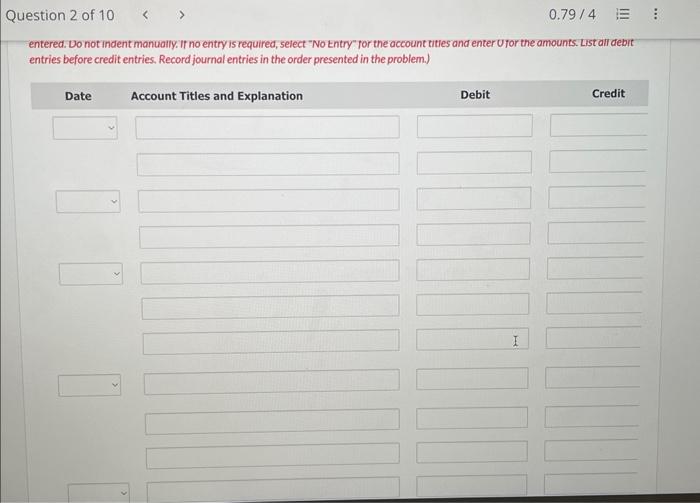

Question: help entered. Do not indent manually. If no entry is required, select No tntry for the account titles and enter Ufor the amounts. List all

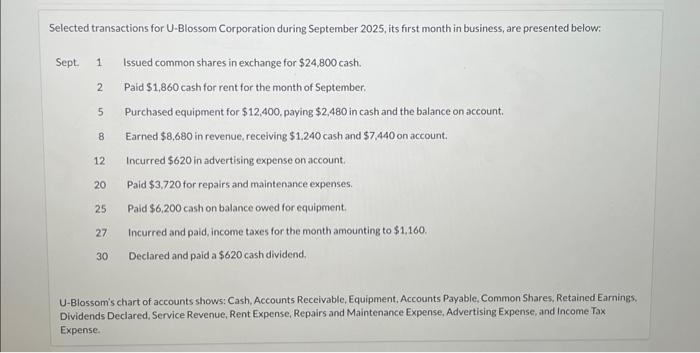

entered. Do not indent manually. If no entry is required, select "No tntry" for the account titles and enter Ufor the amounts. List all debit entries before credit entries. Record journal entries in the order presented in the problem.) Selected transactions for U-Blossom Corporation during September 2025, its first month in business, are presented below: Sept. 1 Issued common shares in exchange for $24,800 cash. 2 Paid $1,860 cash for rent for the month of September. 5 Purchased equipment for $12,400, paying $2,480 in cash and the balance on account. 8 Earned $8,680 in revenue, receiving $1,240 cash and $7,440 on account. 12 Incurred $620 in advertising expense on account. 20 Paid $3,720 for repairs and maintenance expenses. 25 Paid $6,200 cash on balance owed for equipment. 27 Incurred and paid, income taxes for the month amounting to $1,160. 30 Declared and paid a $620 cash dividend. U-Blossom's chart of accounts shows: Cash, Accounts Receivable, Equipment, Accounts Payable, Common Shares, Retained Earnings, Dividends Declared, Service Revenue, Rent Expense, Repairs and Maintenance Expense, Advertising Expense, and Income Tax Expense

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts