Question: Help ASAP please, i need to make sure i did it right. WILDHORSE COMPANY Income Statements For the Year Ended December 31 (inthousands) begin{tabular}{lrr} 2027

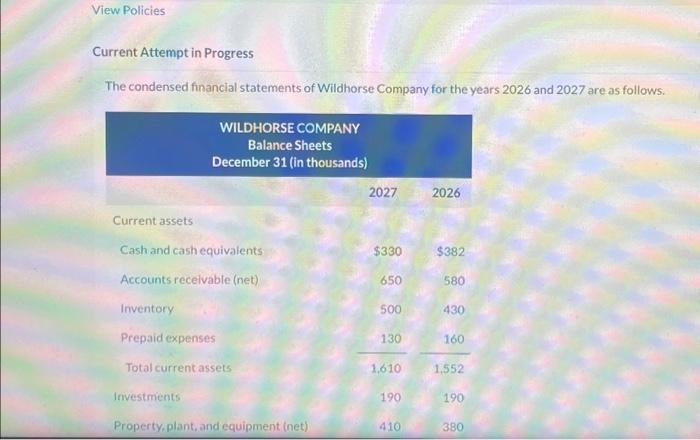

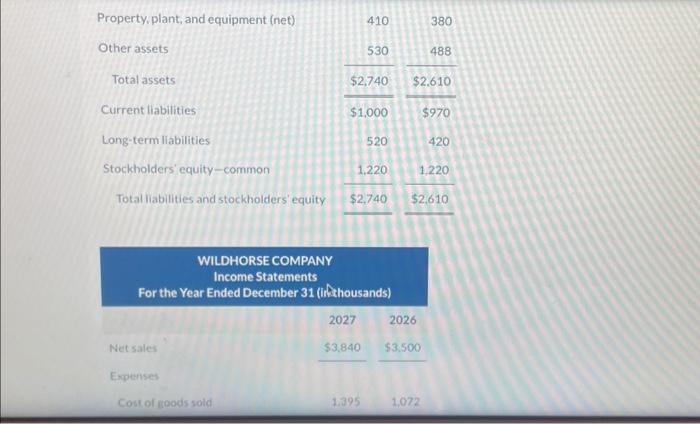

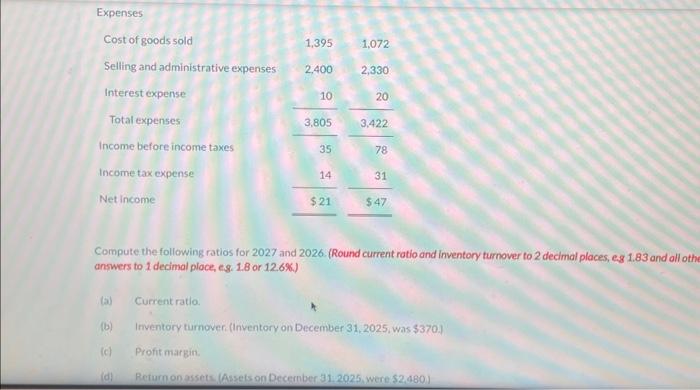

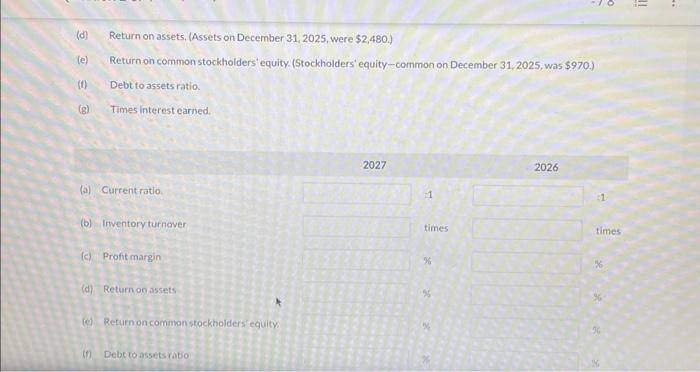

WILDHORSE COMPANY Income Statements For the Year Ended December 31 (inthousands) \begin{tabular}{lrr} 2027 & 2026 \\ Netsales & $3,840 & $3.500 \\ \hline \end{tabular} Expenses Cost of noods sold 1.395 1.072 Current Attempt in Progress The condensed financial statements of Wildhorse Company for the years 2026 and 2027 are as follows. (d) Return on assets, (Assets on December 31, 2025, were \$2,480.) (e) Return on common stockholders' equity. (Stockholders' equity-common on December 31, 2025, was $970.) (f) Debt to assets ratio. (8) Times interest earned. Compute the following ratios for 2027 and 2026 . (Round current rotio and inventory turnover to 2 decimal places, e.8 1.83 and all otf answers to 1 decimal ploce, es. 1.8 or 12.6%.) (a) Current ratio. (b) Inventory tumover (Inventory on December 31, 2025, was \$370.) (c) Profit margin. (d) Returnonassets.(Assets on Deccernber 31:2025, were $2.480 )

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts