Question: help asap Problem 1-1A (Algo) Analyzing transactions and preparing financial statements LO P1, P2 [The following information applies to the questions displayed below.] Gabi Gram

![LO P1, P2 [The following information applies to the questions displayed below.]](https://dsd5zvtm8ll6.cloudfront.net/si.experts.images/questions/2024/10/66fbdac771c4c_57466fbdac6dff9e.jpg)

help asap

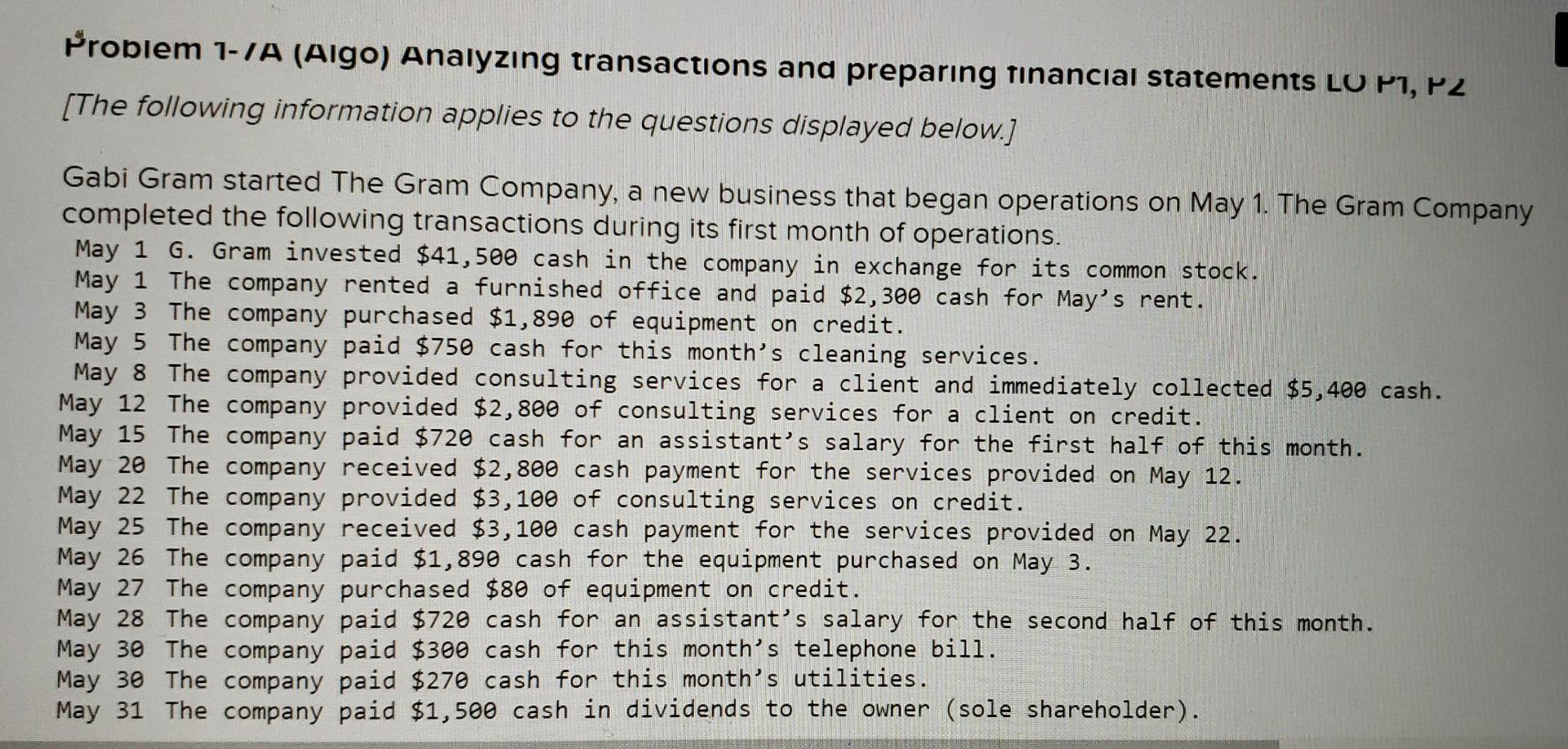

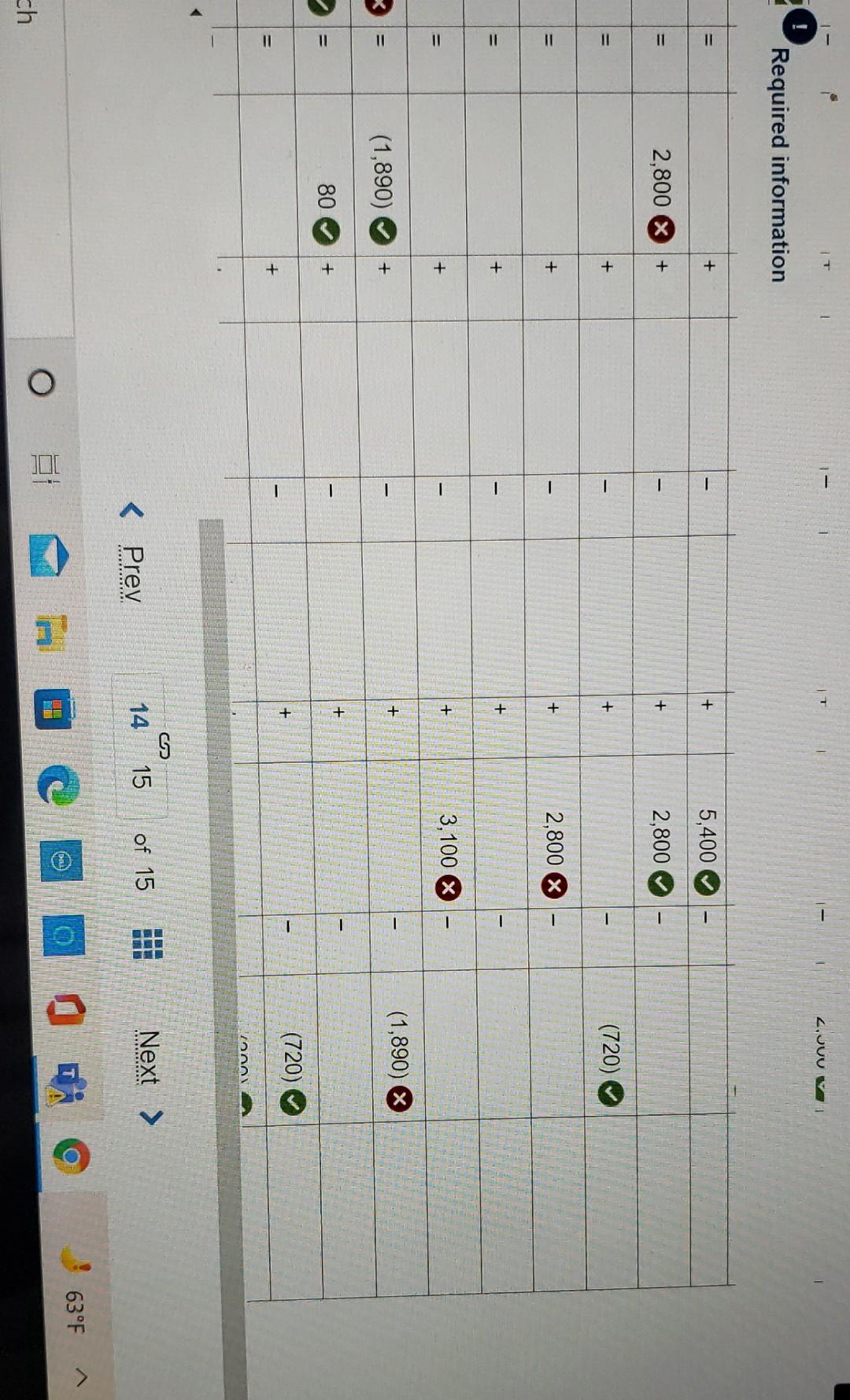

Problem 1-1A (Algo) Analyzing transactions and preparing financial statements LO P1, P2 [The following information applies to the questions displayed below.] Gabi Gram started The Gram Company, a new business that began operations on May 1. The Gram Company completed the following transactions during its first month of operations. May 1 G. Gram invested $41,500 cash in the company in exchange for its common stock. May 1 The company rented a furnished office and paid $2,300 cash for May's rent. May 3 The company purchased $1,890 of equipment on credit. May 5 The company paid $750 cash for this month's cleaning services. May 8 The company provided consulting services for a client and immediately collected $5,400 cash. May 12 The company provided $2,800 of consulting services for a client on credit. May 15 The company paid $720 cash for an assistant's salary for the first half of this month. May 20 The company received $2,800 cash payment for the services provided on May 12. May 22 The company provided $3,100 of consulting services on credit. May 25 The company received $3,100 cash payment for the services provided on May 22. May 26 The company paid $1,890 cash for the equipment purchased on May 3. May 27 The company purchased $80 of equipment on credit. May 28 The company paid $720 cash for an assistant's salary for the second half of this month. May 30 The company paid $300 cash for this month's telephone bill. May 30 The company paid $270 cash for this month's utilities. May 31 The company paid $1,500 cash in dividends to the owner (sole shareholder). Return to question noOLLO 4 LINIILILO yursy Required information May 1 + + II + $ 41,500 (2,300) $ 41,500 -- + of 2 + + IL + - + + + 1,890 > II 1,890 + + + + + + (750) 5,400 + + II + + 5,400 + 2,800 + 2,800 X + 1 + 2,800 1 May 1 May 3 May 5 May 8 May 12 May 15 May 20 May 22 May 25 May IIII (720) + + + - + w 2,800 + (2,800) + II + - + 2,800 -- + 3,100 + = + - + 3,100 + (3,100) + = + - + 3,100 14 A onn 14 Onn Prev 14 15 of 15 Next **PRERE 1 1 4. JUU W ! Required information II = + - + 5,400 2,800 X + - + + 2,800 -- - = + + - (720) + - + 2,800 X = 1 + + - + 3,100 = -- = + + - (1,890) = (1,890) + - + = II 80 + (720) I + + - = = onny 2 14 of 15 63F 10 O ch

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts