Question: HELP ASAP !! PLEASE IF YOU KNOW HOW TO DO IT PERFECTLY HELP ME !! NO MISSING INFORMATION Withholdings Part 1 After evaluating the information

- HELP ASAP !! PLEASE IF YOU KNOW HOW TO DO IT PERFECTLY HELP ME !!

- NO MISSING INFORMATION

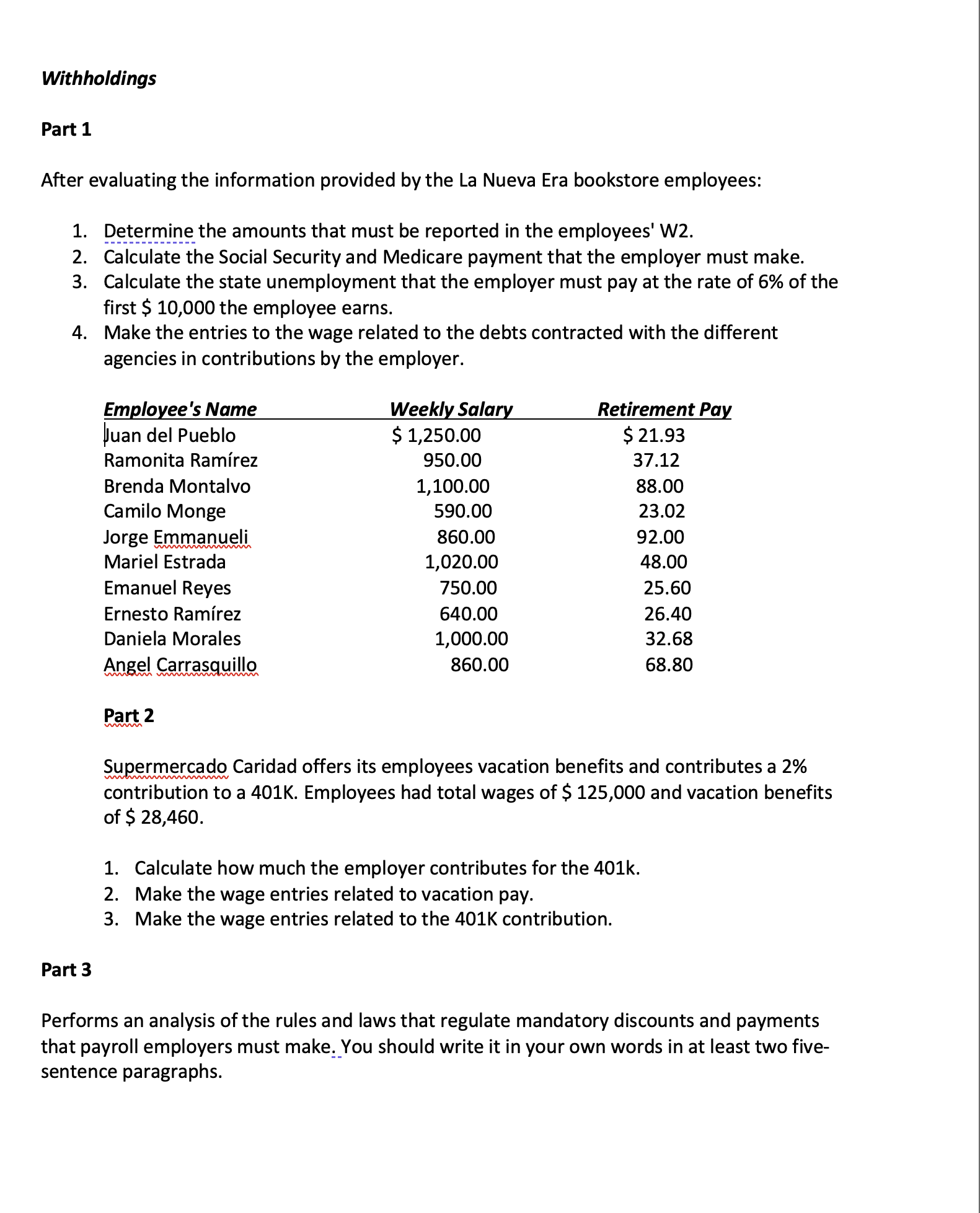

Withholdings Part 1 After evaluating the information provided by the La Nueva Era bookstore employees: 1. Determine the amounts that must be reported in the employees' W2. 2. Calculate the Social Security and Medicare payment that the employer must make. 3. Calculate the state unemployment that the employer must pay at the rate of 6% of the first $ 10,000 the employee earns. 4. Make the entries to the wage related to the debts contracted with the different agencies in contributions by the employer. Employee's Name Weekly Salary Retirement Pay Juan del Pueblo $ 1,250.00 $ 21.93 Ramonita Ramirez 950.00 37.12 Brenda Montalvo 1,100.00 88.00 Camilo Monge 590.00 23.02 Jorge Emmanueli 860.00 92.00 Mariel Estrada 1,020.00 48.00 Emanuel Reyes 750.00 25.60 Ernesto Ramirez 640.00 26.40 Daniela Morales 1,000.00 32.68 Angel Carrasquillo 860.00 68.80 Part 2 Supermercado Caridad offers its employees vacation benefits and contributes a 2% contribution to a 401K. Employees had total wages of $ 125,000 and vacation benefits of $ 28,460. 1. Calculate how much the employer contributes for the 401k. 2. Make the wage entries related to vacation pay. 3. Make the wage entries related to the 401K contribution. Part 3 Performs an analysis of the rules and laws that regulate mandatory discounts and payments that payroll employers must make. You should write it in your own words in at least two five- sentence paragraphs

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts