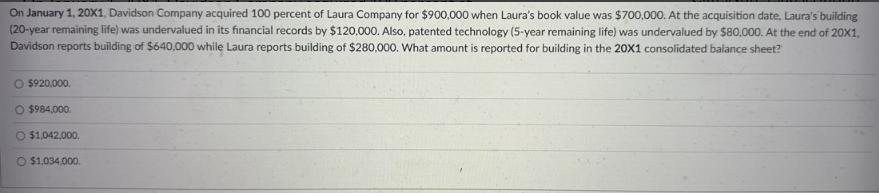

Question: On January 1, 20X1. Davidson Company acquired 100 percent of Laura Company for $900,000 when Laura's book value was $700,000. At the acquisition date,

On January 1, 20X1. Davidson Company acquired 100 percent of Laura Company for $900,000 when Laura's book value was $700,000. At the acquisition date, Laura's building (20-year remaining life) was undervalued in its financial records by $120,000. Also, patented technology (5-year remaining life) was undervalued by $80,000. At the end of 20X1. Davidson reports building of $640,000 while Laura reports building of $280,000. What amount is reported for building in the 20X1 consolidated balance sheet? O $920,000. O $984,000 O $1,042,000. O$1,034,000.

Step by Step Solution

There are 3 Steps involved in it

The correct answer is 1034000 Heres how to calculate the amount reported for building in the 20X1 co... View full answer

Get step-by-step solutions from verified subject matter experts