Question: help Consider a dialogue between Van and Amy, both new employees at a big Fortune 500 company. Both had taken a personal finance class in

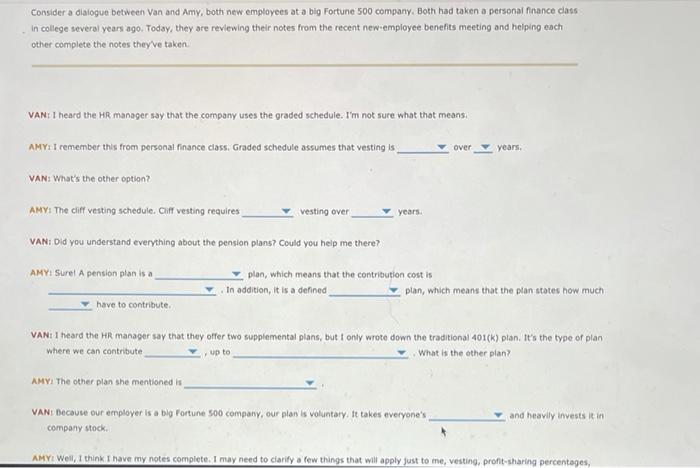

Consider a dialogue between Van and Amy, both new employees at a big Fortune 500 company. Both had taken a personal finance class in college several years ago. Today, they are reviewing their notes from the recent new.employee benefits meeting and helping each other complete the notes they've taken VANI I heard the HR manager say that the company uses the graded schedule. I'm not sure what that means AMY: I remember this from personal finance class. Graded schedule assumes that vesting is Over years VAN: What's the other option? AMY: The cift vesting schedule. Cift vesting requires vesting over years VAN: Did you understand everything about the pension plans? Could you help me there? AMY: Surel A pension plan is a plan, which means that the contribution cost is In addition, it is a defined plan, which means that the plan states how much have to contribute VAN: I heard the HR manager say that they offer two supplemental plans, but I only wrote down the traditional 401(k) plan. It's the type of plan where we can contribute What is the other plan? up to AMY: The other plan she mentioned is VAN: Because our employer is a big Fortune 500 company, our plan is voluntary. It takes everyone's company stock and heavily invests it in AMY: Well, I think I have my notes complete. I may need to clarify a few things that will apply just to me, vesting profit sharing percentages

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts