Question: HELP ASAP show work please! chapter 13 finance. always upvote Suppose your firm is considering irvesting in a project with the cash flows shown as

HELP ASAP show work please! chapter 13 finance. always upvote

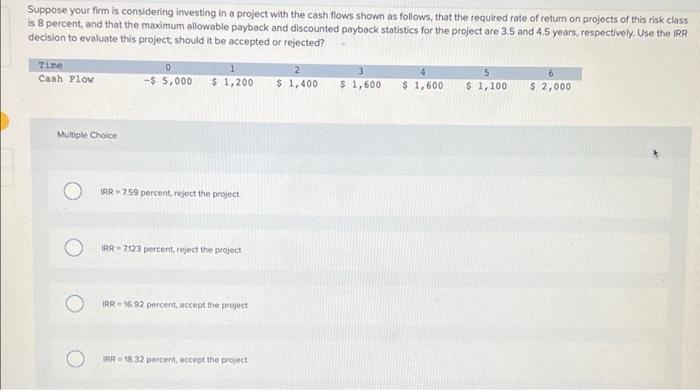

Suppose your firm is considering irvesting in a project with the cash flows shown as follows, that the required rate of refurn on projects of this risk class is 8 percent, and that the maximum allowable payback and discounted payback statistics for the project are 3.5 and 4.5 years, respectively. Use the IRR decision to evaluate this project; should it be accepted or rejected? Multigle Choice iRR =7.59 perceat, reject the project 1AR=7123 percent, reject the project IRR - 1692 percent, aceept the project MR i 18.32 percent, accept the project

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock