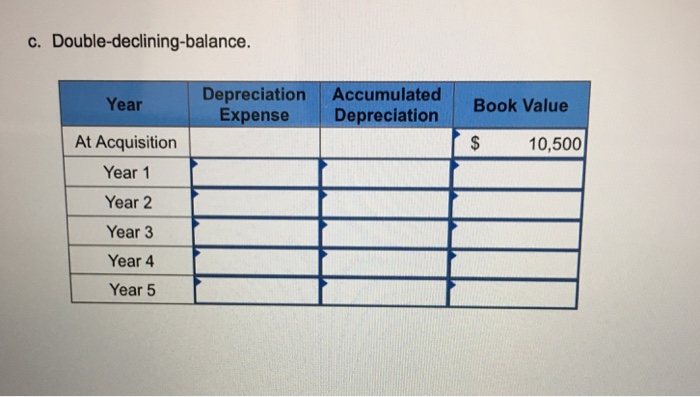

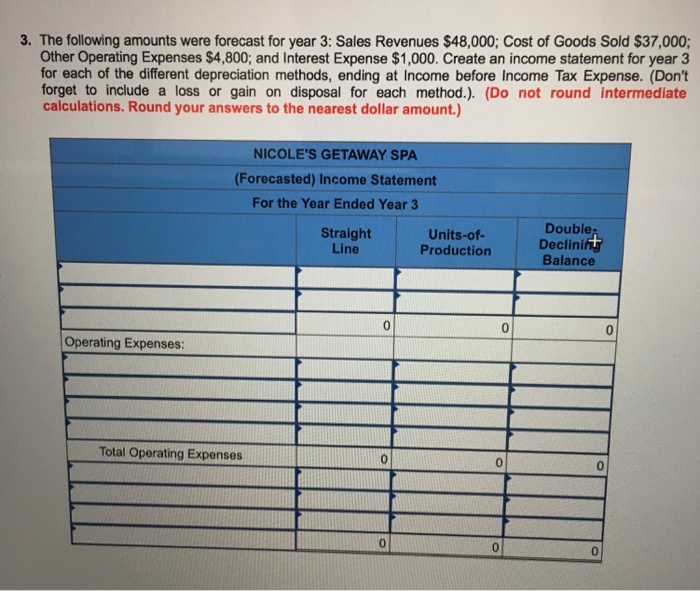

Question: Help calculate the double declining balance The income statement 3rd picture Nicole's Getaway Spa (NGS) purchased a hydrotherapy tub system to add to the wellness

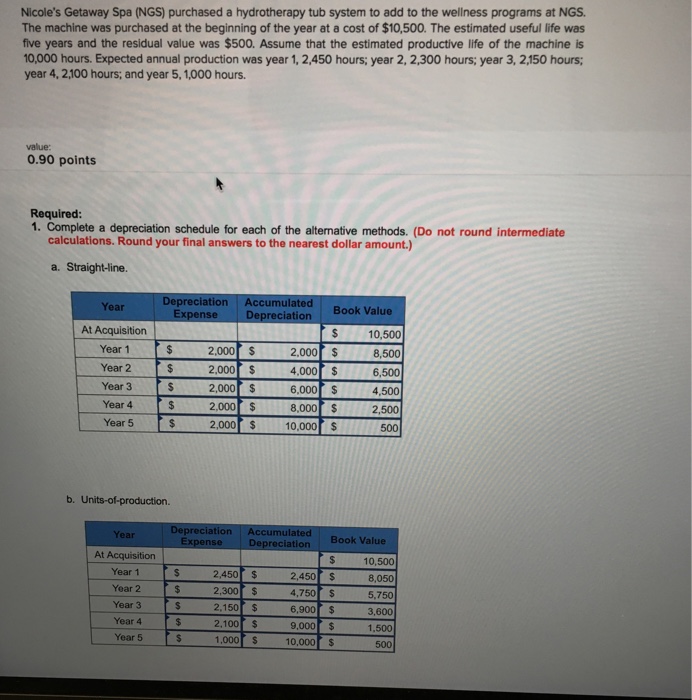

Nicole's Getaway Spa (NGS) purchased a hydrotherapy tub system to add to the wellness programs at NGS The machine was purchased at the beginning of the year at a cost of $10,500. The estimated useful life was five years and the residual value was $500. Assume that the estimated productive life of the machine is 10,000 hours. Expected annual production was year 1, 2,450 hours; year 2,2,300 hours; year 3, 2,150 hours; year 4, 2,100 hours; and year 5,1,000 hours. value: 0.90 points Required: 1. Complete a depreciation schedule for each of the alternative methods. (Do not round intermediate calculations. Round your final answers to the nearest dollar amount.) a. Straight-line. Depreciation Accumulated Year preciation Book Value 10,500 8,500 6,500 4,500 2,500 500 At Acquisition Year 1 Year 2 Year 3 Year 4 2,000 s 2,000 s ,000$ 2,000 $ 2,000 $ 2,000 $ 4,000 $ 6,000 s 8,000 S 10,000$ b. Units-of-production. Accumulated Book Value Year At Acquisition Year 1 Year 2 Year 3 Year 4 Year 5 10,500 8,050 5,750 3,600 1,500 500 450 2,300 $ 2,150 $ 2,100 $ 1,000 $ 2,450 $ 4,750 $ 6,900 $ 9,000 $

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts