Question: help asap Problem I: You uncle is 40 years old and just told you that he would like to retire in 20 years. Knowing that

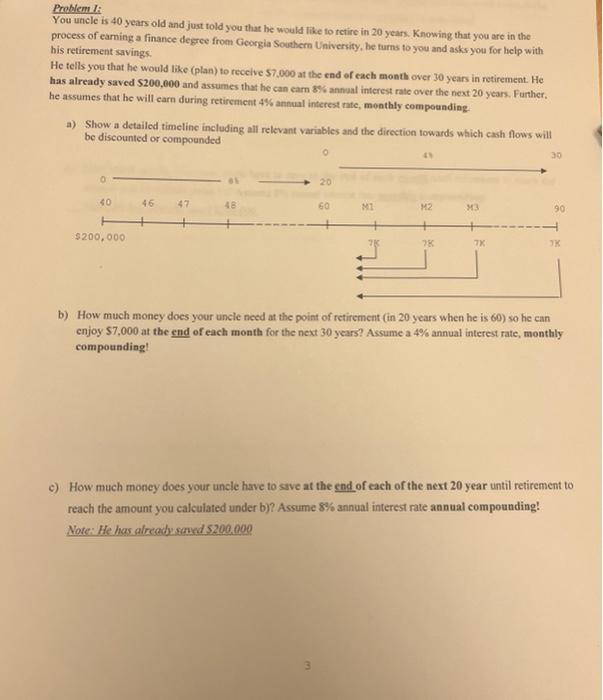

Problem I: You uncle is 40 years old and just told you that he would like to retire in 20 years. Knowing that you are in the process of earning a finance degree from Georgia Southern University, he turns to you and asks you for help with his retirement savings. He tells you that he would like (plan) to receive 57.000 at the end of each month over 30 years in retirement. He has already saved $200,000 and assumes that he can earn 8% annual interest rate over the next 20 years. Further. he assumes that he will earn during retirement 4% annual interest rate, monthly compounding a) Show a detailed timeline including all relevant variables and the direction towards which cash flows will be discounted or compounded 30 o 20 40 46 47 48 GO M M2 13 90 $200,000 7 7X K b) How much money does your uncle need at the point of retirement (in 20 years when he is 60) so he can enjoy 57,000 at the end of each month for the next 30 years? Assume a 4% annual interest rate, monthly compounding! c) How much money does your uncle have to save at the end of each of the next 20 year until retirement to reach the amount you calculated under b)? Assume 8% annual interest rate annual compounding! Note: He has already seed $200.000 d) How much money does your uncle have to save at the end of each month until retirement to reach the amount you calculated under by? Assume 8% annual interest rate annual compounding! Note: He has already sed $200,000 e) How much money does your uncle have to save at the end of each month until retirement to reach the amount you calculated under b)? Assume 8% annual interest rate monthly compounding! Note He has already saved $200.000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts