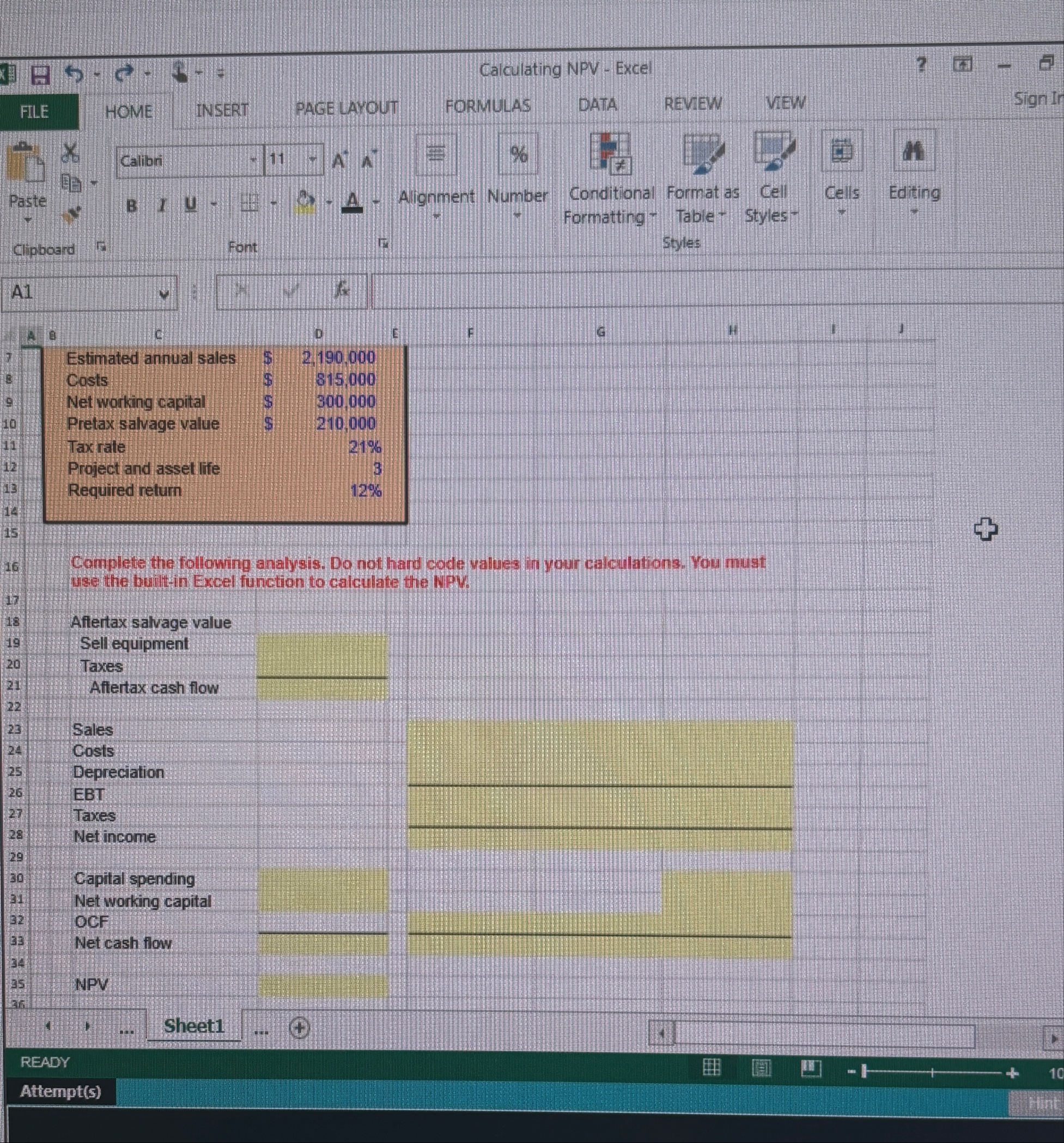

Question: Help asap. Inclue excel function. Complete the following analysis. Do not hard code values in your calculations. You must use the built - in Excel

Help asap. Inclue excel function.

Complete the following analysis. Do not hard code values in your calculations. You must use the builtin Excel function to calculate the WPY

Aftertax salvage value

Sell equipment

Taxes

Aftertax cash flow

Sales

Costs

Depreciation

EBT

Taxes

Net income

Capital spending

Net working capital

OCF

Net cash flow

NPV

READY

Sheet

Attempts

Flint

You are evaluating two different silicon wafer milling machines. The Techron I costs $ has a threeyear life, and has pretax operating costs of $ per year. The Techron II costs $ has a fiveyear life, and has pretax operating costs of $ per year. For both milling machines, use straightline depreciation to zero over the project's life and assume a salvage value of $ If your tax rate is percent and your discount rate is percent, compute the EAC for both machines. Youlr answer should be a negative value and indicated by a minus sign. Do not round intermedlate calculations and round your answers to decimal places, e

tableTectron I,Techron ll

Which machine should you choose?

Techron ill

Techron I

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock