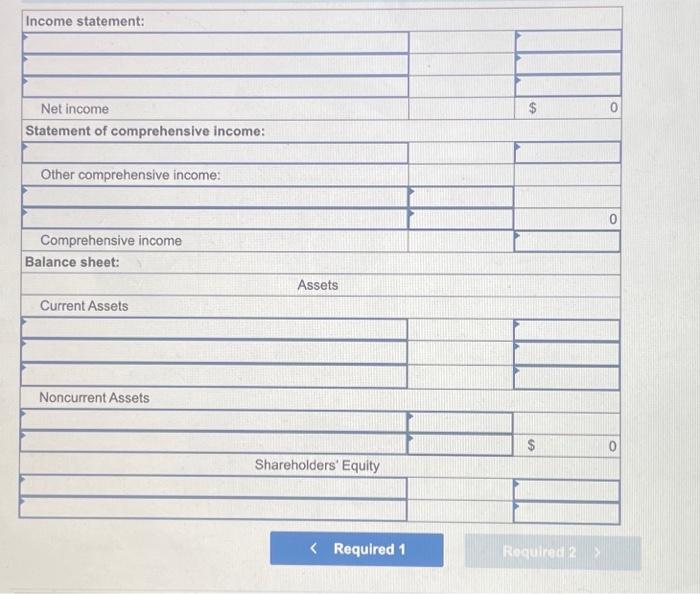

Question: help complete the income statement with information provided Roquired 1 Required 2 The following selected transactions relate to investment activities of Ornamental Insulation Corporation during

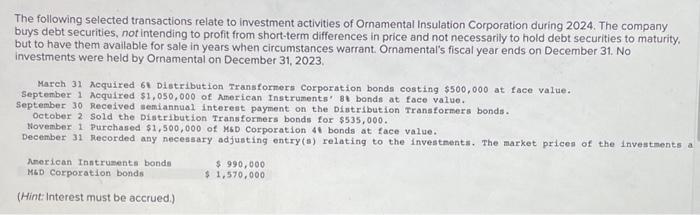

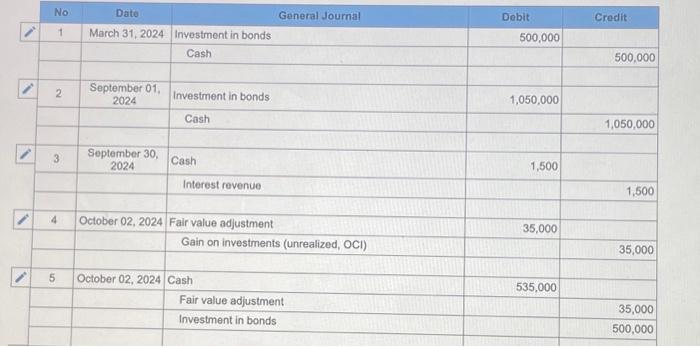

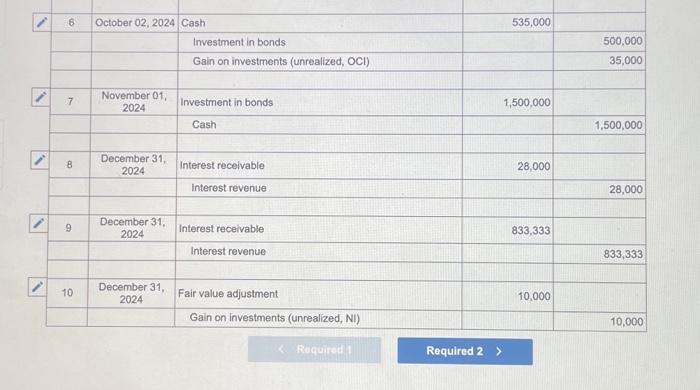

Roquired 1 Required 2 The following selected transactions relate to investment activities of Ornamental Insulation Corporation during 2024. The company buys debt securities, not intending to profit from short-term differences in price and not necessarily to hold debt securities to maturity. but to have them available for sale in years when circumstances warrant. Ornamental's fiscal year ends on December 31 . No investments were held by Ornamental on December 31,2023. Mareh 31 Acquired 61 Distribution Transformers corporation bonds costing $500,000 at face value. September 1 Acquired $1,050,000 of American Instruments" 8t bonds at face value. September 30 Received semiannual interest payment on the Diatribution Transformers bonds. October 2 sold the Distribution Iransformers bonds for $535,000. November 1 Purchased $1,500,000 of M6D Corporation 4t bonds at face value. December 31 Recorded any necessary adjusting entry(s) relating to the investments. The market prices of the investments a American Inntruments bonds MLD Corporation bonds $.990,000 $1,570,000 (Hint: Interest must be accrued.) Roquired 1 Required 2 The following selected transactions relate to investment activities of Ornamental Insulation Corporation during 2024. The company buys debt securities, not intending to profit from short-term differences in price and not necessarily to hold debt securities to maturity. but to have them available for sale in years when circumstances warrant. Ornamental's fiscal year ends on December 31 . No investments were held by Ornamental on December 31,2023. Mareh 31 Acquired 61 Distribution Transformers corporation bonds costing $500,000 at face value. September 1 Acquired $1,050,000 of American Instruments" 8t bonds at face value. September 30 Received semiannual interest payment on the Diatribution Transformers bonds. October 2 sold the Distribution Iransformers bonds for $535,000. November 1 Purchased $1,500,000 of M6D Corporation 4t bonds at face value. December 31 Recorded any necessary adjusting entry(s) relating to the investments. The market prices of the investments a American Inntruments bonds MLD Corporation bonds $.990,000 $1,570,000 (Hint: Interest must be accrued.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts