2% 3% 4% 5% 6% 7% 8% 9% 10% 11% 12% 13% 14% 15% 1 0.990 0.971 0.943 0.909 0.901 0.893 IT 0.877 0.870 TI 2 3 0.926 0.857 0.794 0.735 0.681 0.797 0.712 0.636 4 5 T. A 0.826 0.751 0.683 0.621 0.564 0.513 TTTTT 0.943 0.915 0.888 0.863 0.837 0.813 0.789 0.766 0.567 0.507 0.962 0.925 0.889 0.855 0.822 0.790 0.760 0.731 0.703 0.676 ITT 6 0.980 0.961 0.942 0.924 0.906 0.888 0.871 0.853 0.837 0.820 0.804 0.788 0.773 0.758 0.980 0.971 0.961 0.951 0.942 0.933 0.923 0.914 0.905 0.896 0.887 0.879 0.870 7 0.952 0.907 0.864 0.823 0.784 0.746 0.711 0.677 0.645 0.614 0.585 0.557 0.530 0.505 0.935 0.873 0.816 0.763 0.713 0.666 0.623 0.582 0.544 0.508 0.475 0.444 0.415 0.388 0.890 0.840 0.792 0.747 0.705 0.665 0.627 0.592 0.558 0.527 0.497 0.469 0.442 0.885 0.783 0.693 0.613 0.543 0.480 0.425 0.376 0.333 0.295 8 0.917 0.842 0.772 0.708 0.650 0.596 0.547 0.502 0.460 0.422 0.388 0.356 0.326 0.299 0.467 0.812 0.731 0.659 0.593 0.535 0.482 0.434 0.391 0.352 0.317 0.286 0.258 0.232 0.630 0.583 0.540 0.500 0.463 0.429 0.397 0.368 0.340 0.769 0.675 0.592 0.519 0.456 0.400 0.351 0.308 0.270 0.237 0.208 0.182 0.160 9 0.756 0.658 0.572 0.497 0.432 0.376 0.327 0.284 0.247 0.215 0.187 0.163 0.141 0.452 0.404 0.361 0.322 0.287 0.257 CR 10 0.744 0.722 0.701 0.681 0.661 0.650 0.625 0.424 0.386 0.350 0.319 0.290 0.263 11 12 13 14 1 le 0.261 0.231 0.204 0.181 0.601 0.577 0.229 0.205 Table 2: Present Value of an Annuity of $1.00 Period 1% 2% 3% 4% 5% 6% 7% 8% 9% 10% 11% 12% 13% 14% 15% 1 0.990 1.970 2 3 4 5 6 7 0.980 1.942 2.884 3.808 4.713 5.601 6.472 7.325 8.162 8.983 9.787 10.575 11.348 12.106 2.941 3.902 4.853 5.795 6.728 7.652 8.566 9.471 10.368 11.255 12.134 13.004 0.971 1.913 2.829 3.717 4.580 5.417 6.230 7.020 7.786 8.530 9.253 9.954 10.635 11.296 0.962 1.886 2.775 3.630 4.452 5.242 6.002 6.733 7.435 8.111 8.760 9.385 9.986 0.952 1.859 2.723 3.546 4.329 5.076 5.786 6.463 7.108 7.722 8.306 8.863 9.394 9.899 0.943 1.833 2.673 3.465 4.212 4.917 5.582 6.210 6.802 7.360 7.887 8.384 8.853 9.295 0.935 1.808 2.624 3.387 4.100 4.767 5.389 5.971 6.515 7.024 7.499 7.943 8.358 0.926 1.783 2.577 3.312 3.993 4.623 5.206 5.747 6.247 6.710 7.139 7.536 7.904 8.244 0.917 1.759 2.531 3.240 3.890 4.486 5.033 5.535 5.995 6.418 6.805 7.161 7.487 7.786 0.909 1.736 2.487 3.170 3.791 4.355 4.868 5.335 5.759 6.145 6.495 0.901 0.893 1.713 1.690 2.444 2.402 3.102 3.037 3.696 3.605 4.231 4.111 4.712 4.564 5.146 4.968 5.537 5.328 5.889 5.650 6.207 5.938 6.492 6.194 6.750 6.424 6.982 6.628 0.885 1.668 2.361 2.974 3.517 3.998 4.423 4.799 5.132 5.426 5.687 5.918 6.122 6.302 0.877 0.870 1.647 1.626 2.322 2.283 2.914 2.855 3.433 3.352 3.889 3.784 4.288 4.160 4.639 4.487 4.946 4.772 5.216 5.019 5.453 5.234 5.660 5.421 5.842 5.583 6.002 5.724 8 9 10 11 12 13 "1"19 6.814 7.103 7.367 14 10.563 8.745 X Company is considering replacing one of its machines in order to save operating costs. Operating costs with the current machine are $68,000 per year; operating costs with the new machine are expected to be $32,000 per year. The new machine will cost $48,000 and will last for six years, at which time it can be sold for $2,500. The current machine will also last for six more years but will not be worth anything at that time. It cost $35,000 three years ago but is currently worth only $4,000. Assuming a discount rate of 5%, what is the incremental net present value of buying the new machine instead of keeping the current machine? OA: $105,715 OB: $140,601 OC: $186,999 D: $248,709 OE: $330,783 OF: $439,942 Submit Answer Tries 0/99

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts