Question: Help? can anyone explain the first question? Section Three: Harder (3 points each) Three years ago, in 2016, you bought $100,000 Face Value of Boeing

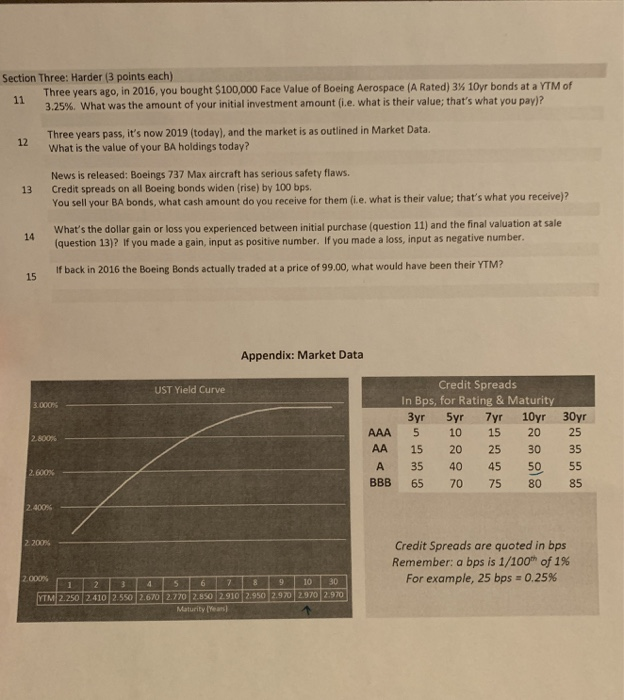

Section Three: Harder (3 points each) Three years ago, in 2016, you bought $100,000 Face Value of Boeing Aerospace (A Rated) 3% 10yr bonds at a YTM of 3.25% What was the amount of your initial investment amount i.e. what is their value; that's what you payl? Three years pass, it's now 2019 (today, and the market is as outlined in Market Data. What is the value of your BA holdings today? News is released: Boeings 737 Max aircraft has serious safety flaws. Credit spreads on all Boeing bonds widen (rise) by 100 bps. You sell your BA bonds, what cash amount do you receive for them (ie. what is their value; that's what you receive)? 14 What's the dollar gain or loss you experienced between initial purchase (question 11) and the final valuation at sale (question 13)? If you made a gain, input as positive number. If you made a loss, input as negative number. If back in 2016 the Boeing Bonds actually traded at a price of 99.00, what would have been their YTM? Appendix: Market Data UST Yield Curve AAA AA A BBB Credit Spreads In Bps, for Rating & Maturity 3yr Syr 7yr 10yr 5 10 15 20 15 20 25 30 35 40 45 50 65 70 75 80 30yr 25 35 55 2. Credit Spreads are quoted in bps Remember: a bps is 1/100 of 1% For example, 25 bps = 0.25% W 2345678910 30 YTM 2.250 2410 2.550 2.670 2.770 2.850 2.910 2.950 2.970 2970 2.970 Maturity

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts