Question: HELP ASAP PLZ 1 2 - 1 8 . Two mutually exclusive investment alternatives are being considered, and one of them must be selected. Alternative

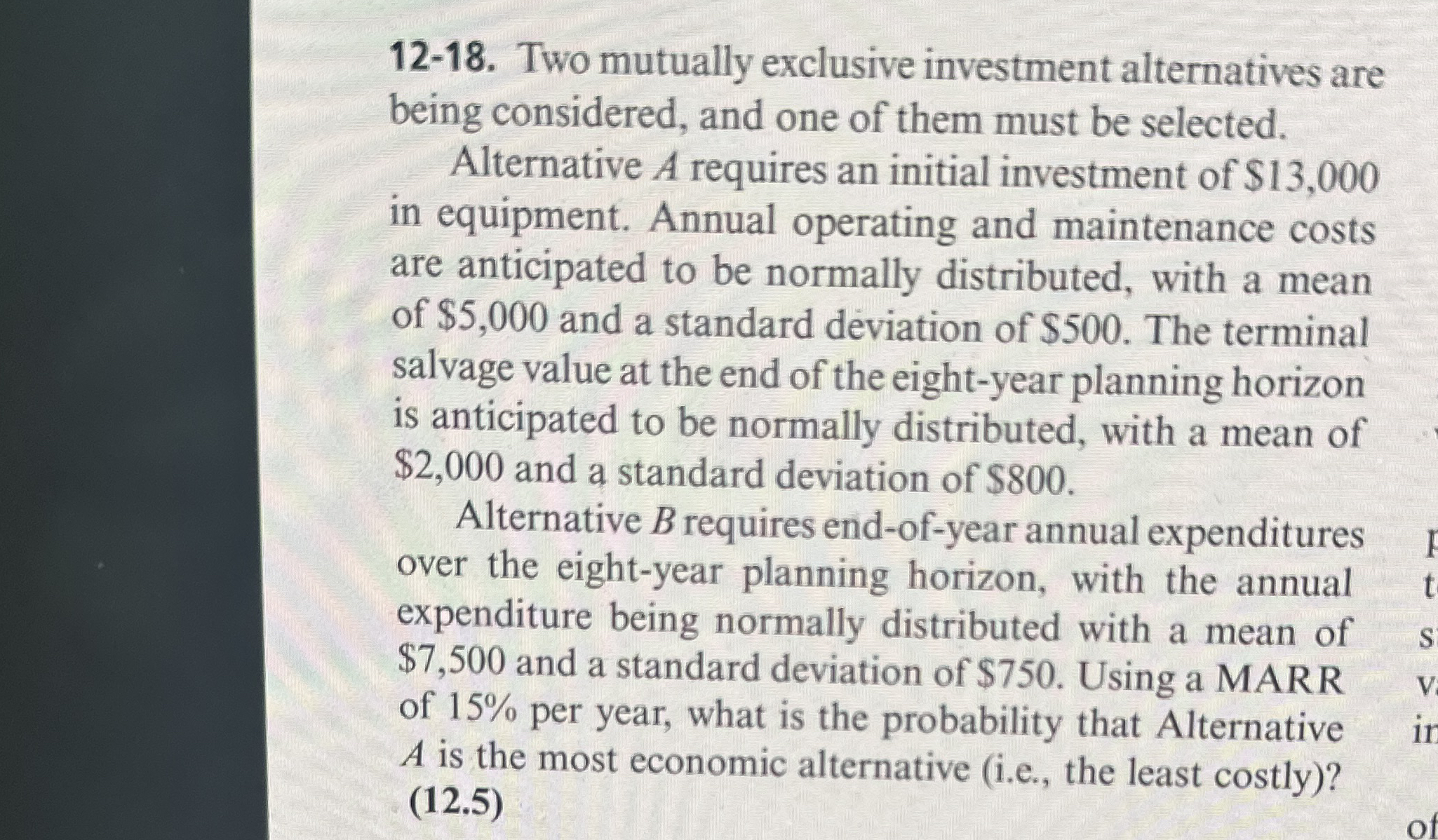

HELP ASAP PLZ Two mutually exclusive investment alternatives are being considered, and one of them must be selected.

Alternative A requires an initial investment of $ in equipment. Annual operating and maintenance costs are anticipated to be normally distributed, with a mean of $ and a standard deviation of $ The terminal salvage value at the end of the eightyear planning horizon is anticipated to be normally distributed, with a mean of $ and a standard deviation of $

Alternative requires endofyear annual expenditures over the eightyear planning horizon, with the annual expenditure being normally distributed with a mean of $ and a standard deviation of $ Using a MARR of per year, what is the probability that Alternative is the most economic alternative ie the least costlytableEnd of Year,Alternative AAlternative

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock