Question: HELP ANSWER PART A & PART B. 15,674 for part A & 8,388 Is the INCORRECT answer for this. Everytime i this they keep giving

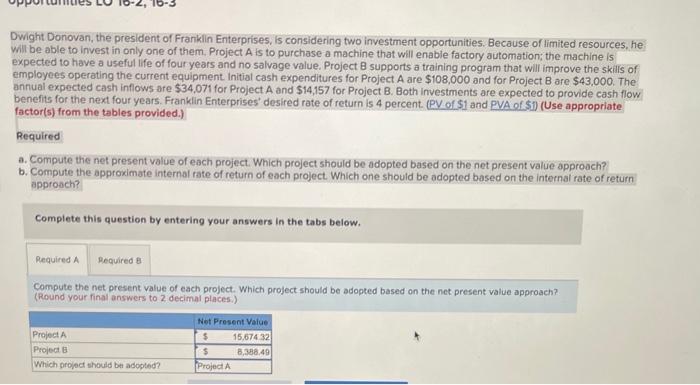

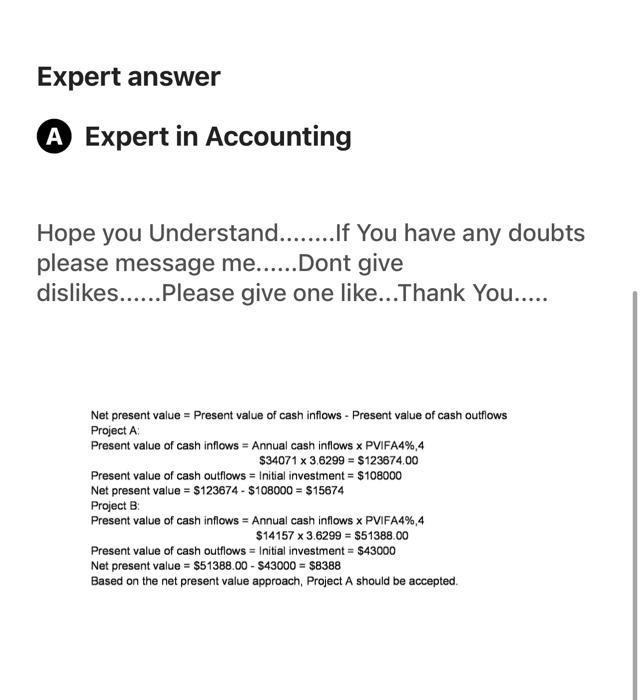

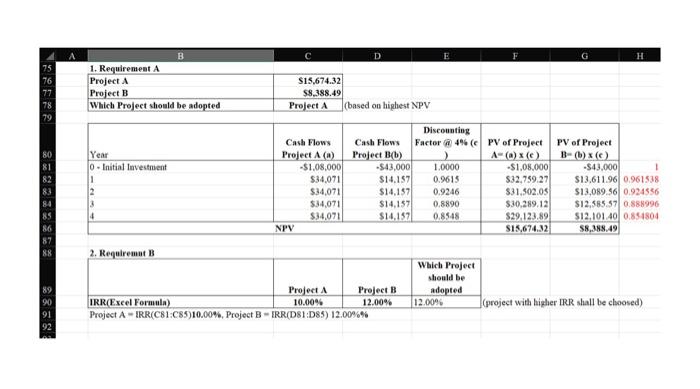

Dwight Donovan, the president of Frankilin Enterprises, is considering two investment opportunities. Because of limited resources, he Will be able to invest in only one of them. Project A is to purchase a machine that will enable factory automation; the machine is expected to have a useful life of fouryears and no salvage value. Project B supports a training program that will improve the skills of employees operating the current equipment initial cash expenditures for Project A are $108,000 and for Project B are $43,000. The annual expected cash inflows are $34,071 for Project A and $14,157 for Project B. Both investments are expected to provide cash flow benefits for the next four years. Franklin Enterprises' desired rate of return is 4 percent. (PV of $1 and PVA of $ ) (Use appropriate. factor(s) from the tables provided.) Required a. Compute the net present value of each project. Which project should be adopted based on the net present value approach? b. Compute the approximate internal rate of return of each project. Which one should be adopted based on the internal rate of return approach? Complete this question by entering your answers in the tabs below. Compute the net present value of each project. Which project should be adopted based on the net present value approach? (Round your final answers to 2 decimal places.) Expert answer A Expert in Accounting Hope you Understand........If You have any doubts please message me......Dont give dislikes......Please give one like...Thank You..... Net present value = Present value of cash inflows - Present value of cash outflows Project A: Present value of cash inflows = Annual cash inflows PVIFA4\%,4 $340713.6299=$123674.00 Present value of cash outflows = Initial investment =$108000 Net present value =$123674$108000=$15674 Project B: Present value of cash inflows = Annual cash inflows x PVIFA4\%,4 $141573.6299=$51388.00 Present value of cash outflows = Initial investment =$43000 Net present value =$51388.00$43000=$8388 Based on the net present value approach, Project A should be accepted. 2. Requiremat B \begin{tabular}{|l|c|c|c|c|} \hline & & Which Project \\ should be \\ IRR(Excel Formula) & Project A & Project B & adopted \\ \hline Project A = IRR(C81;C85)10.00\%. Project B = IRR(D81:D85) 12.00965 & 12.00% & (groject with higher IRR shall be choosed) \\ \hline \end{tabular} Project A = IRR(C81:C85)10.00\%, Project B = IRR(D81:D85) 12.00%%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts