Question: help asap pls Note: For this problem, keep 4 significant figures in the results, i.e. 0.0001 precision. Consider the following scenario. An average of 14

help asap pls

help asap pls

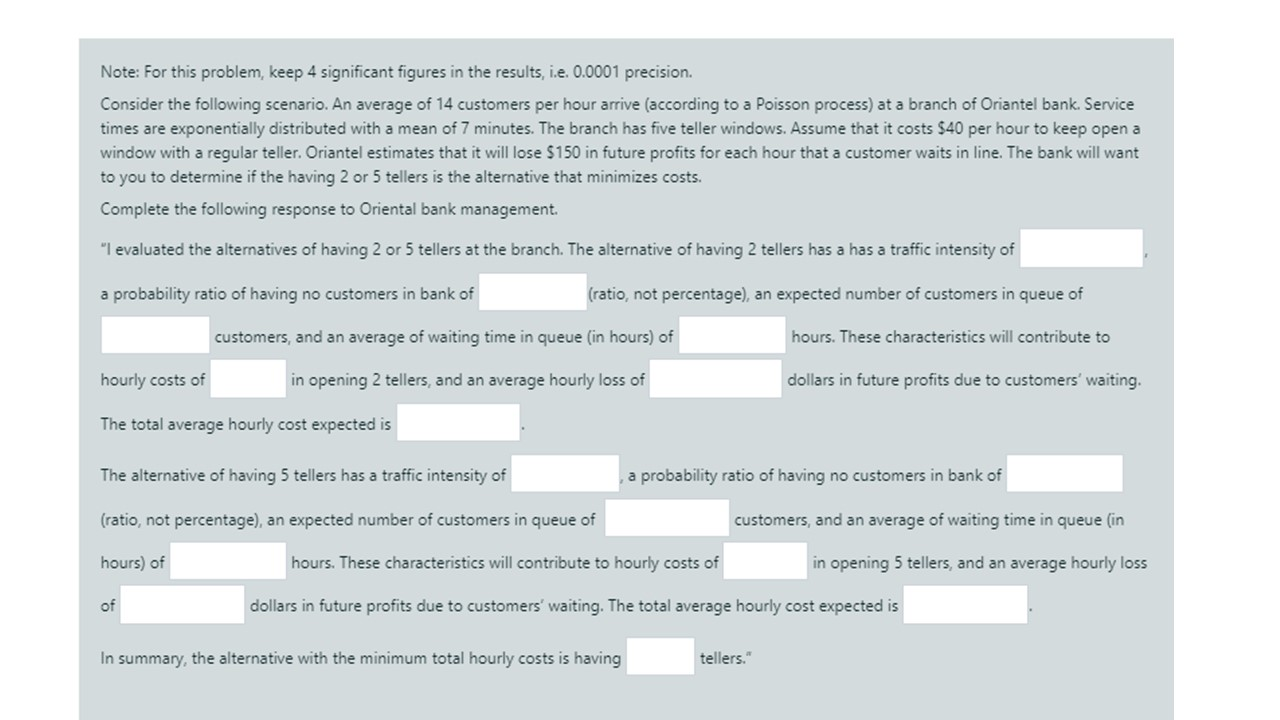

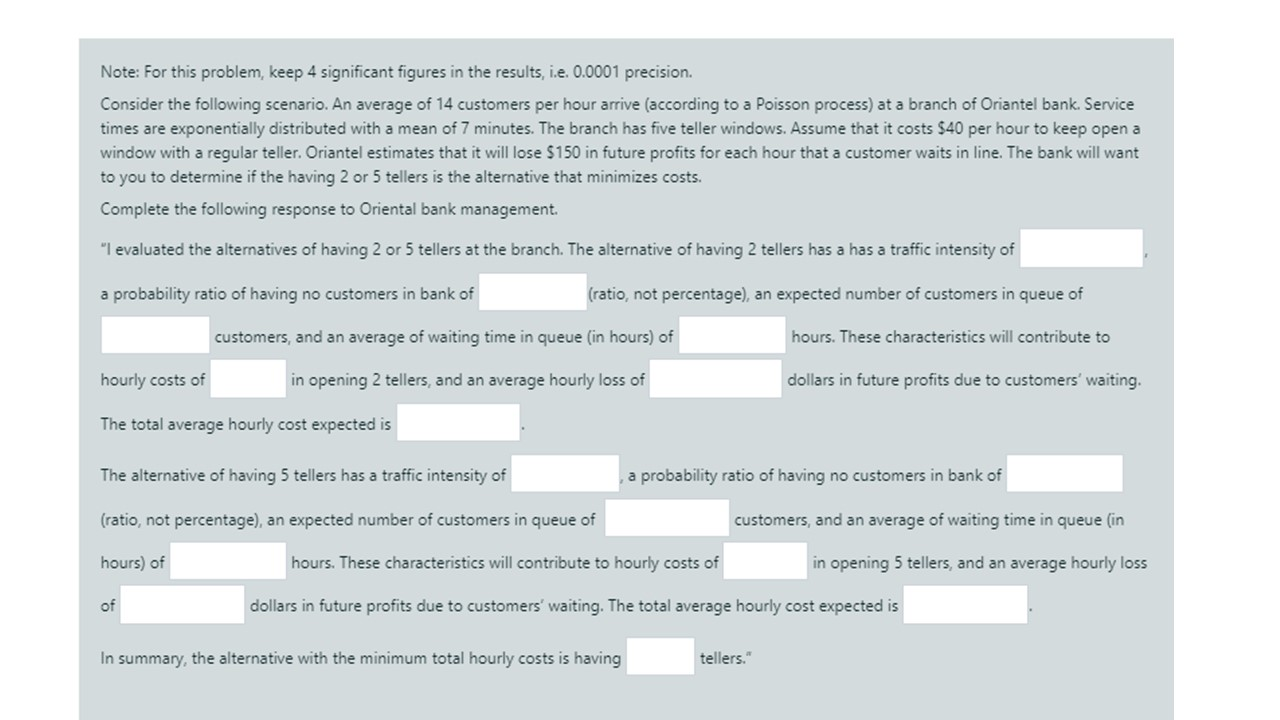

Note: For this problem, keep 4 significant figures in the results, i.e. 0.0001 precision. Consider the following scenario. An average of 14 customers per hour arrive (according to a Poisson process) at a branch of Oriantel bank. Service times are exponentially distributed with a mean of 7 minutes. The branch has five teller windows. Assume that it costs $40 per hour to keep open a window with a regular teller. Oriantel estimates that it will lose $150 in future profits for each hour that a customer waits in line. The bank will want to you to determine if the having 2 or 5 tellers is the alternative that minimizes costs. Complete the following response to Oriental bank management. "I evaluated the alternatives of having 2 or 5 tellers at the branch. The alternative of having 2 tellers has a has a traffic intensity of a probability ratio of having no customers in bank of (ratio, not percentage), an expected number of customers in queue of customers, and an average of waiting time in queue (in hours) of hours. These characteristics will contribute to hourly costs of in opening 2 tellers, and an average hourly loss of dollars in future profits due to customers' waiting. The total average hourly cost expected is The alternative of having 5 tellers has a traffic intensity of a probability ratio of having no customers in bank of (ratio, not percentage), an expected number of customers in queue of customers, and an average of waiting time in queue (in hours) of hours. These characteristics will contribute to hourly costs of in opening 5 tellers, and an average hourly loss of dollars in future profits due to customers' waiting. The total average hourly cost expected is In summary, the alternative with the minimum total hourly costs is having tellers." Note: For this problem, keep 4 significant figures in the results, i.e. 0.0001 precision. Consider the following scenario. An average of 14 customers per hour arrive (according to a Poisson process) at a branch of Oriantel bank. Service times are exponentially distributed with a mean of 7 minutes. The branch has five teller windows. Assume that it costs $40 per hour to keep open a window with a regular teller. Oriantel estimates that it will lose $150 in future profits for each hour that a customer waits in line. The bank will want to you to determine if the having 2 or 5 tellers is the alternative that minimizes costs. Complete the following response to Oriental bank management. "I evaluated the alternatives of having 2 or 5 tellers at the branch. The alternative of having 2 tellers has a has a traffic intensity of a probability ratio of having no customers in bank of (ratio, not percentage), an expected number of customers in queue of customers, and an average of waiting time in queue (in hours) of hours. These characteristics will contribute to hourly costs of in opening 2 tellers, and an average hourly loss of dollars in future profits due to customers' waiting. The total average hourly cost expected is The alternative of having 5 tellers has a traffic intensity of a probability ratio of having no customers in bank of (ratio, not percentage), an expected number of customers in queue of customers, and an average of waiting time in queue (in hours) of hours. These characteristics will contribute to hourly costs of in opening 5 tellers, and an average hourly loss of dollars in future profits due to customers' waiting. The total average hourly cost expected is In summary, the alternative with the minimum total hourly costs is having tellers

help asap pls

help asap pls