Question: HELP ASAP PLEASE!! Your Grandmother will help pay for some of your future expenses by depositing $60,000 into an account in a Saving Bank at

HELP ASAP PLEASE!!

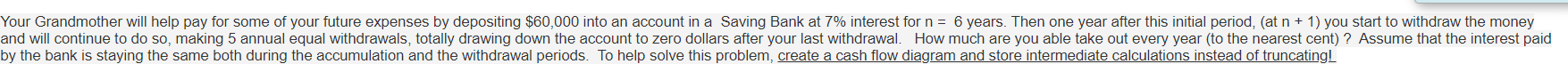

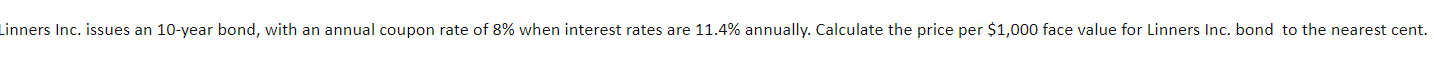

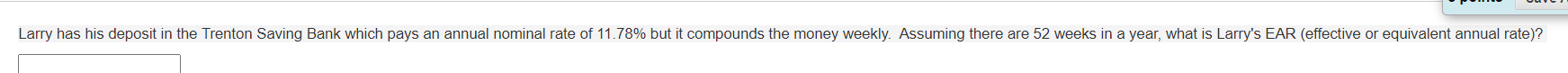

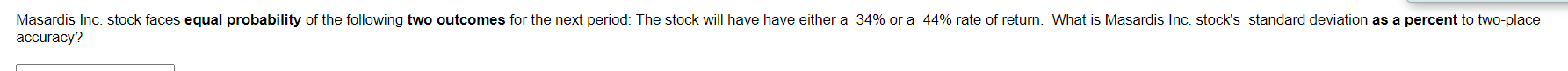

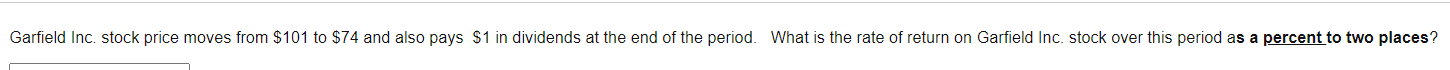

Your Grandmother will help pay for some of your future expenses by depositing $60,000 into an account in a Saving Bank at 7% interest for n = 6 years. Then one year after this initial period, (at n + 1) you start to withdraw the money and will continue to do so, making 5 annual equal withdrawals, totally drawing down the account to zero dollars after your last withdrawal. How much are you able take out every year (to the nearest cent) ? Assume that the interest paid by the bank is staying the same both during the accumulation and the withdrawal periods. To help solve this problem, create a cash flow diagram and store intermediate calculations instead of truncating! Linners Inc. issues an 10-year bond, with an annual coupon rate of 8% when interest rates are 11.4% annually. Calculate the price per $1,000 face value for Linners Inc. bond to the nearest cent. Larry has his deposit in the Trenton Saving Bank which pays an annual nominal rate of 11.78% but it compounds the money weekly. Assuming there are 52 weeks in a year, what is Larry's EAR (effective or equivalent annual rate)? Masardis Inc. stock faces equal probability of the following two outcomes for the next period: The stock will have have either a 34% or a 44% rate of return. What is Masardis Inc. stock's standard deviation as a percent to two-place accuracy? Smyrna Inc. issues some zero-coupon bonds with a maturity of 17-years, when the interest rate is 3.1%. Calculate the price per $1,000 face value for this bond to the nearest cent. Cary is expecting to get the following cash flows over the next three years: $14 one year from today, $24 two years from today, and $34 three years from today. With a 7.3% interest rate, what is the total present value of all three cash flows combined to the nearest cent? Last year, Oakfield Inc. stock has an expected rate of 15.7% while the market risk-premium was 7% and the risk-free rate was 3%. If this year, Oakfield Inc. beta stays the same and so does the risk-free rate, but the market risk premium is going to be 2% more than last year, what will be Oakfield Inc.'s expected stock return as a percent to two places? The Sherman Compny issues some bonds with a maturity of 12-years and with an annual coupon rate of 9.7%. but the bond pays coupon payments semi-annually!! The interet rate is 5.2% per year. Calculate the price per $1,000 face value for this bond ithe the nearest cent. Francis is making 12 annual payments on a loan for a house ($400,000 borrowed) which, like most mortgage loans, is amortized. If the annual interest rate is 4.7%, what part of the first payment (dollar amount to nearest cent) goes toward reducing the principal? Garfield Inc. stock price moves from $101 to $74 and also pays $1 in dividends at the end of the period. What is the rate of return on Garfield Inc. stock over this period as a percent to two places

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts