Question: help answer problems 1,2,3 multiple choice with explanation, please X Company's accountant uses the high-low method to determine the parameters of the company's monthly overhead

help answer problems 1,2,3 multiple choice with explanation, please

help answer problems 1,2,3 multiple choice with explanation, please

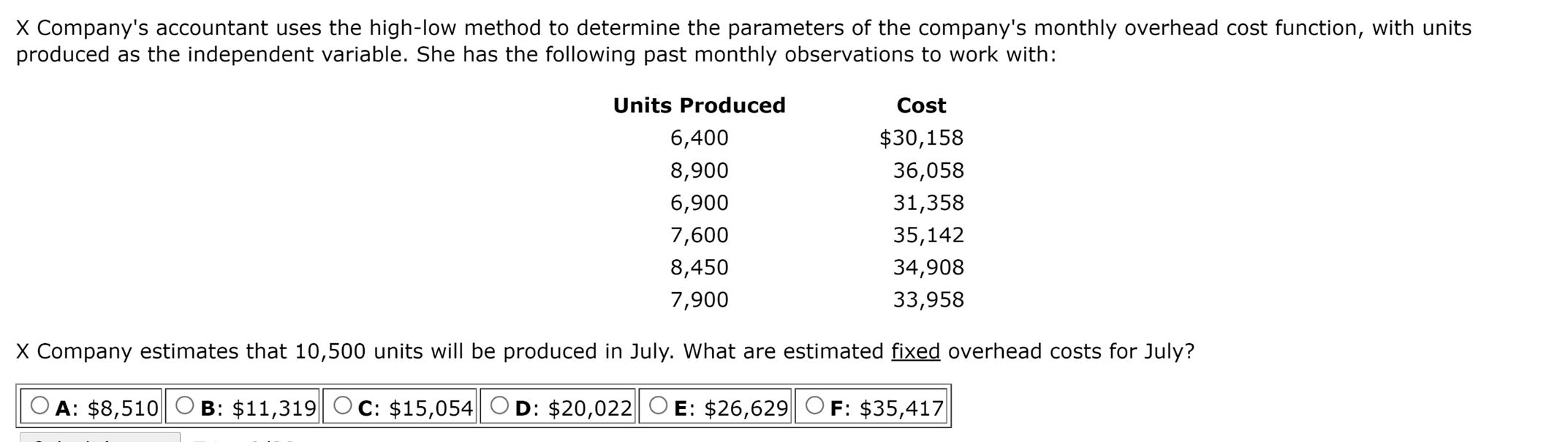

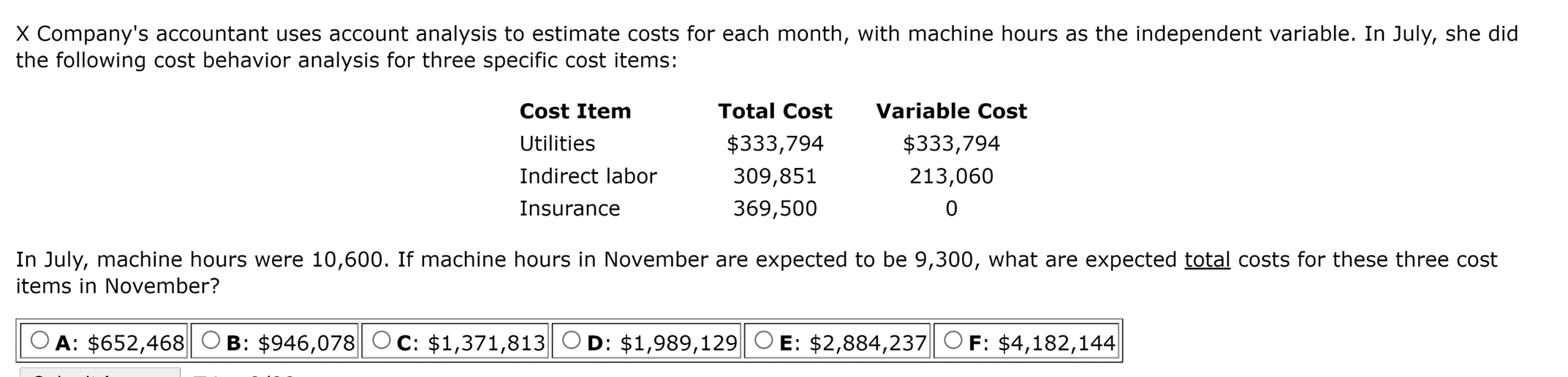

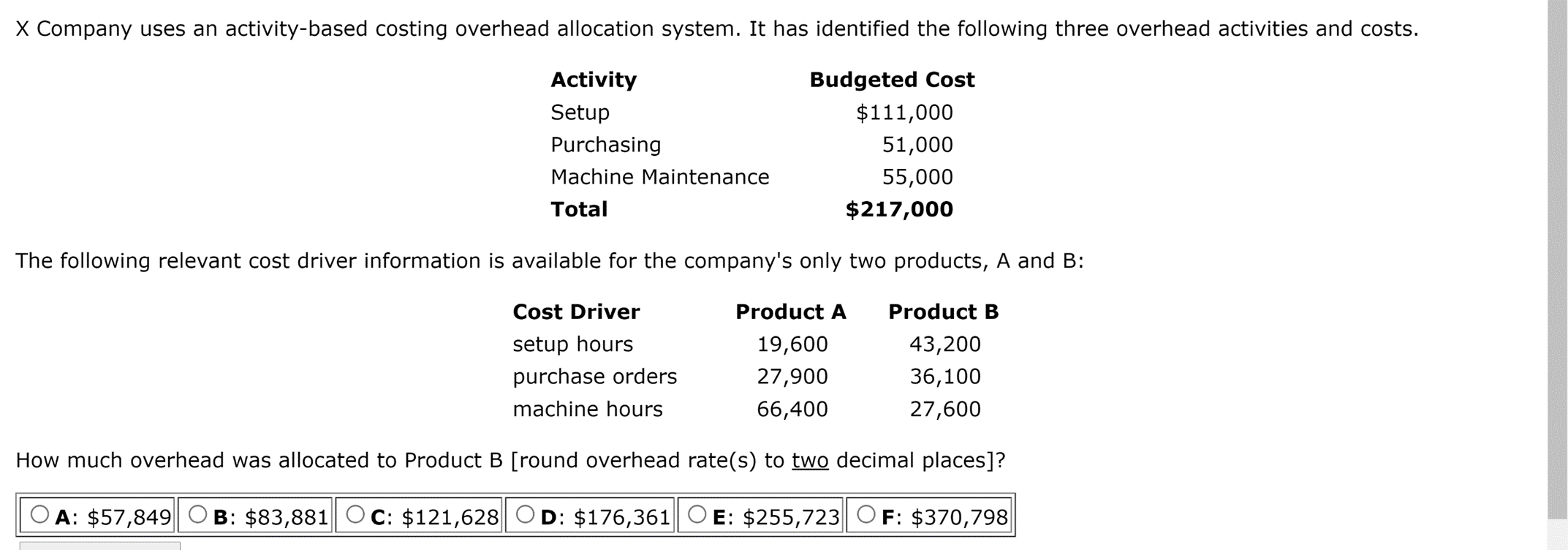

X Company's accountant uses the high-low method to determine the parameters of the company's monthly overhead cost function, with units produced as the independent variable. She has the following past monthly observations to work with: Units Produced 6,400 8,900 6,900 7,600 8,450 7,900 Cost $30,158 36,058 31,358 35,142 34,908 33,958 X Company estimates that 10,500 units will be produced in July. What are estimated fixed overhead costs for July? OA: $8,510 | OB: $11,319 OC: $15,054 OD: $20,022|OE: $26,629 OF: $35,417 X Company's accountant uses account analysis to estimate costs for each month, with machine hours as the independent variable. In July, she did the following cost behavior analysis for three specific cost items: Cost Item Utilities Indirect labor Insurance Total Cost $333,794 309,851 369,500 Variable Cost $333,794 213,060 0 In July, machine hours were 10,600. If machine hours in November are expected to be 9,300, what are expected total costs for these three cost items in November? A: $652,468 B: $946,078| OC: $1,371,813 OD: $1,989,129 E: $2,884,237 F: $4,182,144 X Company uses an activity-based costing overhead allocation system. It has identified the following three overhead activities and costs. Activity Setup Purchasing Machine Maintenance Total Budgeted Cost $111,000 51,000 55,000 $217,000 The following relevant cost driver information is available for the company's only two products, A and B: Cost Driver setup hours purchase orders machine hours Product A 19,600 27,900 66,400 Product B 43,200 36,100 27,600 How much overhead was allocated to Product B [round overhead rate(s) to two decimal places]? A: $57,849| OB: $83,881 C: $121,628| OD: $176,361| O E: $255,723 F: $370,798

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts