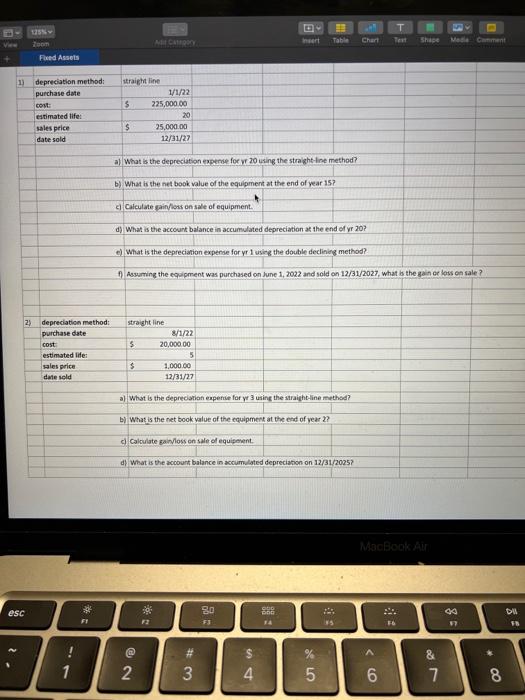

Question: help? !! D T Test MICA sert Table Chant Shige Made Carmen Zoom Feed Assets 1) depreciation method: purchase date con estimated life: sales price

!! D T Test MICA sert Table Chant Shige Made Carmen Zoom Feed Assets 1) depreciation method: purchase date con estimated life: sales price date sold straight line 1/1/2 5 225,000.00 20 $ 25,000.00 12/31/27 a) What is the depreciation expers for vr 20 using the straight line method? b) What is the netbook value of the equipment at the end of year 157 Calculate gain/loss on sale of equipment d) What is the account balance in accumulated depreciation at the end of yr 207 e) What is the depreciation expense for yr using the double declining method? Assuming the equipment was purchased on June 1, 2022 and sold on 12/31/2027. What is the gain or loss on sale? 2) depreciation method: purchase date cost estimated life: sales price date sold straight line 81/22 5 20,000.00 5 $ 1.000.00 12/31/27 a) What is the depreciation expense for yr 3 using the straight-line method? b) What is the netbook value of the equipment at the end of year 2? Calculate galloss on sale of equipment d) What is the account balance in accumulated depreciation on 12/31/2025? MacBook Air 30 esc 00 7 DU IN FT F3 14 1 # 3 N 4 8 st 5

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts