Question: help answering the question I got wrong twice ignment/9285 QUESTIONS Question 3 of 4 Question 1 (4/4) Question 2 (1.5/2) Question 3 (0/3) Question 4

help answering the question I got wrong twice

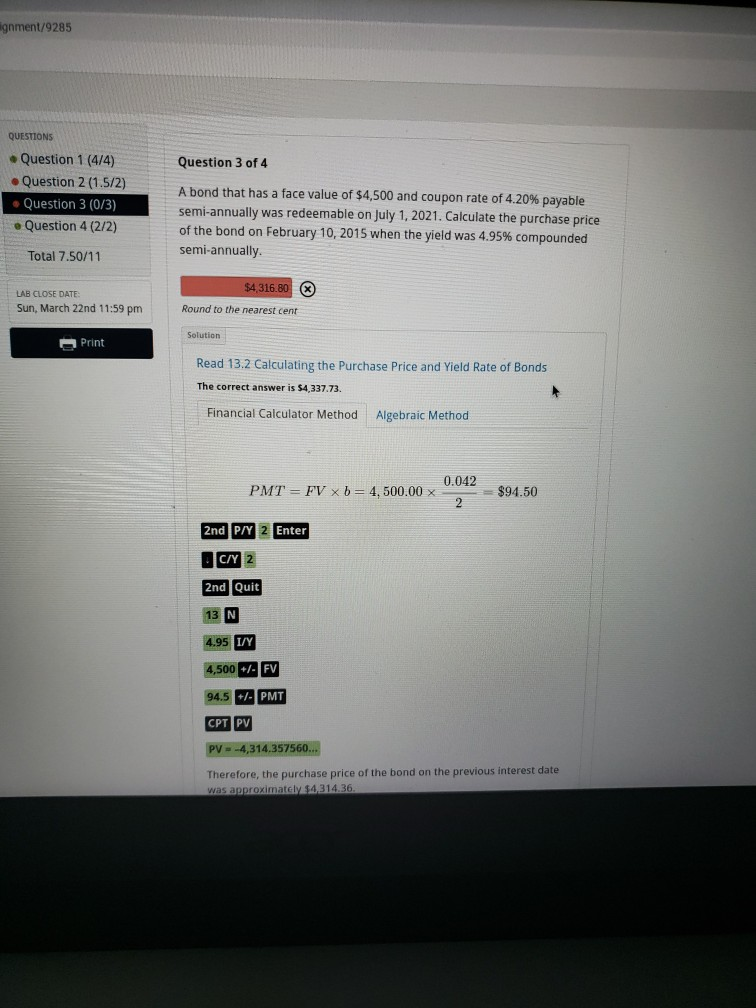

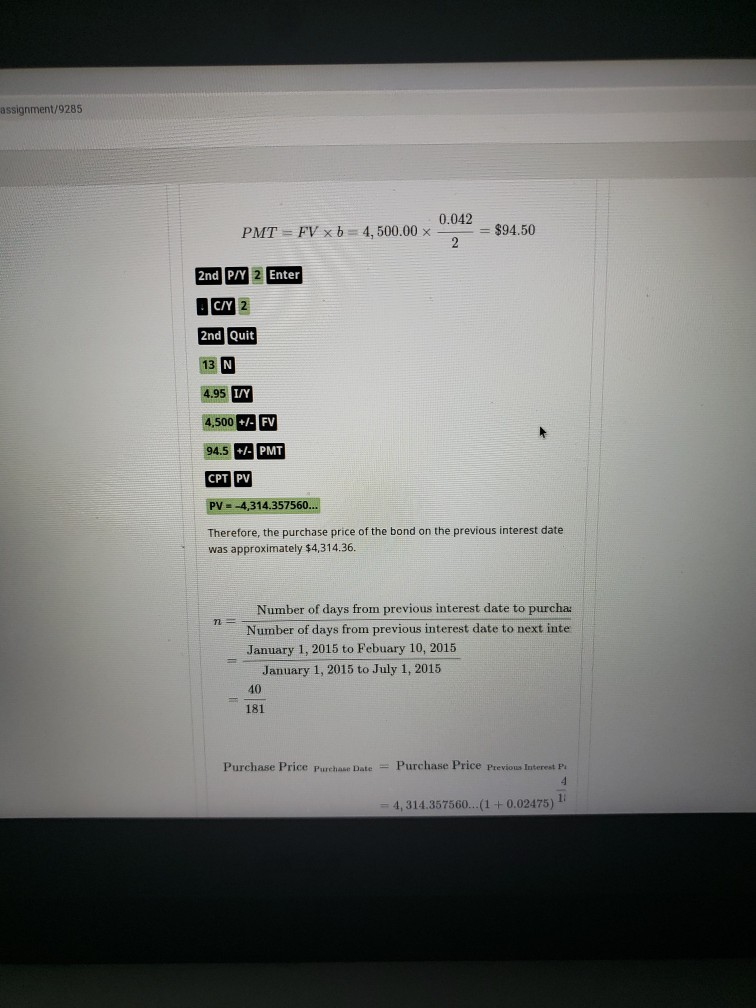

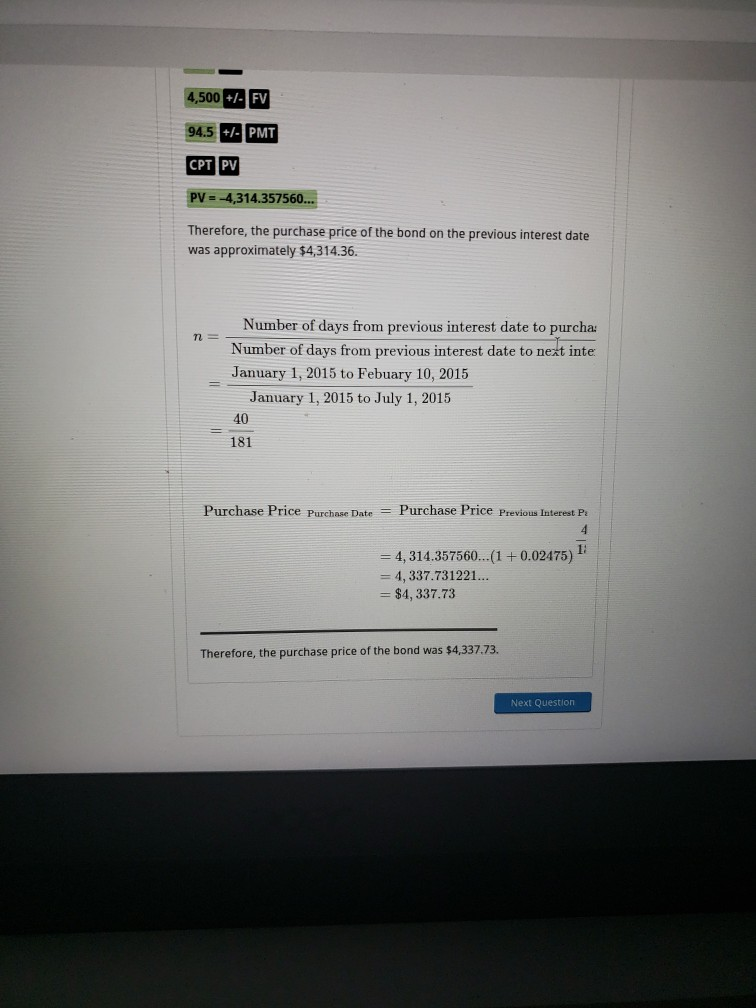

ignment/9285 QUESTIONS Question 3 of 4 Question 1 (4/4) Question 2 (1.5/2) Question 3 (0/3) Question 4 (2/2) A bond that has a face value of $4,500 and coupon rate of 4.20% payable semi-annually was redeemable on July 1, 2021. Calculate the purchase price of the bond on February 10, 2015 when the yield was 4.95% compounded semi-annually. Total 7.50/11 LAB CLOSE DATE: Sun, March 22nd 11:59 pm $4,316.80 Round to the nearest cent Solution Print Read 13.2 Calculating the Purchase Price and Yield Rate of Bonds The correct answer is $4,337.73. Financial Calculator Method Algebraic Method PMT = FV x b= 4,500.00 x $94.50 2nd P/Y 2 Enter OCHY 2 2nd Quit 13 N 4.95 I/Y 4,500 + FV 94.5 +/- PMT CPT PV PV = -4,314.357560... Therefore, the purchase price of the bond on the previous interest date was approximately $4,314.36. assignment/9285 PMT = FV x b = 4,500.00 x 0.042 = $94.50 2nd P/Y 2 Enter C/Y 2 2nd Quit 13 N 4.95 IVY 4,500 +/- FV 94.5 +/- PMT CPT PV PV = -4,314.357560... Therefore, the purchase price of the bond on the previous interest date was approximately $4,314.36. Number of days from previous interest date to purcha: Number of days from previous interest date to next inte January 1, 2015 to Febuary 10, 2015 January 1, 2015 to July 1, 2015 181 Purchase Price Purchase Date = Purchase Price Previous luter P = 4,314.357560...(1 +0.02475) 4,500 +- FV 94.5 +/- PMT CPT PV PV = -4,314.357560... Therefore, the purchase price of the bond on the previous interest date was approximately $4,314.36. n = Number of days from previous interest date to purcha: Number of days from previous interest date to next inte January 1, 2015 to Febuary 10, 2015 January 1, 2015 to July 1, 2015 40 181 Purchase Price Purchase Date = Purchase Price Previous Interest P = 4,314.357560...(1 + 0.02475) 1: = 4,337.731221... = $4, 337.73 Therefore, the purchase price of the bond was $4,337.73. Next

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts