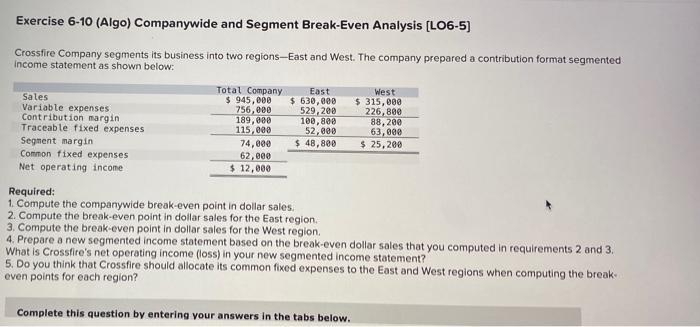

Question: help ASAP will rate good!! 1. 2. Exercise 6-10 (Algo) Companywide and Segment Break-Even Analysis [LO6-5] Crossfire Company segments its business into two regions-East and

![Segment Break-Even Analysis [LO6-5] Crossfire Company segments its business into two regions-East](https://dsd5zvtm8ll6.cloudfront.net/si.experts.images/questions/2024/10/6717dd3ef30a5_2146717dd3e71280.jpg)

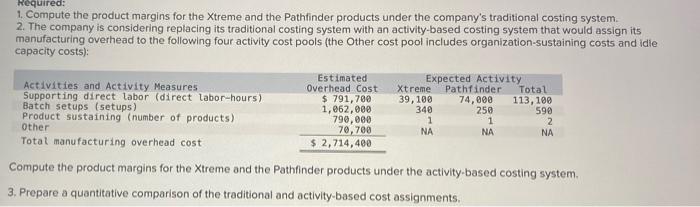

Exercise 6-10 (Algo) Companywide and Segment Break-Even Analysis [LO6-5] Crossfire Company segments its business into two regions-East and West. The company prepared a contribution format segmented income statement as shown below: East West Sales Total Company $ 945,000 756,000 $630,000 529,200 $ 315,000 226,800 88,200 63,000 189,000 Variable expenses Contribution margin Traceable fixed expenses Segment margin 100,800 115,000 52,000 $ 48,800 $ 25,200 74,000 62,000 Common fixed expenses Net operating income. $ 12,000 Required: 1. Compute the companywide break-even point in dollar sales. 2. Compute the break-even point in dollar sales for the East region. 3. Compute the break-even point in dollar sales for the West region. 4. Prepare a new segmented income statement based on the break-even dollar sales that you computed in requirements 2 and 3. What is Crossfire's net operating income (loss) in your new segmented income statement? 5. Do you think that Crossfire should allocate its common fixed expenses to the East and West regions when computing the break- even points for each region? Complete this question by entering your answers in the tabs below. Problem 7-17 (Algo) Comparing Traditional and Activity-Based Product Margins [LO7-1, LO7-3, LO7-4, LO7-5] Smoky Mountain Corporation makes two types of hiking boots-the Xtreme and the Pathfinder. Data concerning these two product lines appear below: Xtreme Pathfinder $ 91.00 Selling price per unit Direct materials per unit Direct labor per unit. $141.00 $ 64.50 $ 17.00 $ 52.00 $ 10.00 Direct labor-hours per unit Estimated annual production and sales 1.7 DLHS 23,000 units 1.0 DLHS 74,000 units The company has a traditional costing system in which manufacturing overhead is applied to units based on direct labor-hours. Data concerning manufacturing overhead and direct labor-hours for the upcoming year appear below: Estimated total manufacturing overhead Estimated total direct labor-hours $ 2,714,400 113,100 DLHS Required: 1. Compute the product margins for the Xtreme and the Pathfinder products under the company's traditional costing system. 2. The company is considering replacing its traditional costing system with an activity-based costing system that would assign its manufacturing overhead to the following four activity cost pools (the Other cost pool includes organization-sustaining costs and idle capacity costs): Required: 1. Compute the product margins for the Xtreme and the Pathfinder products under the company's traditional costing system. 2. The company is considering replacing its traditional costing system with an activity-based costing system that would assign its manufacturing overhead to the following four activity cost pools (the Other cost pool includes organization-sustaining costs and idle capacity costs): Expected Activity Activities and Activity Measures Supporting direct labor (direct labor-hours). Batch setups (setups) Estimated Overhead Cost $ 791,700 1,062,000 790,000 Xtreme Pathfinder Total 39,100 113, 100 340 74,000 250 590 Product sustaining (number of products) 1 1 2 Other 70,700 NA NA NA Total manufacturing overhead cost $ 2,714,400 Compute the product margins for the Xtreme and the Pathfinder products under the activity-based costing system. 3. Prepare a quantitative comparison of the traditional and activity-based cost assignments

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts