Question: Help answer multiple-choice question with explanation please X Company currently buys 8,000 units of a part each year from a supplier for $7.70 per part,

Help answer multiple-choice question with explanation please

Help answer multiple-choice question with explanation please

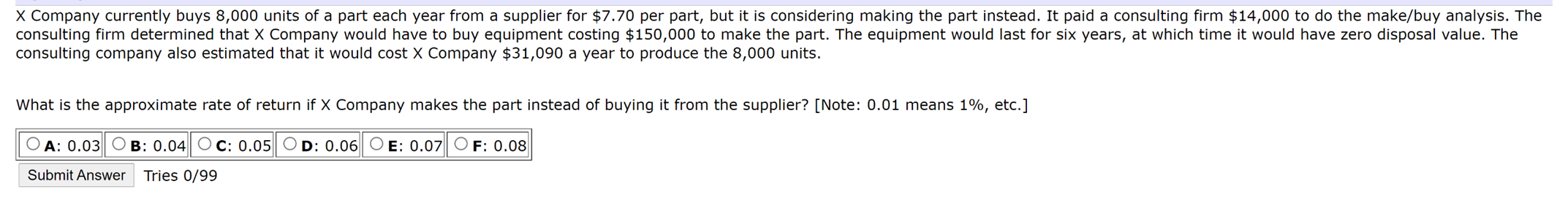

X Company currently buys 8,000 units of a part each year from a supplier for $7.70 per part, but it is considering making the part instead. It paid a consulting firm $14,000 to do the make/buy analysis. The consulting firm determined that X Company would have to buy equipment costing $150,000 to make the part. The equipment would last for six years, at which time it would have zero disposal value. The consulting company also estimated that it would cost X Company $31,090 a year to produce the 8,000 units. What is the approximate rate of return if X Company makes the part instead of buying it from the supplier? [Note: 0.01 means 1%, etc.] OA: 0.03 OB: 0.04 OC: 0.05 OD: 0.06 OE: 0.07 OF: 0.08 Submit Answer Tries 0/99

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts