Question: HELP! asap! will rate good (: this what i have but feel like it may be off Problem 8-4A Computing and revising depreciation; revenue and

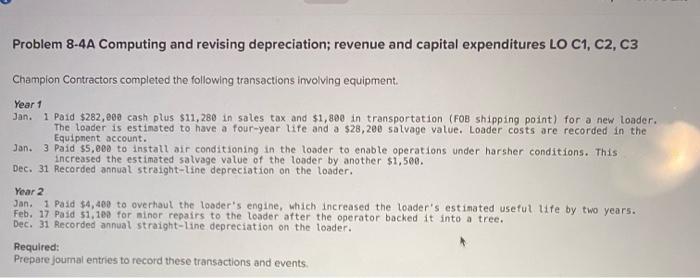

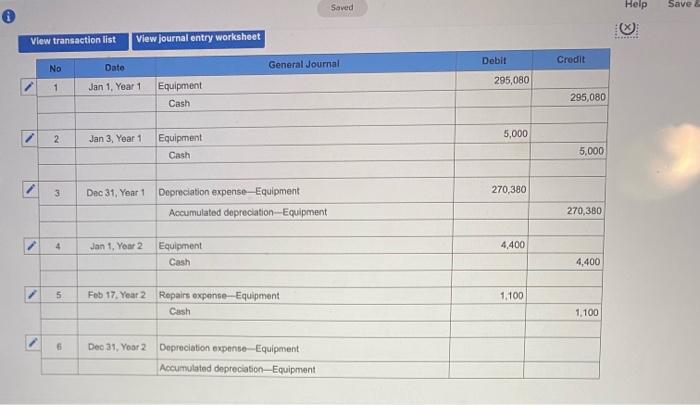

Problem 8-4A Computing and revising depreciation; revenue and capital expenditures LO C1, C2, C3 Champion Contractors completed the following transactions involving equipment. Year 1 Jan. 1 Paid $282,000 cash plus $11,280 in sales tax and $1,890 in transportation (FOB shipping point) for a new loader. The Loader is estimated to have a four-year ute and a $28,200 salvage value. Loader costs are recorded in the Equipment account. Jan. 3 paid $5,000 to install air conditioning in the loader to enable operations under harsher conditions. This increased the estimated salvage value of the loader by another $1,500. Dec. 31 Recorded annual straight-line depreciation on the loader. Year 2 Jan. 1 Paid $4,400 to overhaul the loader's engine, which increased the loader's estimated useful life by two years. Feb. 17 Paid 51,100 for siner repairs to the loader after the operator backed it into a tree. Dec. 31 Recorded annual straight-line depreciation on the loader. Required: Prepare joumal entries to record these transactions and events Saved Help Save View transaction list View journal entry worksheet Debit Credit No Dato General Journal 295,080 1 Jan 1, Year 1 Equipment Cash 295,080 2 Jan 3, Year 1 5,000 Equipment Cash 5,000 1 3 Dec 31, Year 1 270,380 Depreciation expense-Equipment Accumulated depreciation--Equipment 270,380 4 Jan 1. Your 2 4,400 Equipment Cash 4,400 5 1.100 Feb 17 Year 2 Repairs expense--Equipment Cash 1.100 6 6 Dec 31, Year 2 Depreciation expense-Equipment Accumulated depreciation Equipment

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts