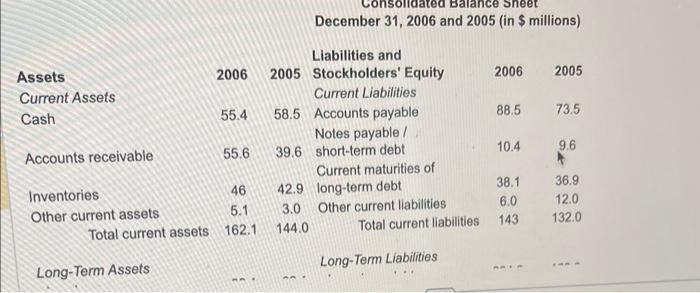

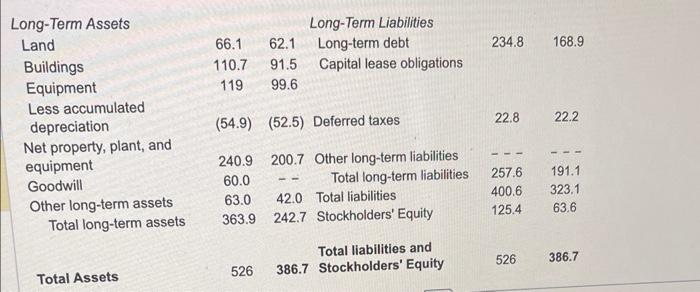

Question: HELP ASAPPPPP December 31, 2006 and 2005 (in $ millions) Refer to the balance sheet above. If in 2006 Luther has 10.2 milliof shares outstanding

HELP ASAPPPPP

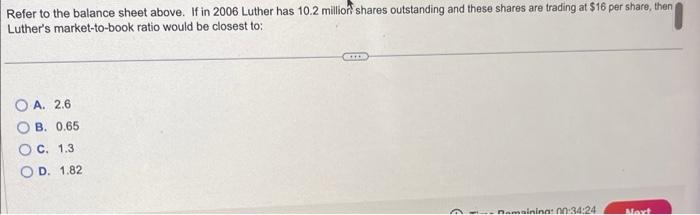

December 31, 2006 and 2005 (in \$ millions) Refer to the balance sheet above. If in 2006 Luther has 10.2 milliof shares outstanding and these shares are trading at $16 per share, then Luther's market-to-book ratio would be closest to: A. 2.6 B. 0.65 C. 1.3 D. 1.82

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock