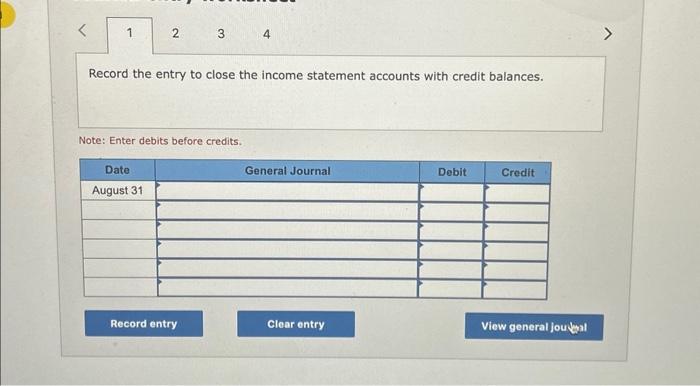

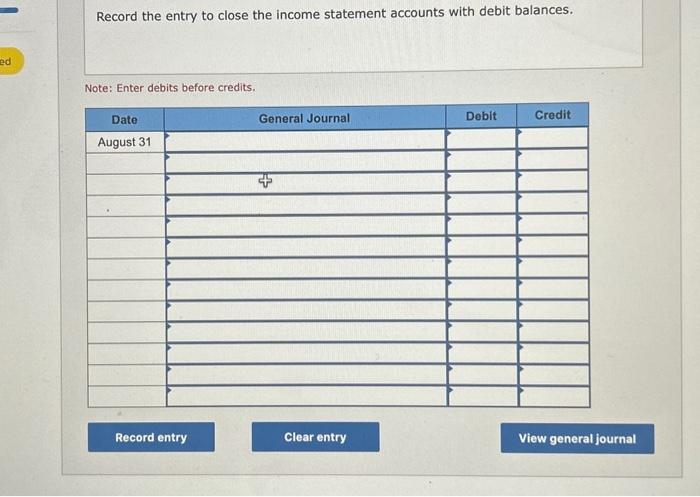

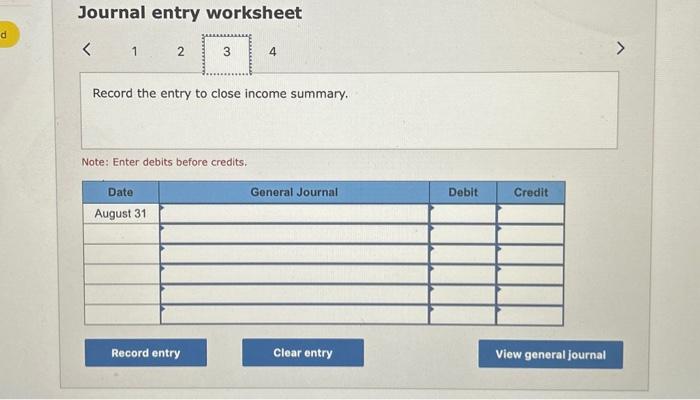

Question: help correct and complete will like. Journal entry worksheet Record the entry to close income summary. Note: Enter debits before credits. Record the entry to

![\hline \multirow[t]{2}{*}{ Cost of goods sold } & Q & & 100,577](https://dsd5zvtm8ll6.cloudfront.net/si.experts.images/questions/2024/09/66ec333e50afa_64566ec333de07cc.jpg)

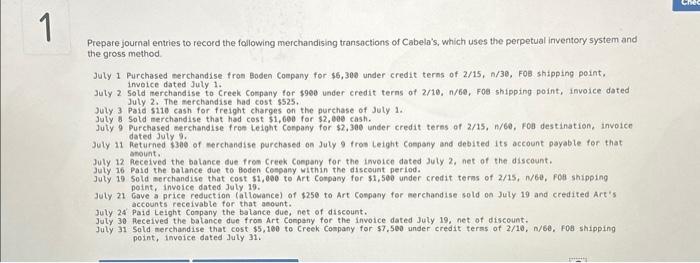

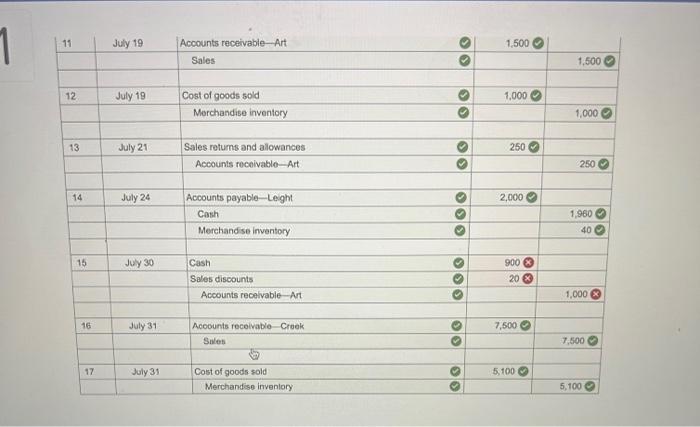

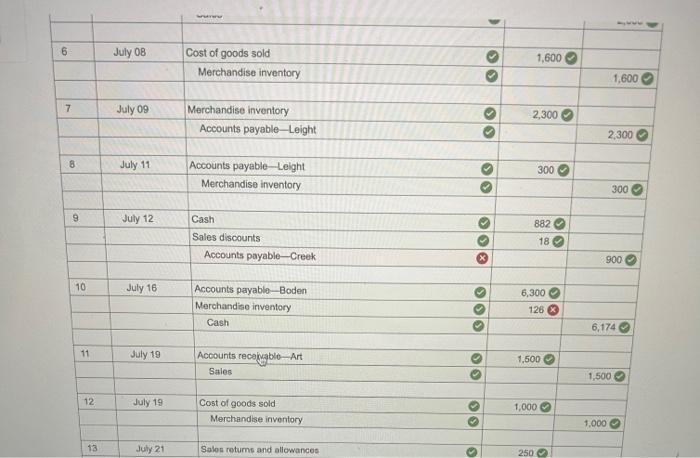

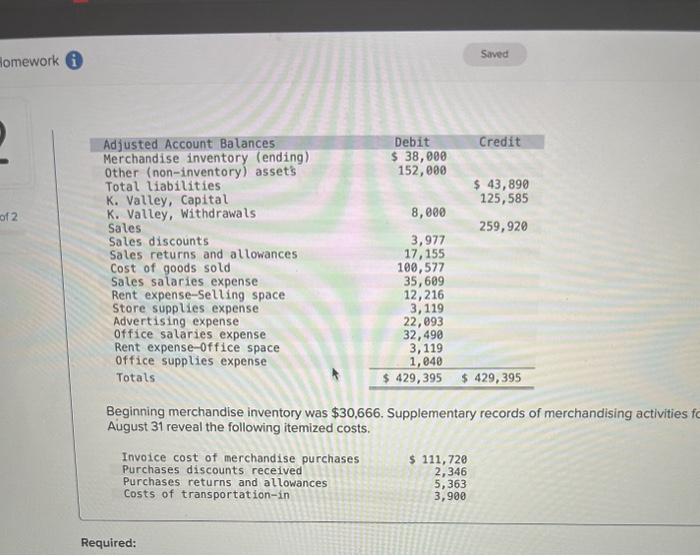

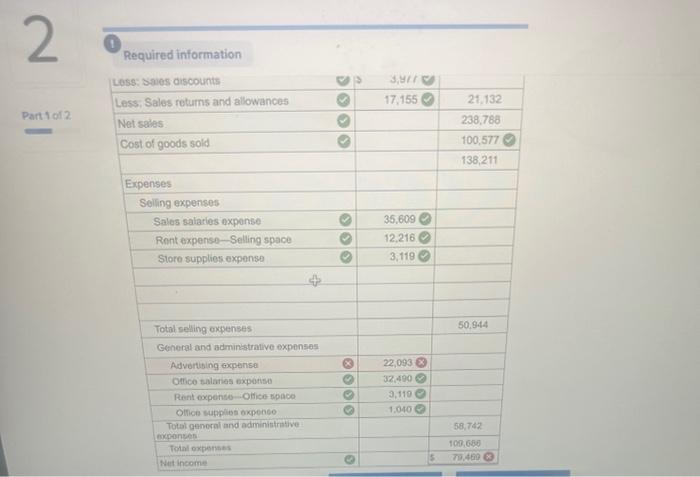

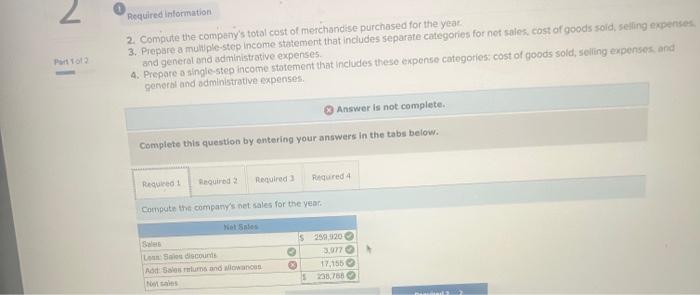

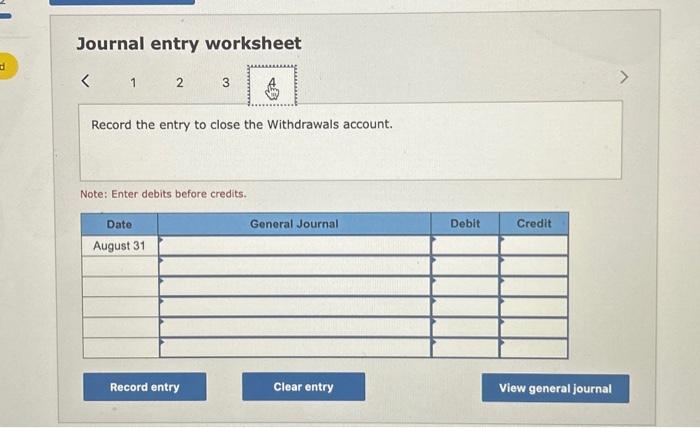

Journal entry worksheet Record the entry to close income summary. Note: Enter debits before credits. Record the entry to close the income statement accounts with debit balances. Note: Enter debits before credits. Required information \begin{tabular}{|c|c|c|c|} \hline Less: Swes discounts & & s,yir e & \\ \hline Less, Sales retums and allowances & 0 & 17,1550 & 21,132 \\ \hline Net sales & & & 238,788 \\ \hline \multirow[t]{2}{*}{ Cost of goods sold } & Q & & 100,577 \\ \hline & & & 138,211 \\ \hline \multicolumn{4}{|l|}{ Expenses } \\ \hline \multicolumn{4}{|l|}{ Selling expenses } \\ \hline Sales salarles expense & 0 & 35,609 & \\ \hline Rent expense - Selling space & 8 & 12,2160 & \\ \hline Store supplies expense & 0 & 3,118 & \\ \hline \\ \hline \multicolumn{4}{|l|}{4} \\ \hline Total seling oxpenses & & & 50,944 \\ \hline \multicolumn{4}{|l|}{ General and administrative expenses } \\ \hline Advortibing experise & & 22,093 & \\ \hline Othco salanes expotsse & 0 & 32,4900 & \\ \hline Rent expenses-Oitice space & Q & 9,110O & \\ \hline Olfices supplies oxpense & 0 & 1.0400 & \\ \hline Totatgenoralandadministrativeexponzes & & & 58,742 \\ \hline Tohal oxpenses & & & 100,630 \\ \hline Net income & 0 & & 5.4600 \\ \hline \end{tabular} Beginning merchandise inventory was $30,666. Supplementary records of merchandising activities August 31 reveal the following itemized costs. Record the entry to close the income statement accounts with credit balances. Note: Enter debits before credits. Required information [The following information applies to the questions displayed below.] Valley Company's adjusted account balances from its general ledger on August 31, its fiscal year-end, follows. It categorizes the following accounts as selling expenses: sales salaries expense, rent expense-selling space, store supplies expense, and advertising expense. It categorizes the remaining expenses as general and administrative. Beginning merchandise inventory was $30,666. Supplementary records of merchandising activities for the year ended August 31 reveal the following itemized costs. Required inlormation 2. Compute the compariy's total cost of merchandise purchased for the year. 3. Prepare a mulit ple-step income statement that includes separate categories for not sales, cost of goods soid, selling expenses and general and administrative expenses. 4. Prepare a single-step income statement that includes these expense categoties: cost of goods sold, selling expenses. and general and odministrative expenses. Answer is not complete. Complete this question by entering your answers in the tabs below. Compute the companys net sales for the year: Prepare journal entries to record the following merchandising transactions of Cabela's, which uses the perpetual inventory system and the gross method. July 1 Purchased merchabdise fron Boden Coepany for $5,300 under credit terns of 2/15,n/30, FoB shipping point, involce dated July 1 . July 2 Sold merchandise to Creek Company for $990 under credit terns of 2/10,n/60, Fos shipping point, invoice dated July 2 . The merchandise had cost $525. July 3 Pald sile cash for freight charges on the purchase of July 1. July of Sold merchandise that had cost $1,600 for $2,800 cash. Juty 9 purchased merchandise fron Leight Conpany for $2,300 inder credit teras of 2/15,n/60, Fon destination, invoice dated July 9 . July 11 Returned $300 of merchandise purchased on July 9 fros leight Company and debited its account payable for that anount. Juty 12 Received the batance due fron Creek Company for the invoice dated July 2, net of the discount, July 16 paid the balance due to Boden Coapany within the discount period. Juty 10 Sold serchandise that cost $1,600 to Art Compacy for $1,500 under credit teras of 2/15, N60, FOB shipping point, invoice dated July 19. July 21 Gave a price reduction (atlowance) of \$250 to Art Company for merehandise sold on July 19 and credited Art's accounts receivable for that aeount. July 24 Paid Leight Conpany the balance due, net of discount. July 30 Received the batance due from Art Company for the invoice dated July 19, net of discount. July 31 Sold merchandise that cost $5,160 to Creek Company for $7,500 under credit teras of 2/10, n/60, f0B shipping point, invoice dated Juty 31 . Journal entry worksheet Record the entry to close the Withdrawals account. Note: Enter debits before credits

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts