Question: Help Eagle Corporation issued $10,150,000, 9 percent bonds dated April 1, year 1. The market rate of interest was 10 percent, with interest paid each

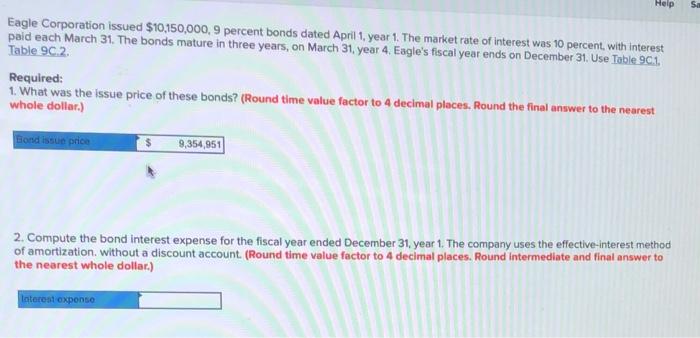

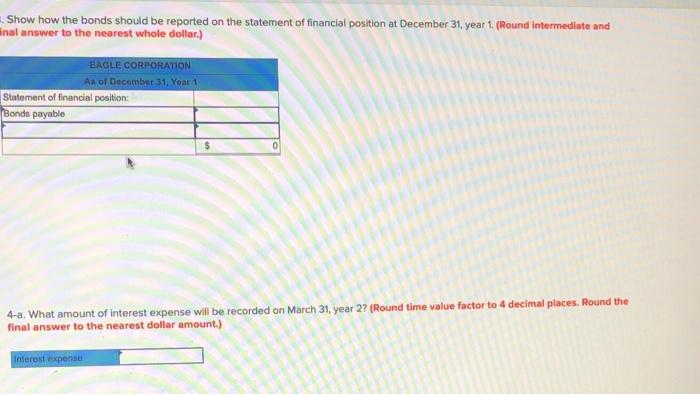

Help Eagle Corporation issued $10,150,000, 9 percent bonds dated April 1, year 1. The market rate of interest was 10 percent, with interest paid each March 31. The bonds mature in three years, on March 31, year 4. Eagle's fiscal year ends on December 31. Use Table 9C.1. Table 9C.2. Required: 1. What was the issue price of these bonds? (Round time value factor to 4 decimal places. Round the final answer to the nearest whole dollar.) Bond issue price $ 9,354,951 2. Compute the bond interest expense for the fiscal year ended December 31, year 1. The company uses the effective-interest method of amortization, without a discount account. (Round time value factor to 4 decimal places. Round Intermediate and final answer to the nearest whole dollar.) Interest expense Show how the bonds should be reported on the statement of financial position at December 31, year 1. (Round intermediate and nal answer to the nearest whole dollar.) EAGLE CORPORATION As of December 31, Year 19 Statement of financial position: Bonds payable $ 4-a. What amount of interest expense will be recorded on March 31, year 2? (Round time value factor to 4 decimal places. Round the final answer to the nearest dollar amount.) Interest expense 4-b. Is this amount different from the amount of cash that is paid? Yes No

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts