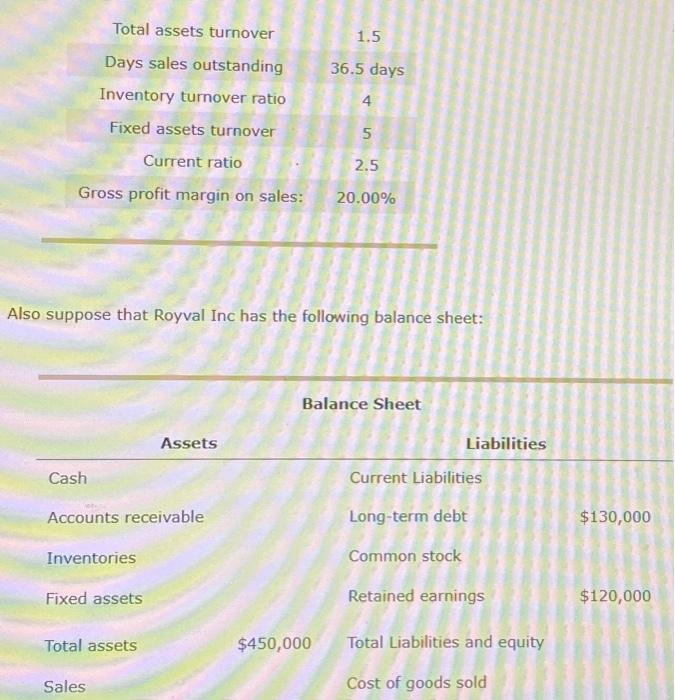

Question: Help. Can you explain where I am wrong and how to do it correctly? Also suppose that Royval Inc has the following balance sheet: According

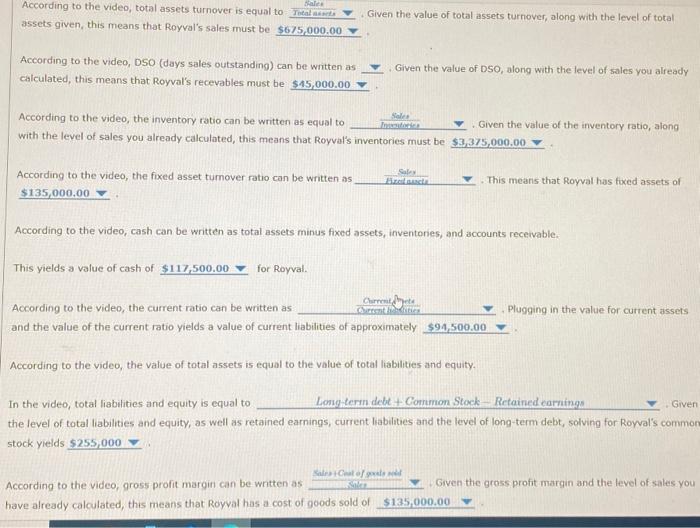

Also suppose that Royval Inc has the following balance sheet: According to the video, total assets turnover is equal to assets given, this means that Royval's sales must be Given the value of total assets turnover, along with the level of total According to the video, DSO (days sales outstanding) can be witten as caiculated, this means that Royval's recevables must be Given the value of DSO, along with the level of sales you already According to the video, the inventory ratio can be written as equal to . Given the value of the inventory ratio, along with the level of sales you already calculated, this means that Royval's inventories must be According to the video, the fixed asset tumover ratio can be written as - This means that Royval has fixed assets of According to the video, cash can be written as total assets minus fixed assets, inventories, and accounts receivable. This yields a value of cash of for Royval. According to the video, the current ratio can be written as - Plugging in the value for current assets and the value of the current ratio yields a value of current liabilities of approximately According to the video, the value of total assets is equal to the value of total liabilities and equity. In the video, total liabilities and equity is equal to Loug-tern debt + Corrunon Stock - Retained carnings Given the level of total liabilities and equity, as well as retained earnings, current liabilaties and the level of long-term debt, solving for Royal's common stock yieids According to the video, gross profit margin can be written as Given the gross profit margin and the level of sales you

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts