Question: help Descriptions a. A company's ability to pay its current liabilities. b. Accounting choices that result in reporting lower income, lower assets, and higher liabilities.

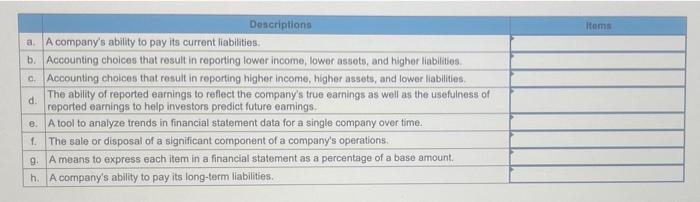

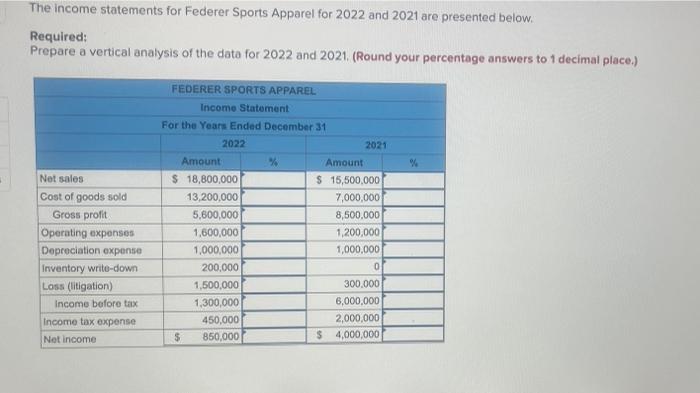

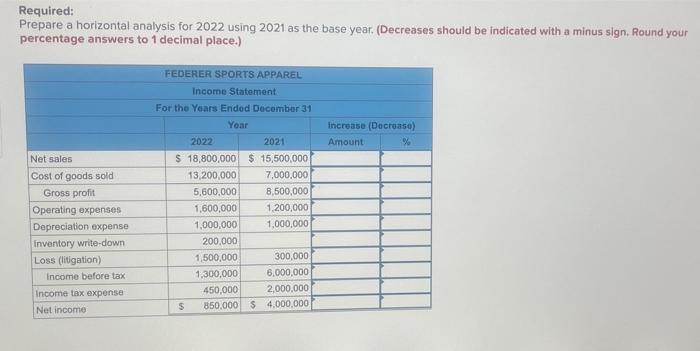

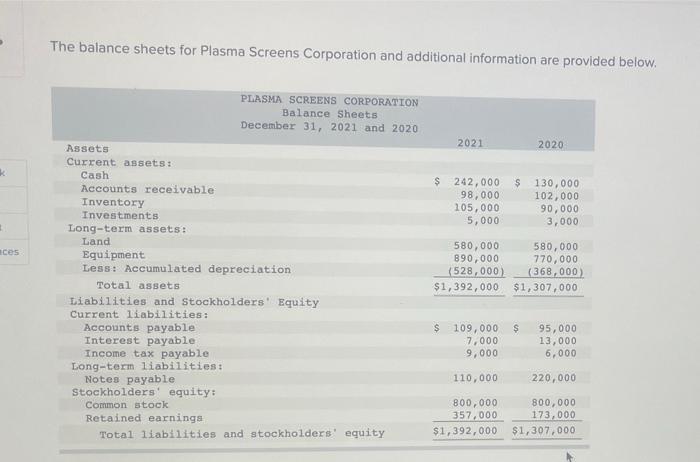

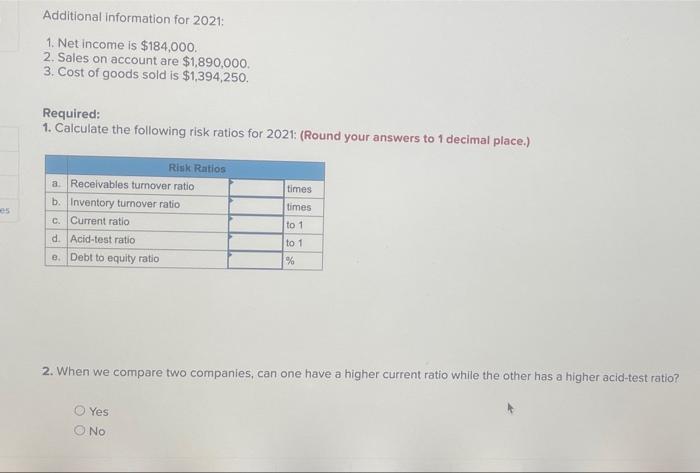

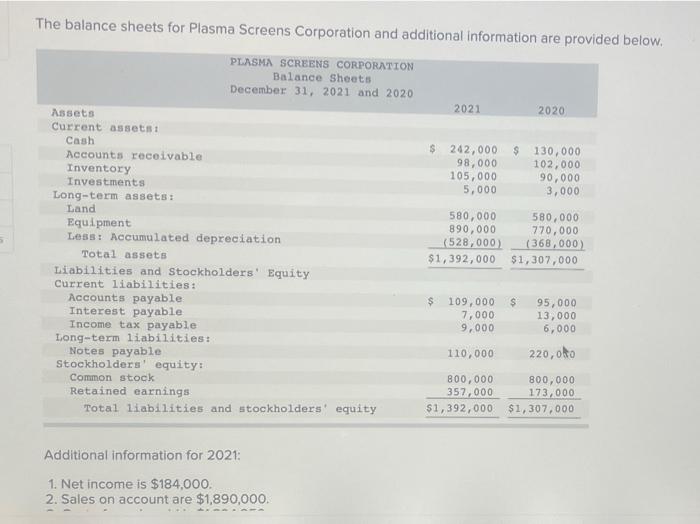

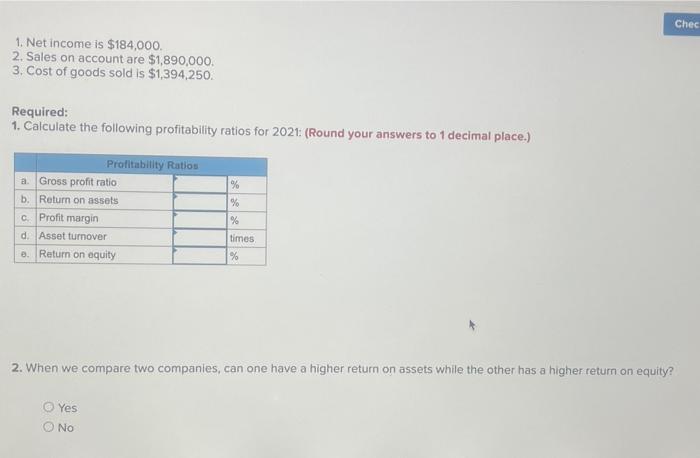

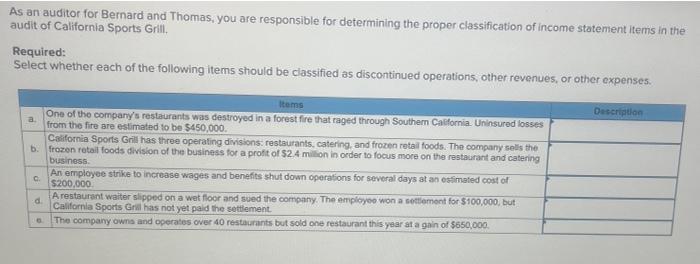

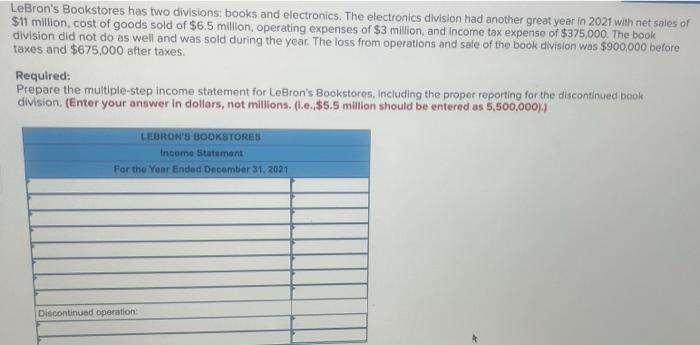

Descriptions a. A company's ability to pay its current liabilities. b. Accounting choices that result in reporting lower income, lower assets, and higher liabilities. c. Accounting choices that result in reporting higher income, higher assets, and lower liabilities. d. The ability of reported earnings to reflect the company's true earnings as well as the usefulness of reported earnings to help investors predict future earnings. e. A tool to analyze trends in financial statement data for a single company over time. f. The sale or disposal of a significant component of a company's operations. 9. A means to express each item in a financial statement as a percentage of a base amount. h. A company's ability to pay its long-term liabilities. Items The income statements for Federer Sports Apparel for 2022 and 2021 are presented below. Required: Prepare a vertical analysis of the data for 2022 and 2021. (Round your percentage answers to 1 decimal place.) FEDERER SPORTS APPAREL Income Statement For the Years Ended December 31 2022 2021 Amount $ 18,800,000 Net sales Cost of goods sold 13,200,000 Gross profit 5,600,000 Operating expenses 1,600,000 Depreciation expense 1,000,000 Inventory write-down 200,000 Loss (litigation) 1,500,000 Income before tax 1,300,000 450,000 Income tax expense 850,000 Net income $ Amount $ 15,500,000 7,000,000 8,500,000 1,200,000 1,000,000 0 300,000 6,000,000 2,000,000 $ 4,000,000 Required: Prepare a horizontal analysis for 2022 using 2021 as the base year. (Decreases should be indicated with a minus sign. Round your percentage answers to 1 decimal place.) FEDERER SPORTS APPAREL Income Statement For the Years Ended December 31 Year increase (Decrease) Amount 2022 2021 % Net sales $ 18,800,000 $15,500,000 Cost of goods sold 13,200,000 7,000,000 Gross profit 5,600,000 8,500,000 Operating expenses 1,600,000 1,200,000 Depreciation expense 1,000,000 1,000,000 Inventory write-down 200,000 Loss (litigation) 1,500,000 300,000 Income before tax 1,300,000 6,000,000 450,000 2,000,000 Income tax expense Net income 850,000 $4,000,000 $ 1 aces The balance sheets for Plasma Screens Corporation and additional information are provided below. PLASMA SCREENS CORPORATION Balance Sheets December 31, 2021 and 2020 2021 2020 Assets Current assets: Cash $ 242,000 $ 130,000 Accounts receivable 98,000 102,000 Inventory 90,000 Investments 105,000 5,000 3,000 Long-term assets: Land 580,000 580,000 Equipment 890,000 770,000 Less: Accumulated depreciation (528,000) (368,000) Total assets $1,392,000 $1,307,000 Liabilities and Stockholders' Equity Current liabilities: $ 109,000 $ 95,000 Accounts payable Interest payable 7,000 13,000 6,000 9,000 Income tax payable Long-term liabilities: 110,000 220,000 Notes payable Stockholders' equity: 800,000 800,000 Common stock 357,000 173,000 Retained earnings $1,392,000 $1,307,000. Total liabilities and stockholders' equity es Additional information for 2021: 1. Net income is $184,000. 2. Sales on account are $1,890,000. 3. Cost of goods sold is $1,394,250. Required: 1. Calculate the following risk ratios for 2021: (Round your answers to 1 decimal place.) Risk Ratios a. Receivables turnover ratio times b. Inventory turnover ratio times c. Current ratio to 1 d. Acid-test ratio to 1 % e. Debt to equity ratio 2. When we compare two companies, can one have a higher current ratio while the other has a higher acid-test ratio? Yes No 5 The balance sheets for Plasma Screens Corporation and additional information are provided below. PLASMA SCREENS CORPORATION Balance Sheets December 31, 2021 and 2020 2021 2020 Assets Current assets: Cash $ 242,000 $ 130,000 98,000 102,000 90,000 105,000 5,000 3,000 580,000 580,000 890,000 770,000 (528,000) (368,000) $1,392,000 $1,307,000 $ 109,000 $ 7,000 95,000 13,000 6,000 9,000 110,000 220,00 800,000 800,000 357,000 173,000 $1,392,000 $1,307,000 Accounts receivable. Inventory Investments Long-term assets: Land Equipment Less: Accumulated depreciation Total assets Liabilities and Stockholders' Equity Current liabilities: Accounts payable Interest payable Income tax payable Long-term liabilities: Notes payable Stockholders' equity: Common stock Retained earnings Total liabilities and stockholders' equity Additional information for 2021: 1. Net income is $184,000. 2. Sales on account are $1,890,000. 1. Net income is $184,000. 2. Sales on account are $1,890,000. 3. Cost of goods sold is $1,394,250. Required: 1. Calculate the following profitability ratios for 2021: (Round your answers to 1 decimal place.) Profitability Ratios a. Gross profit ratio % b. Return on assets % c. Profit margin % d. Asset turnover times. e. Return on equity % 2. When we compare two companies, can one have a higher return on assets while the other has a higher return on equity? Yes OO Chec O No As an auditor for Bernard and Thomas, you are responsible for determining the proper classification of income statement items in the audit of California Sports Grill. Required: Select whether each of the following items should be classified as discontinued operations, other revenues, or other expenses. Items Description a. One of the company's restaurants was destroyed in a forest fire that raged through Southern California. Uninsured losses from the fire are estimated to be $450,000. California Sports Grill has three operating divisions: restaurants, catering, and frozen retail foods. The company sells the frozen retail foods division of the business for a profit of $2.4 million in order to focus more on the restaurant and catering b. business. C. An employee strike to increase wages and benefits shut down operations for several days at an estimated cost of $200,000 d A restaurant waiter slipped on a wet floor and sued the company. The employee won a settlement for $100,000, but California Sports Grill has not yet paid the settlement. 6 The company owns and operates over 40 restaurants but sold one restaurant this year at a gain of $650,000. LeBron's Bookstores has two divisions: books and electronics. The electronics division had another great year in 2021 with net sales of $11 million, cost of goods sold of $6.5 million, operating expenses of $3 million, and income tax expense of $375,000. The book division did not do as well and was sold during the year. The loss from operations and sale of the book division was $900,000 before taxes and $675,000 after taxes. Required: Prepare the multiple-step income statement for LeBron's Bookstores, including the proper reporting for the discontinued book division. (Enter your answer in dollars, not millions. (.e.,$5.5 million should be entered as 5,500,000).) LEBRON'S BOOKSTORES Income Statement For the Year Ended December 31, 2021 Discontinued operation

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts