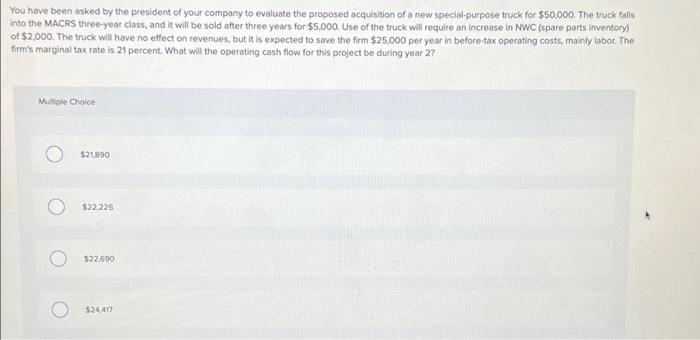

Question: HELP ASAP! please show work. always upvote You have been asked by the president of your company to evaluate the proposed acquisition of a new

HELP ASAP! please show work. always upvote

You have been asked by the president of your company to evaluate the proposed acquisition of a new special-purpose truck for $50.000. The truck falls into the MACRS three-year class, and it will be sold after three years for $5.000, Use of the truck will require an increase in NWC (spare parts inventory) of $2,000. The truck will have no effect on revenues, but it is expected to save the firm $25,000 per year in before-tax operating costs, mainly labor. The firm's marginal tax rate is 21 percent. What will the operating cash flow for this project be during year 2 ? Mutiple Cholce 524890 $22225 522,690 524,417

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock