Question: HELP ASAP PLEASE !! Question 2 4 points Save Answe Your great aunt will put $150,000 into a bank while you are growing up. The

HELP ASAP PLEASE

!!

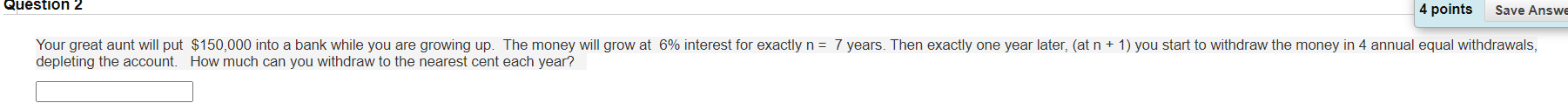

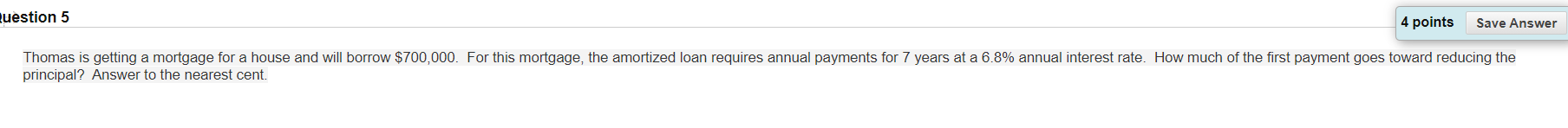

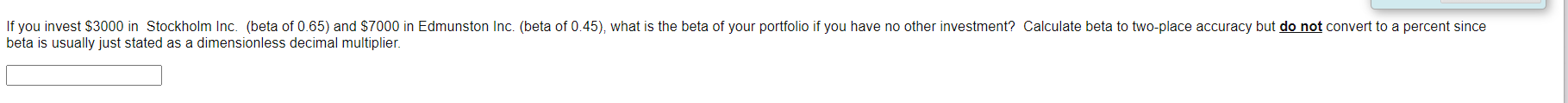

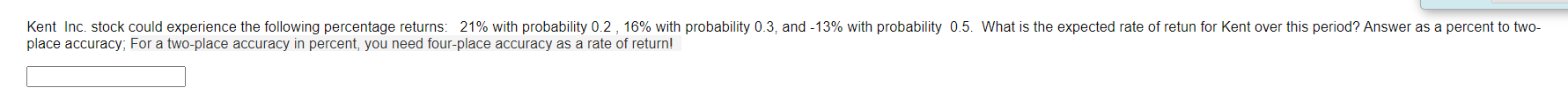

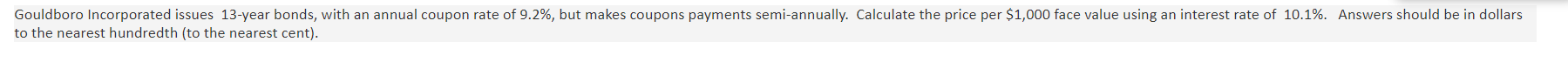

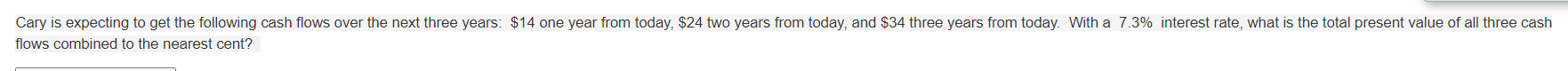

Question 2 4 points Save Answe Your great aunt will put $150,000 into a bank while you are growing up. The money will grow at 6% interest for exactly n = 7 years. Then exactly one year later, (at n + 1) you start to withdraw the money in 4 annual equal withdrawals, depleting the account. How much can you withdraw to the nearest cent each year? Question 5 4 points Save Answer Thomas is getting a mortgage for a house and will borrow $700,000. For this mortgage, the amortized loan requires annual payments for 7 years at a 6.8% annual interest rate. How much of the first payment goes toward reducing the principal? Answer to the nearest cent. If you invest $3000 in Stockholm Inc. (beta of 0.65) and $7000 in Edmunston Inc. (beta of 0.45), what is the beta of your portfolio if you have no other investment? Calculate beta to two-place accuracy but do not convert to a percent since beta is usually just stated as a dimensionless decimal multiplier. Kent Inc. stock could experience the following percentage returns: 21% with probability 0.2, 16% with probability 0.3, and -13% with probability 0.5. What is the expected rate of retun for Kent over this period? Answer as a percent to two- place accuracy; For a two-place accuracy in percent, you need four-place accuracy as a rate of return! Gouldboro Incorporated issues 13-year bonds, with an annual coupon rate of 9.2%, but makes coupons payments semi-annually. Calculate the price per $1,000 face value using an interest rate of 10.1%. Answers should be in dollars to the nearest hundredth (to the nearest cent). Cary is expecting to get the following cash flows over the next three years: $14 one year from today, $24 two years from today, and $34 three years from today. With a 7.3% interest rate, what is the total present value of all three cash flows combined to the nearest cent

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts